As the South Korean and Japanese trade disputes rages on, investors are increasingly optimistic on Micron (MU) stock.

For numerous reasons, shares of the semiconductor giant have risen nearly 40% since the start of the summer, with the Asian dispute playing a role. The conflict began when Japan restricted the export of fluorinated polyimides, photoresists, and hydrogen fluoride (the three key materials needed for semiconductors) to South Korea, home to industry giants Samsung and SK Hynix. As a result, the two companies have been forced to curb production, leading to lower supply and increased prices industry-wide. Micron, meanwhile, has benefited from this saga, as pricing is increasingly turning to its favor.

5-star Deutsche Bank analyst Sidney Ho does not believe the tensions will contribute much moving forward. But overall, the analyst remains positive on Micron stock, reiterating a Buy rating and $55 price target. (To watch Ho’s track record, click here)

Even though the Japan-Korea dispute has contributed to increase optimism over Micron stock, Ho says the tensions are “increasingly unlikely to have a meaningful impact on industry supply.” Nevertheless, the short-term effects of the dispute most likely had an impact on better pricing, and Ho believes “global trade tensions are shifting some of the bargaining power from memory buyers to memory suppliers despite still-elevated inventory levels,” favoring companies like Micron.

The analyst points out that DRAM prices are up 10% since June, and contract pricing for PC DRAM was flat after seven straight months of decline, indicating a turning point. Looking ahead, Ho believes “risks of further significant price declines are diminishing and we see F4Q as the trough quarter for MU in the current cycle.”

On inventory, Ho continues to expect DRAM inventory at memory suppliers and their customers to reach normalized levels by the end of this year, as Micron recently said it expects demand to rebound in some segments. The analyst’s overall takeaway is that while inventory remains elevated, it is moving in the right direction, and believes the risk of inventory levels worsening is diminishing.

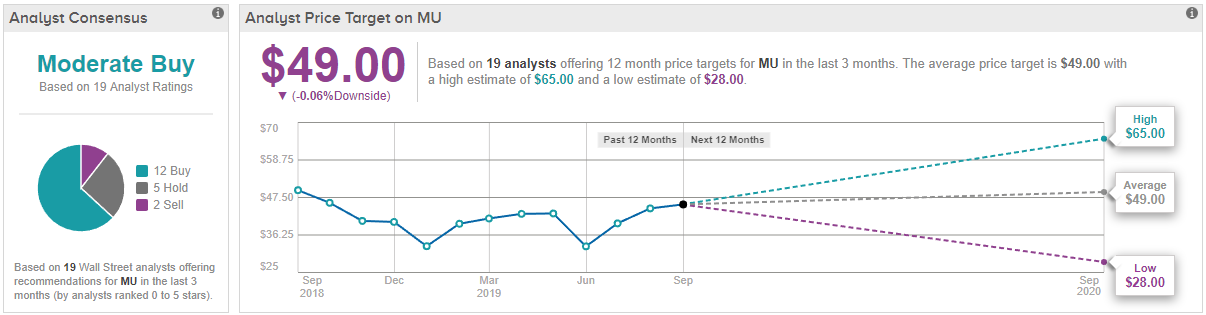

All in all, the tide continues to be shifting for Micron, as more investors see the light for both the company and industry, with inventory and pricing both improving. TipRanks analysis of 19 analyst ratings shows a Moderate Buy rating on Micron, with 12 analysts recommending Buy, five saying Hold and two suggesting Sell. However, target expectations appear to have more apprehension baked into expectations. (See MU’s price targets and analyst ratings on TipRanks)