More than a month after Morgan Stanley’s Joseph Moore last upgraded Micron (MU) stock, things are playing out more or less as the analyst predicted. “Supply risks,” which Moore highlighted at the time, are reviving demand among computer memory users to build up inventory, lending at least some support to prices. And yet, the 5-star analyst remains cautious on Micron, and unwilling to recommend “buying” it. For now, Moore remains sidelined on the stock with an Equal-weight rating and $48 price target. (To watch Moore’s track record, click here)

Consistent with Moore’s predictions back in July, actual “supply challenges in [obtaining] NAND, and perceived challenges in DRAM,” incentivized customers to accumulate inventory of both DRAM and NAND flash memory in Q3 2019. DRAM demand may now be weakening again, and prices are falling. But demand for NAND, at least, “remains strong” in both volume, and in the prices Micron is getting for its product as well.

Despite this positive development in the short term, however, Moore still worries that demand remains “challenged in nearly every memory consumer market.” Furthermore, thanks in part to the recent accumulation of inventory among consumers, the analyst says “both producer and customer inventories” remain “excessive, so our longer term view is cautious.”

Moving into the fourth and final quarter of the year, Moore predicts that demand will decline both sequentially (i.e. versus Q3) and year over year (i.e. versus Q4 2018). And with less demand will come lower prices — down “at least 10%” in the fourth quarter, and potentially even worse than that.

Accordingly, Moore says DRAM margins have not yet hit bottom.

The picture in NAND is a bit better. “NAND improvements have persisted longer than our initial expectations,” reports the analyst. What’s more, producers such as Micron have plenty of supply on hand with which to sell at “better pricing” so long as demand remains strong. Indeed, pricing might even improve “through year end.”

And yet, even here Moore sounds a cautious note. NAND demand looks so good right now that the analyst worries it just might be “unsustainably strong” (emphasis Moore’s). Even as supply growth runs wild (up 60% versus last year in the most recent month), Moore notes that there’s been “significant customer inventory accumulation.” Any shock to demand for smart phones, for example, could be enough to convince buyers to work down their “significant” inventories of NAND flash memory, instead of buying more.

Nevertheless, the upshot of all the above is still a somewhat brighter picture for Micron stock. With unit volumes shipped growing and price declines slowing, Moore now predicts that Micron will reap sales of about $4.7 billion in Q4 (5% better than previously predicted), and earn $0.56 per share — 27% better.

Looking a bit farther out to the November quarter (i.e. Q1 2020), Moore sees sales moderating sequentially, but still better than previously predicted — still $4.7 million. Earnings should likewise be a bit less robust than in Q4 2019 — $0.48 per share. But relative to the $0.30 per share Moore was previously looking for in Q1 2020, that prediction, too, should leave Micron investors smiling.

The only bad news? With Micron shares already up 12% from early August, and actually trading slightly ahead of Moore’s $48 price target, it looks like the good news could already be priced into Micron stock.

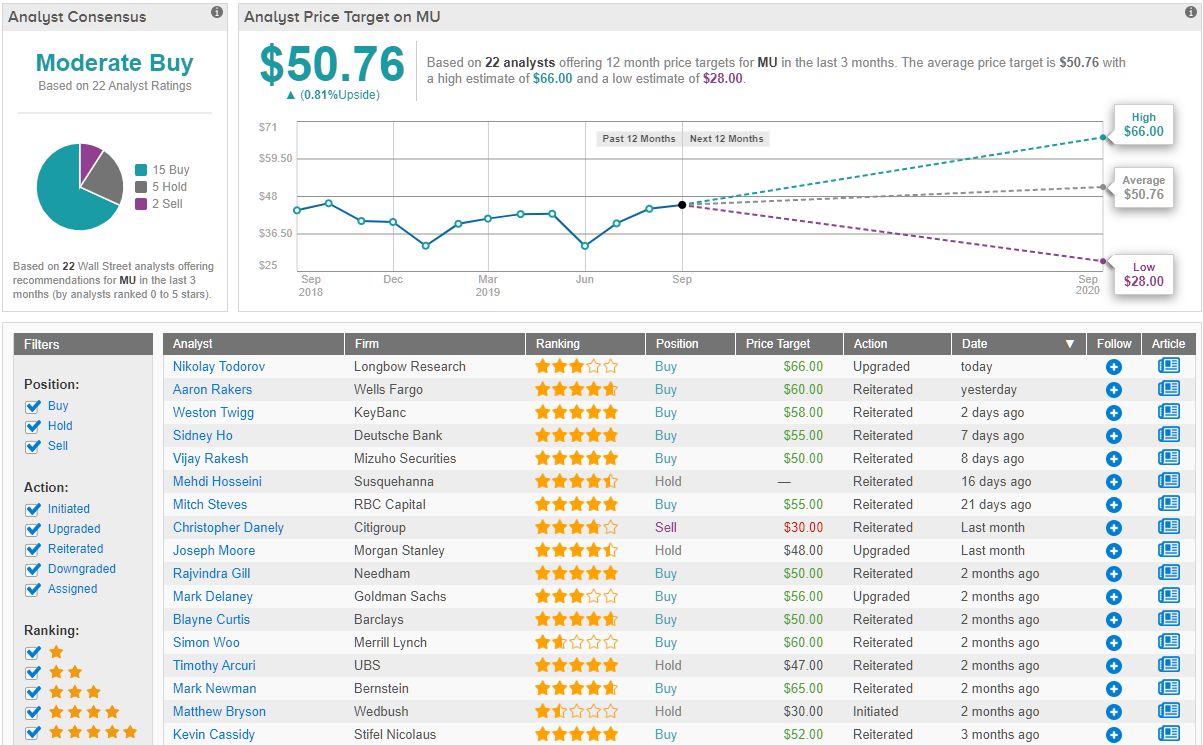

All in all, this ‘Moderate Buy’ stock is no Wall Street secret. After all, in just three months, the stock has attracted 15 ‘buy’ ratings from Wall Street analysts, along with 5 ‘hold’ and 2 ‘sell’ ratings. However, the stock’s consensus price target stands at $50.76. In other words, optimism is already priced into the stock. (See MU’s price targets and analyst ratings on TipRanks)