Is Boeing (BA) preparing to get the 737 MAX back up and running? If its latest move is any indication, the answer is yes.

The aircraft manufacturer recently said it would begin to hire hundreds of temporary workers to help facilitate the re-launch of the MAX, which has been grounded since earlier this year after two fatal crashes were blamed on the airplane’s safety systems. These employees will include mechanics, technicians and electricians as all MAX airplanes will need to be equipped with new software to fix the troubled MCAS safety system. Though it remains unclear when exactly the planes will be ready for takeoff, the FAA could approve the planes for flight by the end of the year.

5-star Cowen analyst Cai Rumohr expects Boeing to be in the clear soon, as he maintains an Outperform rating on BA stock, along with $460 price target. For perspective, Boeing’s stock closed at $356.01 today, so this implies upside of about 30%.

Since the grounding of the MAX in March, Boeing has hit many hurdles in its re-development of its MCAS software. But the signs are pointing that the airplane will be cleared for take off by the end of the year, with Rumohr saying an “FAA certification flight could be 4-6 weeks off.” While Boeing hasn’t provided much in terms of updates recently, the analyst says, “no news is good news.”

Rumohr and the Cowen airline team surveyed North American MAX operators on delivery and RTS plans, with the common plan to “take what Boeing can deliver or ~80+ planes to get them to their initial y/e 2019 targets.” Southwest, American and United are readying for the arrivals of the MAX airline by this year or early next, but Boeing will still fall well-short of the 270 MAX planes Rumohr had estimated for 4Q19 delivery. Nonetheless, the analyst says if the FAA, EASA and Transport Canada all approve the MAX around the same time, “demand shouldn’t be the gating factor to MAX deliveries in Q4.”

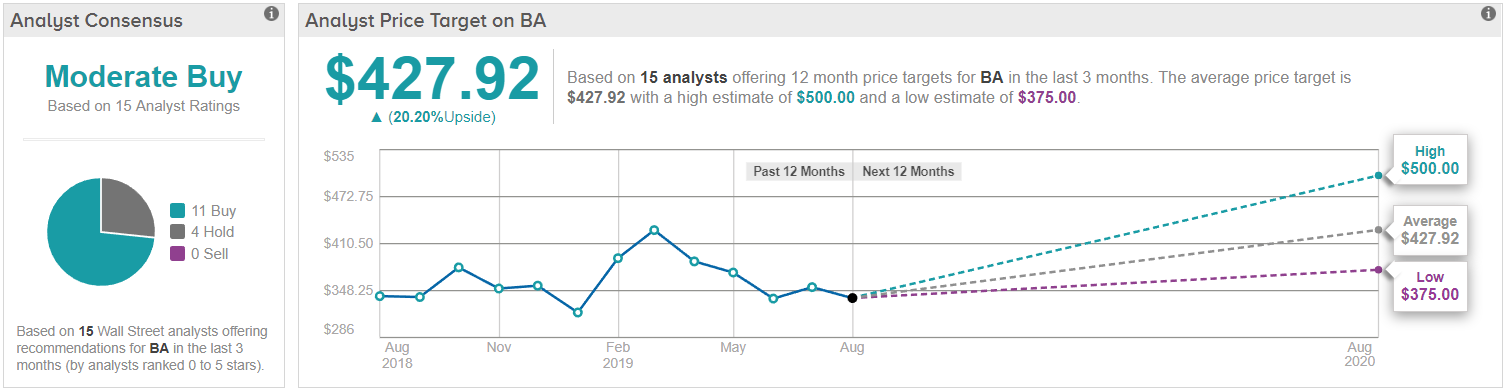

All in all, though Boeing stock took a major hit this year as its new flagship aircraft was grounded, many on Wall Street believe the good times will return once the MAX problems are fixed. TipRanks analysis of 15 analyst ratings shows this long-term confidence, with a consensus Moderate Buy. Of the 15 analysts, 11 are Buying, while four are Holding. There is an average price target of $427.92, representing nearly 20% upside from current levels. (See BA’s price targets and analyst ratings on TipRanks)