Rate Cut May Not Be Enough To Dampen The Aussie Dollar

Recent price action around the Reserve Bank of Australia's rate-setting meetings, and stretched short positions, signal some upside risk for the Australian dollar around the Bank’s announcement overnight.

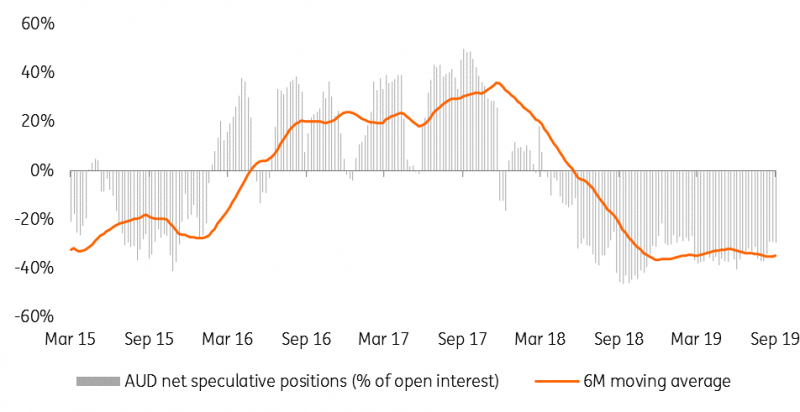

Speculative markets remain extensively short AUD

Latest CFTC positioning data shows that the market retains a bearish stance on the Australian dollar, with short contracts now reaching 29% of open interest.

(Click on image to enlarge)

Source: CFTC, Bloomberg, ING

This is likely explained by lingering global trade tensions, with the negative implications for Australia's China-dependent exports still clouding the economic outlook. The RBA has played a role in denting appetite for the AUD by eroding the rate advantage versus low-yielding safe havens, prompting investors to choose other “activity currencies”, such as the Canadian dollar, to position for any rebound in global sentiment.

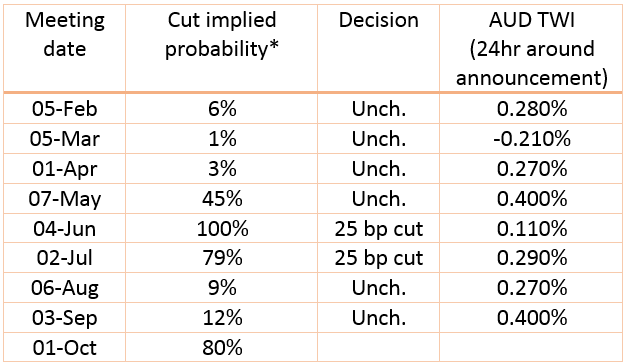

AUD rose in 24 hours around 7 of the last 8 RBA meetings

(Click on image to enlarge)

Source: Bloomberg, ING

* Derived from the RBA Cash Rate futures one day before the meeting

Pre-empting moves by other global central banks, the RBA cut interest rates in June and followed up with another 25 basis point reduction in July, taking the cash rate to a new record low of 1%. Arguably, this has contributed to the weakening of AUD/USD by approximately 4.20% year-to-date, although the deterioration in US-China trade relationships has likely played a bigger role in denting appetite for the currency.

However, the intraday performance of the Aussie dollar around the RBA meetings has been generally positive (looking at the changes in the AUD trade-weighted index in the 24 hours around the meeting). Focusing on the last two RBA cuts specifically, the easing move did not trigger AUD weakness.

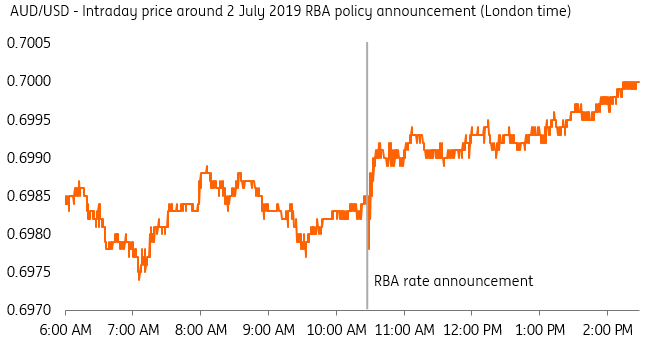

Similarities with the July meeting

The RBA cash rate futures currently display an 80% implied probability of a 25 basis point cut tomorrow. This is approximately how much was priced in right before the 2 July rate cut.

And the analogies don’t stop there. The data flow in September has been quite similar to that seen in June (right before the July policy announcement). In both instances, GDP numbers showed some resilience, matching estimates, while the unemployment rate came in higher than expected at 5.2% in May (report published mid-June) and 5.3% in August (report published mid-September).

(Click on image to enlarge)

Source: Bloomberg, ING

Forward-looking language will be key

Should the RBA go ahead and cut rates tomorrow (as the market expects), we could see the Aussie dollar respond as it did the last time the Bank cut rates. While market expectations for a cut in July were not unanimous, AUD/USD traded higher as markets quickly overlooked the rate cut and instead focused on the forward-looking language by Governor Philip Lowe, who failed to provide clear indications about more easing ahead.

As noted by our economics team in the RBA meeting preview, there are a number of arguments in favor of keeping rates on hold. Should this be the case, AUD/USD would likely jump above the 0.68 level as rate expectations are scaled back. However, even in the case of a rate cut, there is a non-negligible risk that the forward-looking language will be (similar to July) less dovish than expected. This may erase the negative effect of the cut on AUD, with the possibility of replicating the July price action, ultimately averting any AUD downside on the day.

The market’s stretched positioning also raises the risk of some short-covering, which suggests a possible upside risk for the currency. All this leads us to conclude that the balance of risks for the AUD is skewed to the upside ahead of tomorrow’s RBA policy meeting.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more