You’re in the investment markets to make money, and that means you’ll be looking for stocks with a strong return. Returns come in two forms – appreciation, the gains share price that strong stocks will show, and dividends, the profit-sharing payments companies make to shareholders. Today, we’ll be looking at four tech stocks that show a winning combination of both. These are the names that will bring you a return, no matter what the upside may be.

To find these stocks, we’ve used the TipRanks’ Stock Screener tool. The Screener is chock full of filters to make your market research simple. You can sort companies by market cap, average price target, investor sentiment, or market sector. Or, you can do what we did – sort out the stocks with high dividend yields and Buy ratings from the analyst consensus. Let’s take a look at our market stalwarts for strong returns.

AT&T (T)

The first stock on our list is one of the market’s most venerable names, AT&T. The largest descendant of the old Bell system, AT&T is still the largest landline provider in the US, as well as world’s largest telecom company and mobile provider. The company does over $170 billion worth of business annually, realizing a net profit on the order of $19.9 billion. T stock is up over 34% year-to-date, outstripping the NASDAQ’s 25% gains.

On the red side of the ledger, AT&T is held down by a massive $160 billion debt load. The company purchased Time Warner last year, for $85 billion, in a move to gain a proven content provider as it prepares to enter the streaming space. In recent weeks, AT&T has started divesting itself of lesser stakes in Europe, using the proceeds to work down the debt.

AT&T has a long-standing policy of returning profits to shareholders regardless of market performance. Management has consistently raised the dividend for the last 16 years, and the yield is now a healthy 5.5%, giving an annualized payout of $2.04 per share. This is income on top of the strong appreciation noted above.

AT&T has just reported mixed earnings for Q3, showing 94 cents per share against a forecast of 93 cents. This marked a 4.4% gain from the year-ago quarter. The earnings beat came even as revenues were down slightly, with the $44.59 billion just under the year-ago figure of $45.74 billion.

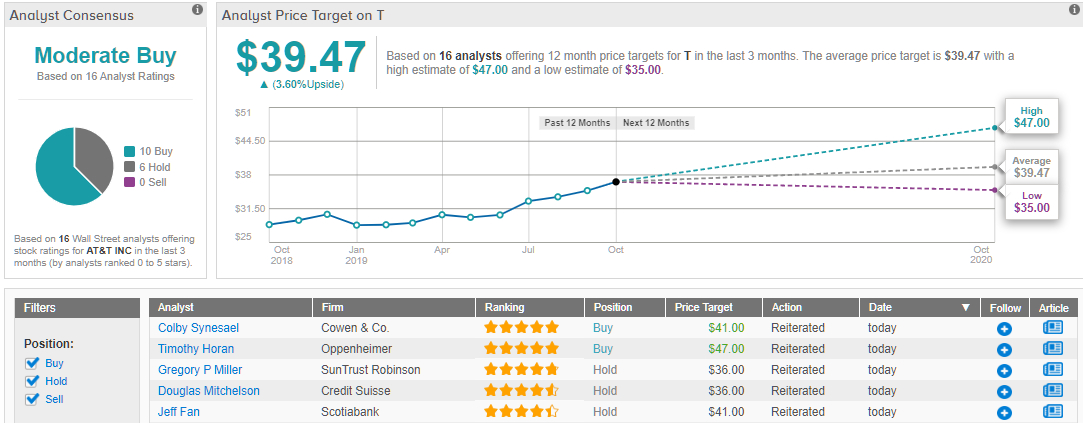

Nomura’s 4-star analyst Jeff Kvaal sees AT&T’s current situation as strong. His prediction of Q3 earnings being “more positive than not” was vindicated, and he says, “AT&T’s reticence to match Verizon’s price cut implies confidence in wireless…” Kvaal sets a $43 target on T, for an 11% upside. (To watch Kvaal’s track record, click here)

Overall, T’s Moderate Buy consensus comes from 10 “buy” and 6 “hold” ratings. The stock trades for $38; the average price target of $38.92 suggests a modest 4% upside. (See AT&T stock analysis on TipRanks)

Verizon Communications (VZ)

Second spot on our list goes to Verizon, the second-place telecom giant. With 153 million mobile subscribers, Verizon is second to AT&T in the US wireless market. It is also second in revenue, with $130.86 annually making it the second-largest telecom company in the world. Version sees a net income of $15.5 billion.

Despite its second-place status, VZ just reported firmer earnings than AT&T. Verizon beat both the EPS and revenue forecasts. The $1.25 EPS was just ahead of the $1.24 expected, while the $32.84 quarterly revenues were a half-percentage higher than the estimates. Sales revenues were in-line with the year-ago quarter.

Yielding 4%, and showing dividend growth for the last 11 years, Verizon is another champion income investment. The payout ratio of 49% indicates that the company should have no problem maintaining the high yield, which is about double the S&P 500’s average. Verizon pays $2.46 per share annually.

