When the dentist advises you to brush your teeth, what do you do? You brush your teeth. And when the car mechanic urges you to pump your tires, you’re going to listen to his advice and pump them, right?

Well, investing is not much different: when you need some guidance, you heed the expert’s advice.

Deutsche Bank is Germany’s largest bank, and one of the world’s largest by total assets. It staffs some of the best analysts on the Street and it currently ranks as number 7 in TipRanks Top Performing Research Firms chart.

With this in mind, we decided to take a look at some of the German giant’s recent stock recommendations. Let’s jump right in.

Mastercard (MA)

Payment processing giant Mastercard has a huge market cap of $281 billion and has swiped its way into the public’s conscience via its ubiquitous presence in our everyday life.

Even so, it is not one to rest on its laurels, and has many income streams. The company is developing its ACH (Automated Clearing House) infrastructure, winning new market share (it is in the process of adding Santander in the UK, BNP Paribas, and BMW portfolio, amongst others) and working with fintech disruptors such as Revolut, N26, and Monzo.

5-star Deutsche analyst Bryan Keane thinks the multinational firm has an “operating model that delivers,” noting, “MA is dedicated to expanding its card business while also layering on incremental network growth over the mid to long-term through new opportunities such as ACH/real-time payments, B2B, cross-border account-to-account and new applications like bill pay.”

The Bill Pay Exchange is set to launch in the US in 4Q19 and represents a big investment for Mastercard. The service will allow consumers to pay bills without having to remember multiple passwords, set up accounts with different billers, and log into multiple websites. Mastercard believes it can become a key player in the bill presentment and payer market.

Keane added, “Overall, we believe MA can continue to grow solid low-double-digits top-line (propelling into mid-teens growth) and deliver operating leverage even while investing in future network expansion initiatives, which should drive EPS growth above the high-teens, in our view.”

To this end, Keane reiterated a Buy rating on MA, with a price target of $320, which provides potential upside of 15% from its current price of $277. (To watch Keane’s track record, click here)

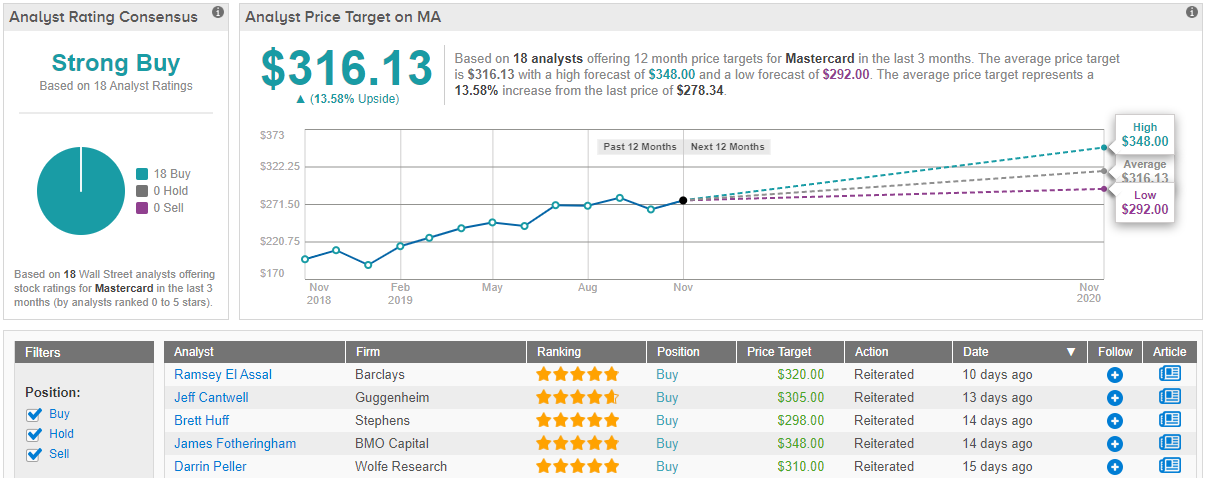

All in all, over the last three months, MA stock has received a whopping 18 Buy ratings. As a result, the stock has a ‘Strong Buy’ analyst consensus rating. These analysts believe (on average) that the financial services giant has big upside potential of over 13% from the current share price. This would take MA from $278.34 all the way to $316.13. (See Mastercard stock analysis on TipRanks)

