Qualcomm (QCOM) recently came to an agreement with LG Electronics to license 5G technology to the phone maker. Though the deal didn’t send shares skyrocketing, it did reinforce the idea that Qualcomm is the leader in 5G, which is expected to go mainstream in the next few years. In addition, as a reminder, the company also recently came to terms with once-rival Apple to develop 5G technology on the iPhone.

However, the main topic on many investors’ minds is the recent antitrust ruling against Qualcomm. Judge Lucy Koh said that the company’s “licensing practices have strangled competition…” and have brought harm to rivals and consumers. She ruled that the company must change its business practices, including renegotiating licensing agreements.

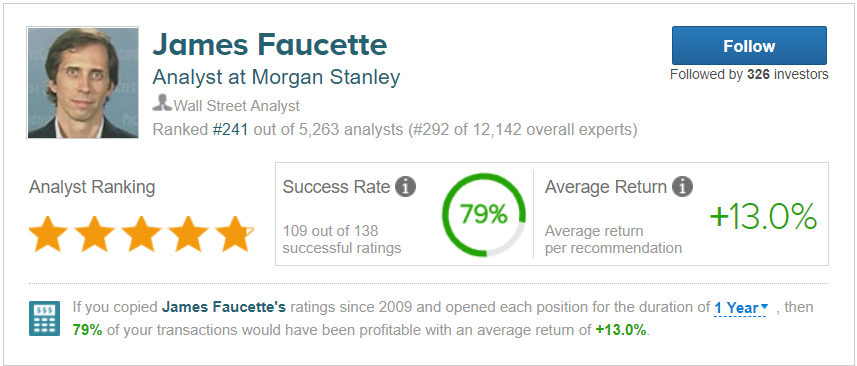

While many investors are staying away from Qualcomm for the moment, Morgan Stanley’s James Faucette is diving in. The 5-star analyst maintained an Overweight rating on QCOM stock, with $89 price target, which implies over 20% upside from current levels.

The analyst says that “most existing agreements, including the new one with LG, are largely consistent with that ruling,” and that the LG agreement shows the ruling is “largely irrelevant to Qualcomm’s ability to collect royalties and to the underlying economics” of the business.

Yet, Faucette doesn’t see the LG deal as a major win. He believes the agreement is “encouraging,” and sees it as “further validation…that the FTC case should not weigh on investor sentiment,” but is not adjusting his estimates or increasing his price target.

To Faucette, the more important headwind is the US-China trade war. The analyst does not think Huawei will pay Qualcomm royalties unless a wider trade agreement is reached, which, while not a major revenue generator, is important for the company, especially as Huawei continues to increase its market share in China.

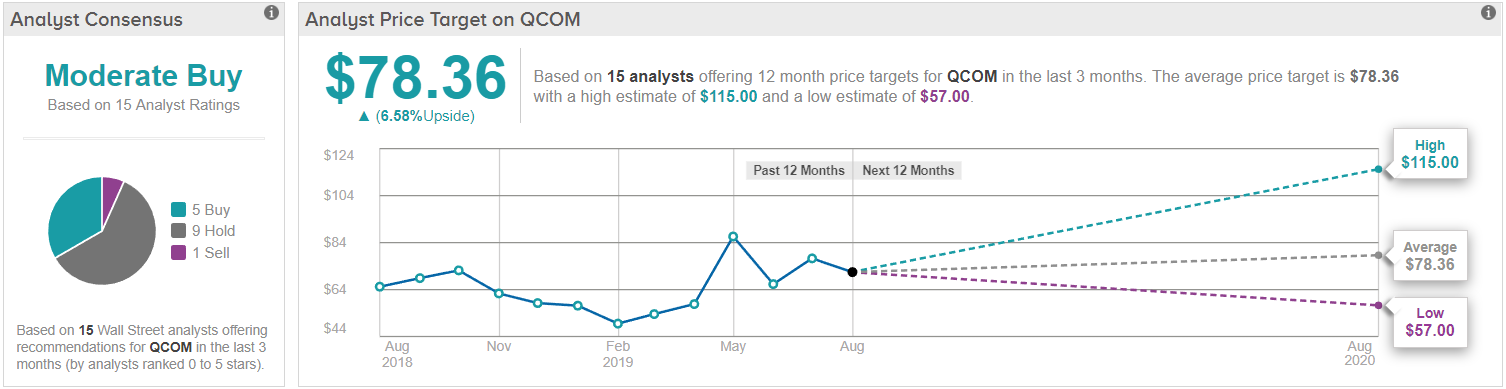

Overall, Wall Street is not convinced just yet on this chip giant, but cautious optimism is circling, as TipRanks analytics demonstrate QCOM as a Moderate Buy. Based on 15 analysts polled in the last 3 months, 5 rate Qualcomm stock a Buy, 9 maintain a Hold, while only 1 recommends Sell. The 12-month average price target stands at $78.36, marking ~7% upside from where the stock is currently trading. (See QCOM price targets and analyst ratings on TipRanks)