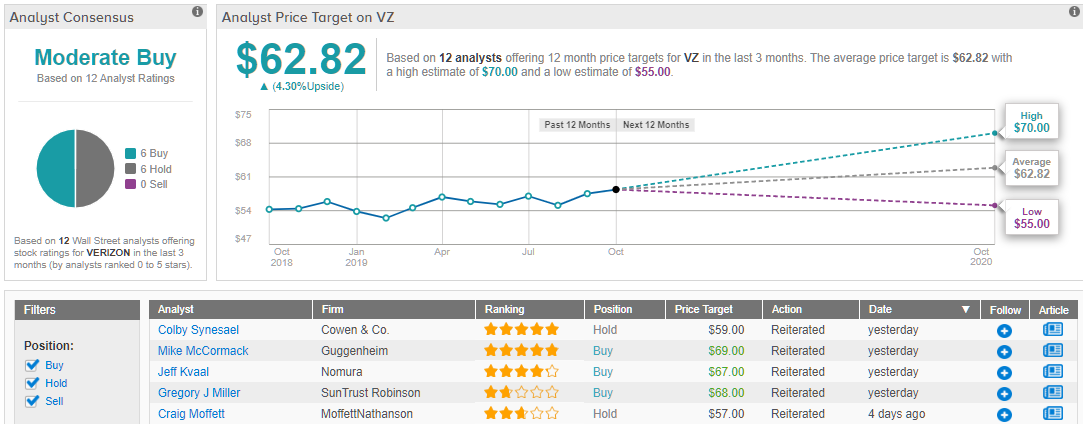

In the wake of the Q3 earnings, VZ has attracted several laudatory analyst reviews. 5-star Mike McCormack, of Guggenheim, put a Buy rating and $69 price target on the stock, saying, “The company reported strong Q3 Wireless results, with revenue, earnings, and free cash flow coming in ahead of consensus…” His target suggests an upside of nearly 15%. (To watch McCormack’s track record, click here)

Also bullish is SunTrust Robinson’s Greg Miller. Miller’s $68 target indicates a possible 13% upside, and in his comments he said, “Verizon reported 3Q19 results indicative of success in a strategy designed to lay the groundwork for a successful 5G launch that utilizes much of the infrastructure currently being deployed to support accelerating 4G consumption.”

Verizon’s analyst consensus is a Moderate Buy, based on an even split of 6 “buy” and 6 “hold” ratings. The stock sells for $60.22, and the $62.82 average target suggests a modest 4% upside. (See Verizon stock analysis on TipRanks)

International Business Machines (IBM)

IBM is one of the storied names in business tech. Founded in 1911, IBM has proven that giant conglomerates can adapt to changing times – the company has was invented in the early days of time-punch clocks and mechanical tabulators, saw the rise of punch card analog computers and electric typewriters, moved into PCs, and now is positioning itself for cloud computing. Annual sales revenue upwards of $79.6 billion, and net income of $8.7 billion, show that IBM remains a powerful force in business technology.

That has come at a cost, however. The company spent $34 billion to acquire open-source cloud software leader Red Hat, which became a subsidiary company in July of this year. The deal brings in a proven revenue generator, but also forced IBM to swallow steep losses in its third quarter as it had to report the debt before realizing any gains. This made Q3 the fifth consecutive losing quarter for IBM, as revenues of $18.03 billion came in under the $18.22 estimate. Earnings, however, have started to gain, with the $2.68 reported just over the $2.67 forecast. Red Hat saw its own revenues climb by 20%, a good sign for IBM moving forward.

Through it all, IBM has maintained its dividend payments. The company pays out an impressive $6.48 per share per year, on a robust 4.77% yield – and management is committed to continuing to pay that out, despite the losses and debt incurred in recent years. In another positive sign, despite recent share price slips, IBM stock is up 19% so far this year, putting it only slightly behind the S&P and NASDAQ indexes.

