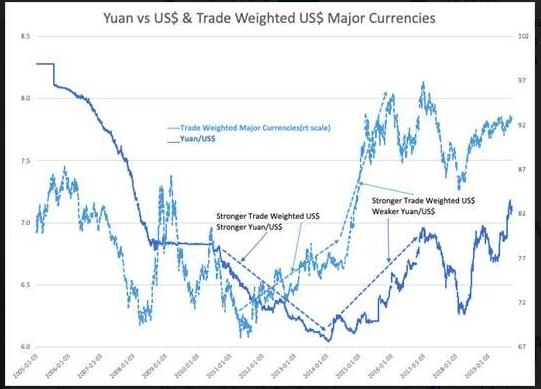

The Basis For Increase In Negative Rates Seen In The Yuan Vs US$ Vs Trade Weighted US$ Relationship

“Davidson” submits:

The basis for the rapid increase in negative rates is seen in the Yuan vs US$ compared to the Trade Weighted US$ relationship. Daily data shows periods of Yuan improving strength relative to the US$ through 2013 even though the Trade Weighted US$ Index began to turn higher in 2010. The Yuan continued to gain strength till the end of 2013 when it suddenly turned weaker with Russia’s invasion of Ukraine. Little watched at the same time, one might even suspect it as a coordinated activity with Russia, was the beginning of China’s military expansion on the Spratly Islands. The first concerns were voiced in early 2015, “The South China Sea Transformed”. The Yuan has weakened in steps as Xi’s actions shifted further away from the previously assumed Democratic path many thought China was on and towards autocratic leadership.

THE SOUTH CHINA SEA TRANSFORMED - FEBRUARY 18, 2015

(Click on image to enlarge)

(Click on image to enlarge)

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more