Which stocks are primed for positive reactions? While less trendy than biotechs, Wall Street pros point to chemical stocks as capable of rewarding investors handsomely in the years to come. Not only has this sector generated double-digit returns in the last five years, but names in this space also typically perform well in an economic downturn.

“Even during the financial crisis, the chemicals industry outperformed other industries. And the difference in value creation is substantial: where a $100 investment in telecoms in 2000 would have returned a meager $164 by 2018, the same investment in chemicals would have returned over $500,” wrote Arthur D Little consultants Michael Kolk, Koji Uchida and Marc de Pater.

With the consultants noting that the demand for chemical-based solutions is likely to persist, we turned to one of the Street’s best-performing analysts, Wells Fargo’s Michael Sison, to find compelling investments in the sector.

Using TipRanks, we were able to take an in-depth look at his top picks in the chemical industry. On top of getting a vote of confidence from Sison, each of the names has amassed enough support from other Wall Street analysts in the last three months to warrant a “Strong Buy” consensus rating.

Ingevity Corporation (NGVT)

Performance materials and chemicals company Ingevity provides specialty chemicals and high performance carbon materials. While investors have expressed concerns related to the demand for pine chemicals, Sison remains optimistic about NGVT.

The five-star analyst tells investors that NGVT is a stand-out as it’s the only major global player that can meet the new Vapor Emission regulatory road map. This is necessary to be compliant with stricter standards in the U.S., China and Canada.

“We believe NGVT is the only player serving the U.S. and Canada changes and market share in China could double in the term. Performance materials has grown well above 20% annually for the last three years including 2019 and we expect double digit growth through 2021,” Sison commented.

It also doesn’t hurt that regulatory requirements in China as well as sales of its honeycomb scrubber products drove a third quarter earnings beat. In addition, given the company’s recent purchase of Perstorp Holding AB’s Capa segment and its pine chemicals stabilization, Sison is convinced that NGVT will be a long-term winner. As a result, the analyst reiterated his Buy rating and $100 price target, which implies about 15% upside from current levels.

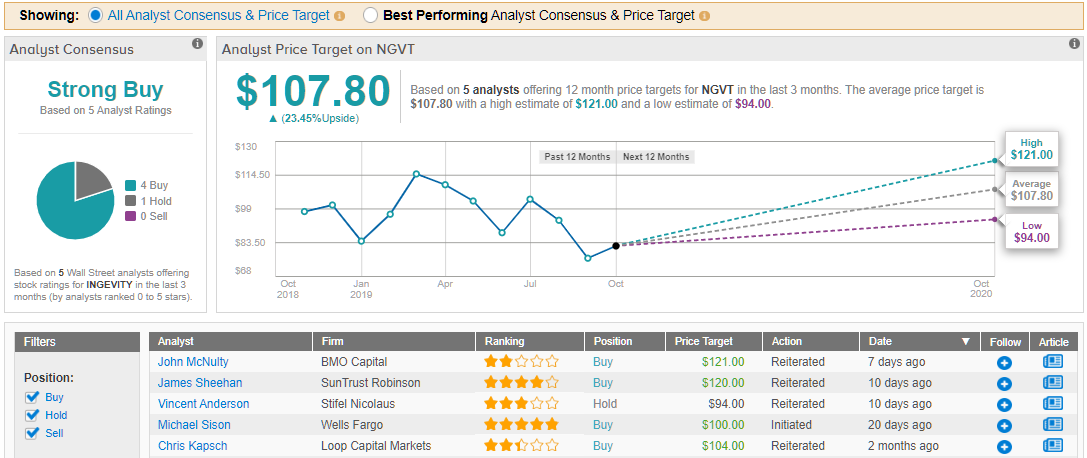

Similarly, the rest of the Street takes a bullish approach when it comes to NGVT. 4 Buy ratings and 1 Hold received in the last three months add up to a ‘Strong Buy’ analyst consensus. Not to mention its $108 average price target implies 23% upside potential. (See Ingevity stock analysis on TipRanks)

Ashland Global Holdings (ASH)

On the heels of recent divestitures, Sison argues that now is the ideal time to buy chemical company Ashland.

Over the last decade, ASH has placed a significant focus on tailoring its product portfolio to become a pure play specialty chemical and ingredient company. Sison believes this shift away from non-chemical and more commoditized assets, which included divesting from Composites and its Marl BDO facility, was strategic as it could drive substantial gains.

“With recent divestitures, ASH is now a pure-play specialty chemical company with EBITDA margins firmly in the low 20s, with a pathway to move to the mid-20s. We see growth for the next couple years anchored by cost savings initiatives, improved organic growth and bolt-on acquisitions,” the analyst explained.

Sison also highlights ASH for its long-term goal of improving EBITDA margins. He adds that this improvement could be fueled by “a combination of more productivity/cost savings initiatives and more capital deployed to its consumer and personal care franchises to drive more consistent organic sales growth.”