Take-Two (TTWO)

Popular video game holding company, Take-Two, might have a problem. However, its problem is one most companies would like to have: how do you follow a bonanza success with another?

Its most successful game, Grand Theft Auto V, (made by Rockstar Games, one of the holding company’s publishing labels), has sold more than 115 million copies worldwide. Its sequel, Grand Theft Auto VI, is not expected until late 2020 at the earliest. With the incredible success of GTA V, it remains to be seen whether the new release can match it. Nevertheless, there’s enough action kicking off in the meantime to keep investors happy.

Take Two recently posted a strong F2Q20 report. Net revenue grew 74% to $857.8 million, EPS gained 186% to reach $0.63, and the company raised its operating outlook for fiscal year 2020.

Deutsche’s Clay Griffin thinks the game designer is in good shape, noting, “While investors wait, GTA V/Online remains extremely healthy (and sets the stage for an earnings step function in GTA VI), the NBA2K franchise continues to move higher, and we have a high level of confidence in the long term net bookings contribution of Red Dead Online… While it may not have the predictability of its larger peers, pound-for-pound we see TTWO’s portfolio of IP and creative excellence as differentiated. We think it is in the middle stages of a major content cycle that should crescendo into a Grand Theft Auto VI launch in F’22.”

Griffin rates the stock as a Buy, with the price target of $145 implying over 20% upside. (To watch Griffin’s track record, click here)

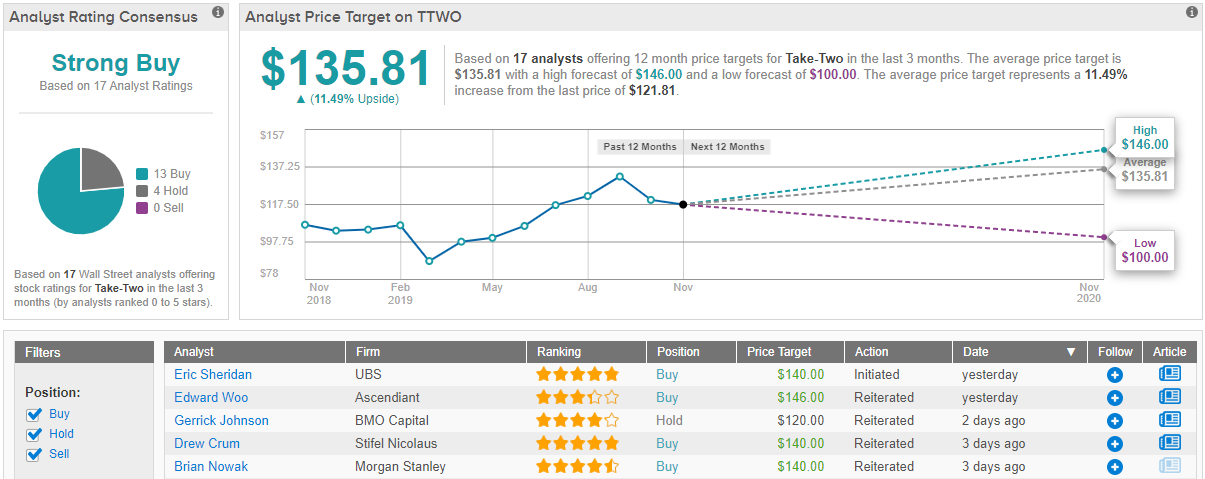

All in all, there is a fair amount of positivity surrounding TTWO right now. TipRanks deems the stock as Strong Buy, which is based on 13 “buy” and 4 “hold” ratings. The average price target is $135.81, which indicates an upside of about 11% from its current price of $121.78. (See Take Two’s stock analysis on TipRanks)

Dropbox (DBX)

Although Dropbox might have started as a simple consumer-based storage solution, it has gone through a transformation process over the years, and now describes itself as “the world’s first smart workplace.”

