October is set to be a particularly volatile month for the market. That’s because this is a critical period for many investors and companies that manage performance to calendar year-end. So how can you best take advantage of the current investing climate? One option is to turn to value stocks. Luckily Goldman Sachs has released a report revealing its top value stocks right now. According to the firm, these are stocks that “have the potential for continued asymmetric upside.”

“While fundamentals will also determine the long-term trajectory of stocks, we use signals from options and credit markets to identify 20 value stocks from among those where our analysts’ estimates show strong value scores,” the firm’s Vishal Vivek told clients recently. These are stocks that sold off over the last year, but are now showing strong rebound potential.

Here we ran the 20 stocks recommended by the firm through our database to find the 5 stocks on the list with the most Street support. Indeed, as you will see below, all five stocks covered below show a ‘Strong Buy’ or ‘Moderate Buy’ consensus from Wall Street. This is based on all the ratings received by each stock over the last three months- and means analysts believe now is a compelling time to buy into these names. Let’s take a closer look:

1. Marathon Petroleum

Based in Ohio, Marathon Petroleum (MPC – Get Report) is a leading downstream energy company. The company operates the US’s largest refining system 3 million + barrels per day of crude oil capacity across 16 refineries. Five out of six analysts covering Marathon are bullish on the stock’s outlook. And the average analyst price target works out at $68 (23% upside potential). Encouragingly, MPC’s 2Q19 results came in strong across the board. Plus synergies from its Andeavor acquisition are starting to come through more rapidly. Achieving a $1.4 billion synergy target would be a major catalyst says RBC Capital’s Brad Heffern.

He is also a fan of Marathon’s retail business, Speedway. This “is the most attractive retail franchise in our coverage universe, and the extension of the Speedway model to the acquired ANDV stores could provide meaningful upside” stated the analyst. Even though the stock is trading down 7% year-to-date, shares have rallied 12% since the start of September.

2. Morgan Stanley

All four analysts covering Morgan Stanley (MS – Get Report) rate the stock a buy right now. On average these analysts see shares climbing 37% from current levels. Most tellingly, Citigroup’s Keith Horowitz recently upgraded MS from Hold to Buy while boosting his price target from $48 to $52. He advised investors to use weakness as an opportunity to increase exposure to a high-quality franchise with limited rates exposure.

“We see Morgan Stanley net income growth of 2-3% over the next two years by continuing to gain market share in both its institutional and retail franchises, which compares more favorably against the flat to slightly declining net income growth among the rest of the bank universe” the analyst told investors. Shares are down 12% on a one-year basis, but have climbed 10% year-to-date.

3. Kohl’s Corp

Although this department store retail chain scores a Moderate Buy rather than Strong Buy consensus, Kohl’s (KSS – Get Report) still has its fair share of supporters. For instance, five-star Guggenheim analyst Robert Drbul has just reiterated his KSS buy rating. After hosting a lunch with Kohl’s CEO Michelle Gass and VP Mark Rupe, Drbul wrote “In an increasingly dynamic retail environment, we believe KSS remains a strong operator, led by a talented team with a clear strategy.”

Despite a poor second quarter (as reflected by stock performance) Drbul notes an improvement in seasonal goods and traffic during August. “As we think about the remainder of ’19, we reiterate our BUY rating as we believe management has the playbook to drive positive comps in 2H19 given the multitude of initiatives planned (led by the expanded Amazon partnership)” he writes. Kohl’s now accepts returns from Amazon (AMZN) customers at all of its more than 1,150 Kohl’s stores nationwide.

4. Valero Energy

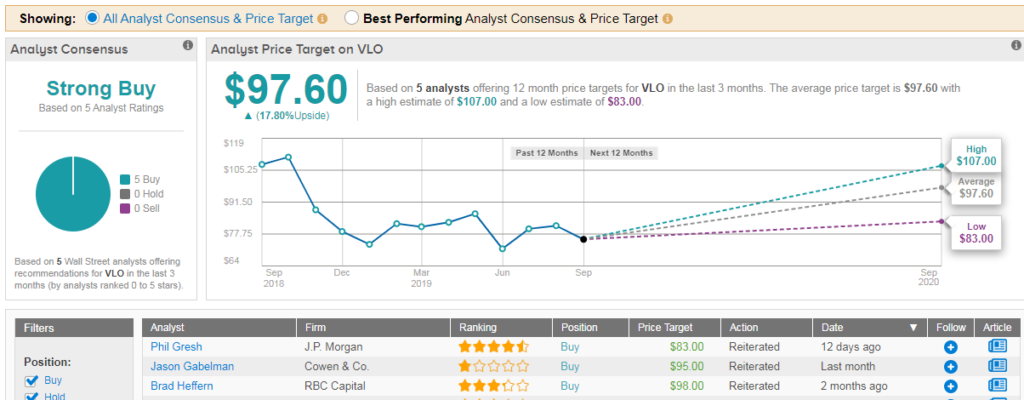

Among the large cap refiners, Valero (VLO – Get Report) remains the one (essentially) pure play refining company, with modest exposure to ethanol and renewable diesel. Like other stocks covered here, VLO is trading down 25% over the last one year- but up 10% year-to-date. What’s more all five analysts polled on VLO rate the stock a buy right now. With a $98 average analyst price target, analysts are anticipating upside of 18% from current levels.

“The primary positive that we see with VLO is that it has the highest exposure to the Texas Gulf Coast, which could benefit from widening crude differentials” explains JP Morgan’s Phil Gresh. He believes VLO should have its choice of light and heavy crude on the Gulf Coast, with a unique angle on its Texas exposure.

5. Conagra Brands

Packaged food giant Conagra Brands (CAG – Get Report) may be down 20% on a one-year basis, but the stock has bounded back from its lows. Year-to-date shares have rebounded an impressive 39%. Out of all six analysts covering the stock, four rate CAG a buy right now. That gives the stock a ‘Strong Buy’ consensus. Meanwhile the average analyst price target stands at $32 (9% upside potential). JP Morgan’s Kenneth Goldman has just boosted his price target from $31 to $33. “We believe that CAG has many levers to pull in terms of innovation and synergies” he explains.

Visit TipRanks Analysts’ Top Stocks page, to find the latest stock picks from the Street’s best-performers.