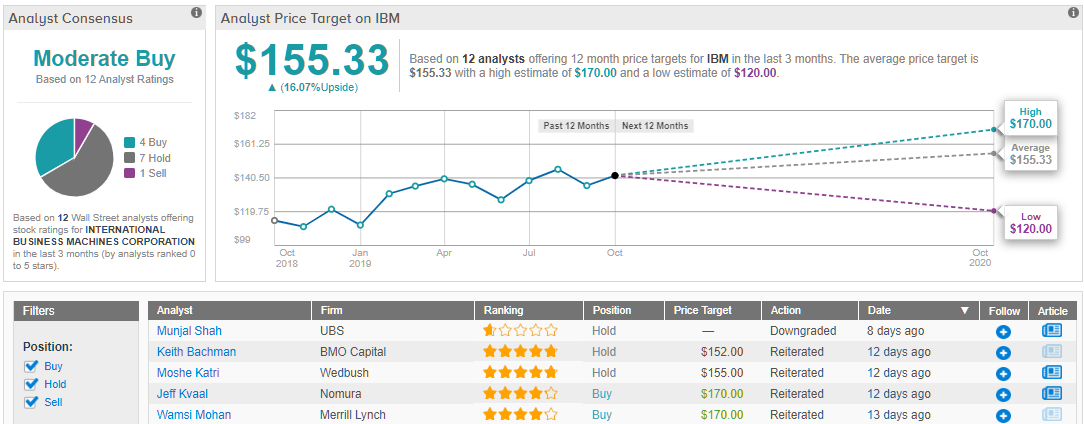

Representing the bulls is Jeff Kvaal from Nomura. He wrote, “IBM is growing in the right places given the Red Hat acceleration as well as encouraging indications for the mainframe business.” Kvaal sees room for a 25% upside to IBM, as he sets a $170 price target.

Also bullish is 5-star analyst David Grossman of Stifel. Grossman’s $169 price target indicates confidence in a 24% upside, reflecting his belief that the Red Hat acquisition and “secular challenges” are now baked into the stock price, and that investors will not be phased by “modest downward pressure on earnings in 2020.”

IBM’s recent travails, and its 5 straight quarters of revenue dips, have combined to push the analyst consensus toward a Moderate Buy, based on 4 “buy,” 7 “hold,” and 1 “sell” ratings. The $155 average price target suggests a 14% upside from the $135 share price. This gives IBM the highest upside of the stocks on this list – a vote of confidence in the company’s proven ability to roll with the changes. (See IBM stock analysis on TipRanks)

Broadcom (AVGO)

Our fourth dividend champion stock today is the sixth largest semiconductor company in the world, measuring by revenues. Broadcom brought in over $18.45 billion in sales last year, growing 4% from the year before. The stock has gained 14% year-to-date, a strong performance in an industry that has been showing uneven gains in the last 18 months.

Broadcom beat the earnings forecasts for both revenues and EPS in Q3, although the beat was modest. The EPS of $5.16 was just under 1% over the forecast, while the revenue of $5.52 billion beat the consensus by a quarter percent. Both numbers showed gains from the year-ago quarter.

For investors, the key points here are the share price growth, which while underperforming the general market is still solid, and the dividend, which at 3.64% is well above the market average. Even though AVGO’s dividend yield is the lowest of the four stocks in this article, the high share price boosts the annualized dividend payment to $10.60 per share. The payout ratio of 66% shows that the company can maintain this high return to investors.

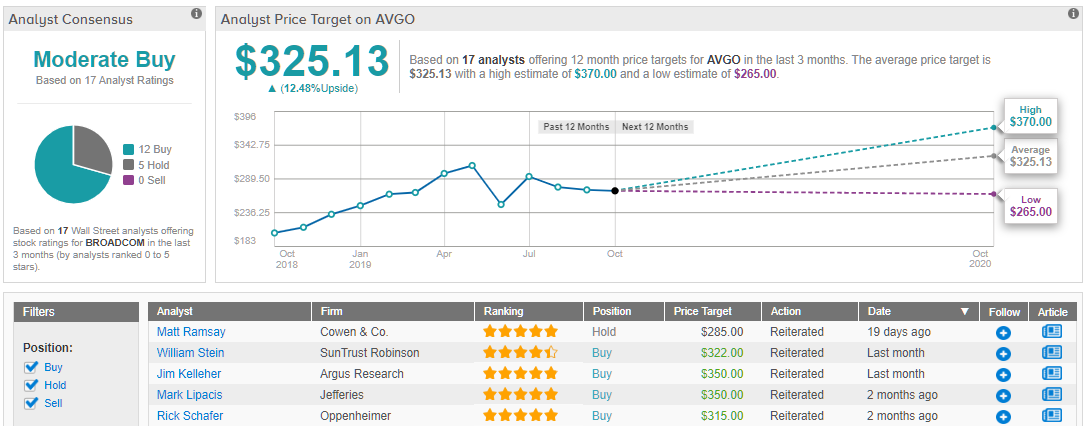

Argus analyst Jim Kelleher was cheered by the Q3 results, and said that the dip in share prices was due more to the company’s cautious forward guidance than to recent performance. He added, “We believe that Broadcom’s strong cash flow outlook remains intact, and it is now attractively valued at a significant discount relative to its recent valuations.” His price target, $350, suggests an upside potential here of 20%. (To watch Kelleher’s track record, click here)

William Stein, of SunTrust Robinson, put a $322 price target and 10% upside to AVGO. He took a positive view of the company’s move to pay down debt, and wrote approvingly of “management’s staged goal: to temporarily transition capital return from buybacks to deleveraging.”

All in all, AVGO shares sell for $291, and the average price target of $325 suggests a 12% upside. This is in line with the consensus view of Moderate Buy, based on 17 recent ratings, including 12 “buy” and 5 “hold” ratings. (See Broadcom stock analysis on TipRanks)