All of the above factors prompted the analyst to initiate his ASH coverage with a bullish call. On top of this, Sison’s $90 price target indicates that he sees shares rising 15% over the next twelve months.

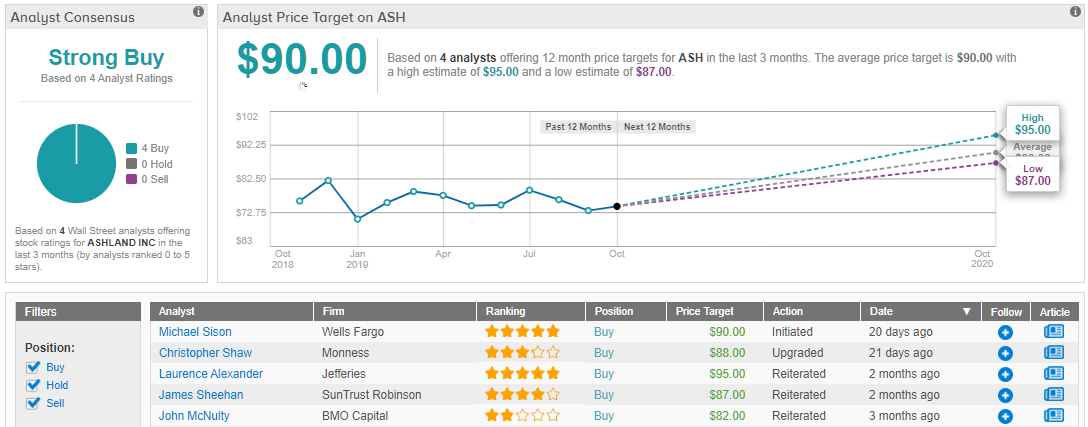

As only Buy recommendations have been issued in the last three months, the message is clear: ASH is a ‘Strong Buy’. The average price target of $90 has the upside potential falling right in line with Sison’s projection. (See Ashland stock analysis on TipRanks)

Linde (LIN)

Sison maintains that Linde is a solid bet in the space thanks to the fact that its strong long-term growth narrative is supported by integration synergies, positive pricing and several new projects.

Back in October 2018, the company merged with Praxair to become the largest industrial gas company in the world. With the expected cost and capex synergies resulting from the merger landing at $1.1 billion, it’s no wonder Sison is excited about this name. Not to mention he adds that the upside potential from cross selling offerings as well as improved focus on applications and technology could bring EBITDA margins back to the low 30s. If that wasn’t enough, the analyst sees EPS growth being driven by the $4.7 billion worth of backlogged projects it had as of Q2 2019.

Sison reminds investors that the industry as a whole remains attractive with “four global players where pricing power is accelerating, margins are high, customer contracts are long term in nature with some having take or pay provisions and all focused on improving returns on capital”.

Based on all of these positives, the five-star analyst gave LIN his stamp of approval by starting coverage with a Buy rating. According to his $223 price target, the upside potential comes in at about 12%.

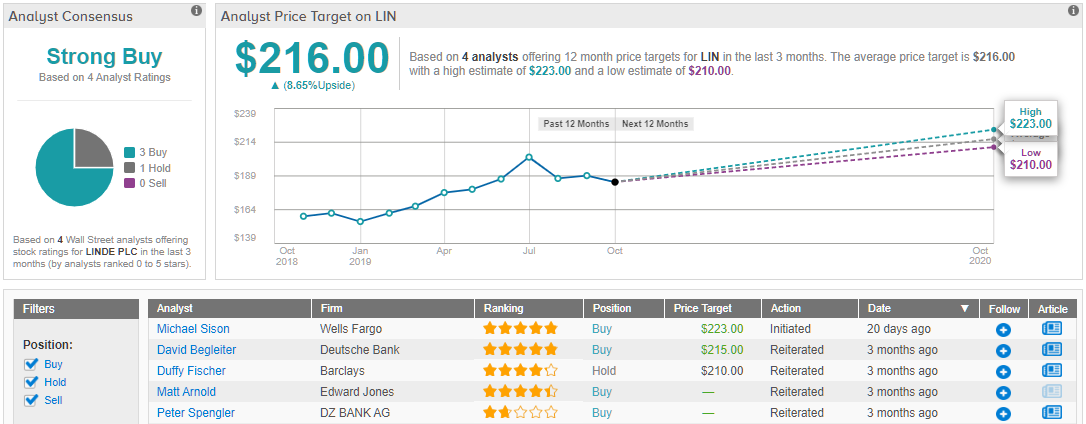

Other Wall Street analysts appear to mirror the analyst’s sentiment. As a result of the 3 Buy ratings and 1 Hold it racked up over the last three months, LIN is a ‘Strong Buy’. (See Linde stock analysis on TipRanks)