Tesla (TSLA) stock has been up and down over the past year — mostly down (about 17%) for the year, but largely up (about 36%) over the last three months, since the depths plumbed back in early June.

The June nadir, by the way, came after a big Q1 loss and fears of waning Model 3 demand sparked a call from CEO Elon Musk to “examine every expenditure at Tesla no matter how small” in an effort to cut costs. But since then, Tesla has had mostly positive news to report, including last quarter’s earnings report featuring a near-60% spike in sales.

And wouldn’t you know it? Tesla thinks the good times are going to keep on rolling.

We know this because, in a just-released write-up yesterday detailing the “takeaways” from his meeting with Tesla investor relations head Martin Viecha, Deutsche Bank analyst Emmanuel Rosner reported that Tesla is predicting a “critical turning point” for the company within the next 12 months. As Rosner explains, Tesla’s Model 3 business seems to be stabilizing, and its upcoming Model Y crossover vehicle will soon boost profit margins. Meanwhile, the advent of a new production line in China offers Tesla direct access to the world’s largest consumer market for electric cars.

Here’s a quick rundown of what Rosner uncovered:

Model 3

When first launched in mid-2017, Tesla’s Model 3 — advertised as the $35,000-a-car mass market Tesla — actually retailed for closer to $55,000 to $60,000 per unit because of all the upgrades customers were ordering (and the fact that Tesla was only selling cars ordered with those pricey upgrades). Now that that initial wave of enthusiasm has passed, though, Tesla average selling prices are drifting lower, to about $50,000 or so as of Q2 2019, on par with the cost of luxury gas-powered small automobiles from Mercedes, Audi, and BMW.

Going forward, Tesla anticipates it will be able to hold the line at or about $50,000 for the Model 3, inasmuch as the car offers “fuel savings and superior experience” when compared to competing gas-powered luxury cars. And seeing as Tesla has managed to improve the gross profitability of the car by about 200 basis points year over year already, this promises to prop up Tesla’s profits going forward — especially because the company expects to reap further cost savings from increased production volumes, improved efficiencies of scale, and mass purchases of parts that will be common to both the Model 3 and the upcoming Model Y.

Model Y

Speaking of which, Tesla is planning to unleash the Model Y on the market in the fall of 2020. In addition to sharing parts with the Model 3, Tesla expects the new electro-buggy to command higher prices because customers generally are willing to pay $4,000 to $5,000 more for an SUV than for a sedan of comparable characteristics — even though the Model Y’s “cost to manufacture will be similar to” that of the Model 3.

In other words, the extra $4,000 to $5,000 will be pure profit, falling straight to Tesla’s bottom line.

China

In Rosner’s opinion, the speed at which Tesla is able to start production of the Model Y will be one key to determining “Tesla’s 2020 profits and free cash flow.” The other key factor in this equation “will depend on how successful the company is in ramping up output at its new Shanghai facility.”

In that regard, Rosner notes that the new production line in Shanghai has already been cheaper to build and should be cheaper operate than the company’s original production line in Fremont “because [Tesla is taking] a simpler approach” in Shanghai. For example, it’s using more robots and fewer humans, building on a single floor — and with 75% fewer assembly steps than Fremont must deal with.

Exterior construction on the Shanghai factory was completed last week, and production lines should begin humming before 2019 is out. By mid-next year, the analyst expects Shanghai to be churning out as many as 150,000 Teslas per year, selling them at prices competitive with gas-powered cars, and earning profit margins superior to what Tesla gets in the U.S.

Bottom Line

Good as all this sounds, however, for the time being, Deutsche Bank believes this good news is priced into Tesla’s $243 stock price, and is sticking with its “hold” rating on the stock. (To watch Rosner’s track record, click here)

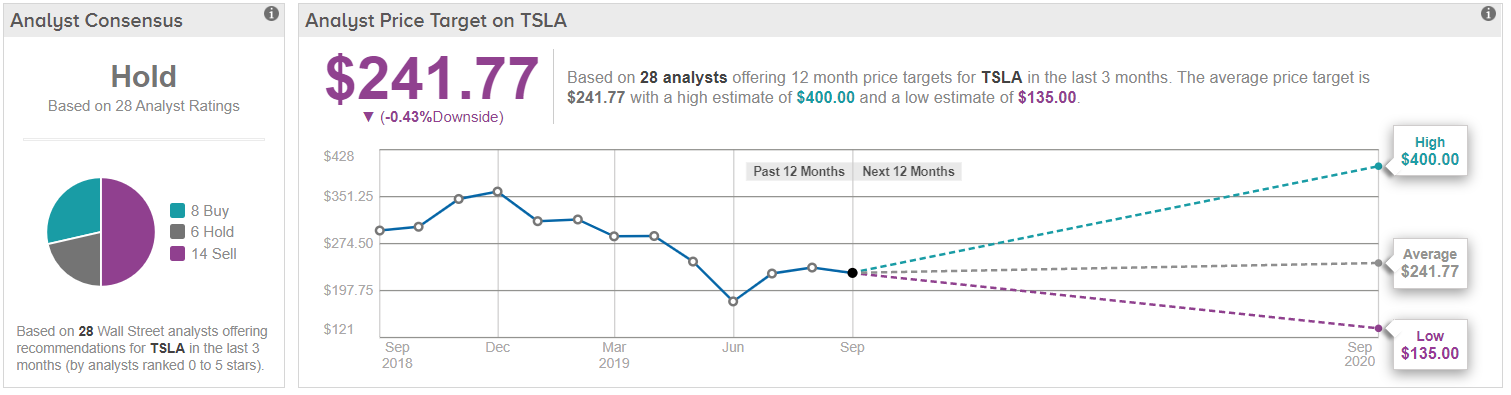

The majority of the Street sides with the Deutsche Bank analyst’s cautious take on the electric car maker, as TipRanks analytics demonstrate TSLA as a Hold. Out of 28 analysts polled in the last 3 months, 8 are bullish on Tesla stock, 6 remain sidelined, while 14 are bearish on the stock. The average price target among these analysts stands at $241.77, suggesting the stock is fairly valued. (See TSLA’s price targets and analyst ratings on TipRanks)

Visit TipRanks’ Trending Stocks page, and find out what companies Wall Street’s top analysts are looking at now.