The company recently launched Dropbox Spaces, a set of tools which includes new features developed through its machine intelligence platform, DBXi. In addition, the company added several new collaboration features across Dropbox surfaces. Alongside the new features though, the company also increased the price of its Dropbox Plus service.

The company’s recently posted 3Q19 report was the first to examine the impact of the price increase on average revenue per user (ARPU) and net adds/churn. The print left a solid impression on 5-star Deutsche Bank analyst Karl Keirstead, who noted, “Dropbox delivered solid/clean results, marked by a modest top-line beat (20% c/c growth relative to 19%-20% guide) made up of ARPU growth of 4% (5%-6% ex-FX) and net adds of 400k (compared with guidance of 300k, implying no material uptick in churn).” The analyst continued, “The debate may now turn to whether the 4Q19/1Q20 guide for net adds of just 200k is evidence of delayed churn or merely conservative guidance. We continue to believe that the outlook for high-teens/20% growth and margin expansion warrants 2020 multiples higher than the current levels of 4x revs and 24x FCF.”

As a result, Keirstead reiterated his Buy rating on DBX stock along with a $28 price target, suggesting room for almost 50% upside. (To watch Keirstead’s track record, click here)

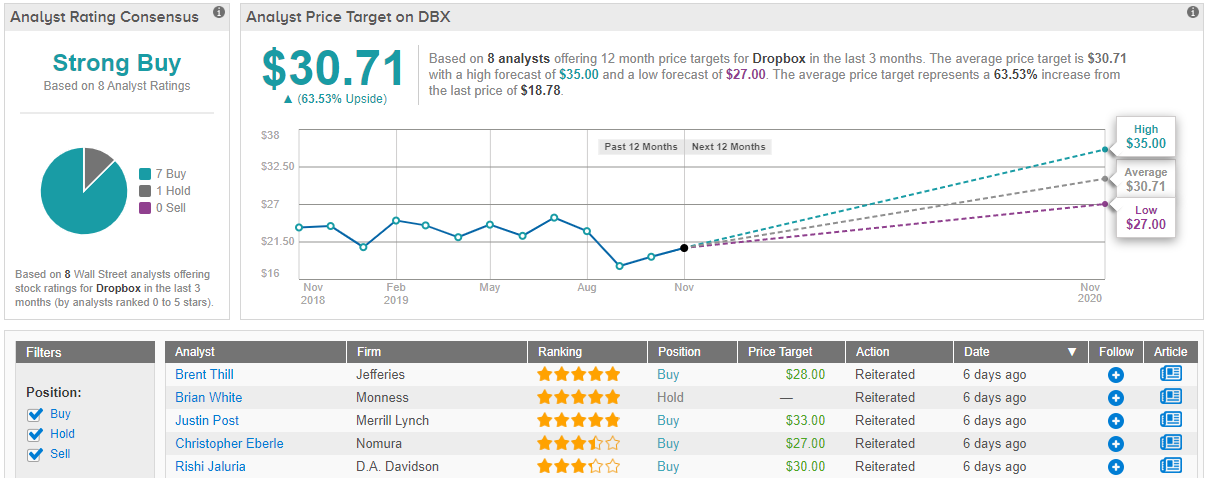

The Street is with Keirstead on this one, as Dropbox currently has a consensus of 7 Buys and 1 Hold, making it a Strong Buy. With an average stock-price forecast of $30.71, analysts are predicting a handsome upside potential of over 60% for the stock. (See Dropbox’s stock analysis on TipRanks)