Penny stocks are controversial, to say the least. When it comes to these under $1 per share investment opportunities, Wall Street observers usually either love them or hate them. The penny stock-averse point out that while the bargain price tag is tempting, there could be a reason shares are trading at such low levels like poor fundamentals or insurmountable headwinds.

However, the other side of the coin has merit as well. Naturally, with these cheap tickers, you get more bang for your buck in terms of the amount of shares. On top of this, other more expensive and well-known names aren’t as likely to produce the colossal gains that penny stocks are capable of.

Given the nature of these investments, Wall Street analysts recommend doing some due diligence before pulling the trigger, noting that not all penny stocks are bound for greatness.

With this in mind, we set out on own search for compelling investments that look like a steal. Using TipRanks’ Stock Screener tool, we filtered the results by current share price, analyst consensus and price target upside to track down 3 penny stocks that have amassed enough analyst support to earn a “Strong Buy” consensus rating. Adding to the good news, each pick boasts over 50% upside potential. Let’s dive in.

Lineage Cell Therapeutics (LCTX)

Like the name implies, this biotech uses its proprietary cell-based therapy platform to develop specialized, terminally-differentiated human cells. These cells can potentially replace or support cells that are dysfunctional or absent as a result of a degenerative disease or traumatic injury, or even help the body defend itself against cancer. On the heels of its recent data readout, one analyst argues that the $0.81 price tag is a steal.

The company just released data from the Phase 1/2a study for OpRegen, its retinal pigment epithelium cell transplant for advanced dry age-related macular degeneration (dry AMD). According to the results, the therapy produced significant improvements in vision, with no unexpected complications or serious adverse events reported. Not to mention for some patients, structural improvements in the retina and decreases in drusen density have been maintained, and there is evidence of the continued presence of transplanted OpRegen cells three years after the therapy was administered.

Based on this outcome, Dawson James analyst Jason Kolbert stated, “The data continues to demonstrate improvements in visual acuity, pointing to what may be a robust new therapy for Dry Age-Related Macular Degeneration.” On top of this, he believes the fact that the Orbit Subretinal Delivery System (Orbit SDS) and a new Thawand-Inject (TAI) formulation of OpRegen have already demonstrated signs of success “continues to support the use of retinal pigment epithelial (RPE) cells.”

With the analyst estimating that macular degeneration is a multi-billion dollar market opportunity, he thinks OpRegen is the lead product and the performance driver for LCTX. In line with his optimistic take, Kolbert maintained a Buy rating as well as the $6 price target. This brings the potential twelve-month gain to a whopping 641%. (To watch Kolbert’s track record, click here)

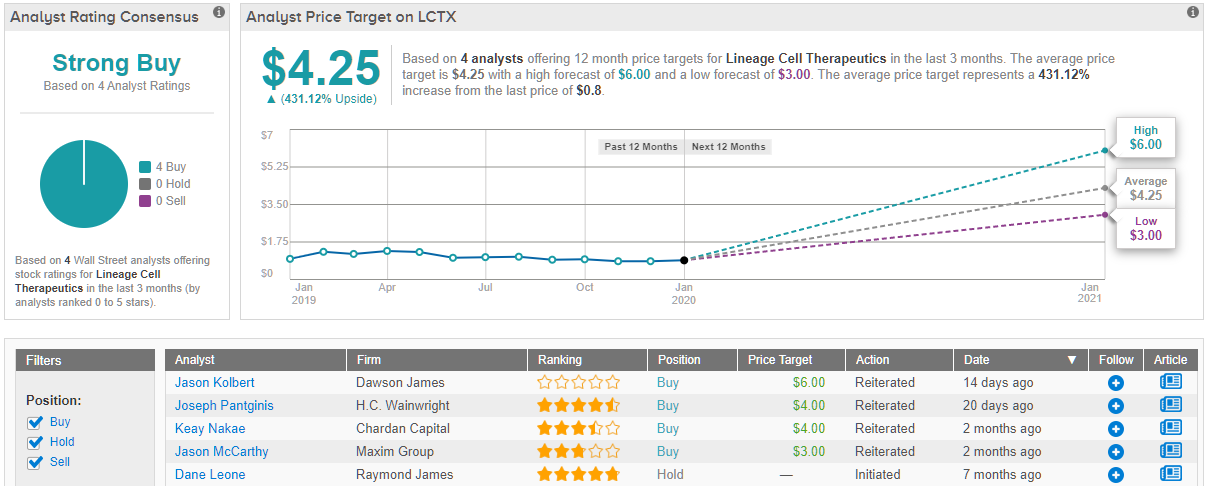

It turns out that the rest of the Street wholeheartedly agrees with the Dawson James analyst. With 4 Buys and no Holds or Sells, the message is clear: LCTX is a Strong Buy. The $4.25 average price target puts the upside potential below Kolbert’s forecast at 431%. (See Lineage Cell price targets and analyst ratings on TipRanks)

Great Panther Mining (GPL)

Intermediate gold and silver mining and exploration company Great Panther operates three mines including the Tucano Gold Mine in Amapá State, Brazil and two primary silver mines in Mexico: the Guanajuato Mine Complex and the Topia Mine as well as owns the Coricancha Mine in Peru. At only $0.60 per share, some members of the Street see an attractive entry point.

Part of the excitement surrounding the company is related to its recent production beat. On January 13, GPL announced that fourth quarter 2019 consolidated production reached 146,853 gold equivalent ounces, blowing expectations out of the water. Management stated that this strong result was driven primarily by a better-than-expected quarter in Tucano, with production landing at 34,181 ounces. While Roth Capital’s Jake Sekelsky acknowledges that the company beat his conservative estimate at Tucano thanks to additional tonnage from the Urucum North and Urucum South pits, he sees the geotechnical review at the UCS pit as an inflection point for shares.

Also encouraging is management’s decision to raise non-dilutive cash at the end of Q4 and early Q1 2020 via two separate transactions. “Given the company’s increased cash balance, we believe the company possesses the necessary working capital to move forward with the technical review at Tucano aimed at bringing the UCS pit back into production in 2021,” Sekelsky explained. He adds that this approach also de-risks GPL.

To this end, the analyst stays on the bulls’ side. Along with his bullish call, Sekelsky bumped up the price target from $0.80 to $1, implying shares could be in for a 67% gain in the next twelve months. (To watch Sekelsky’s track record, click here)

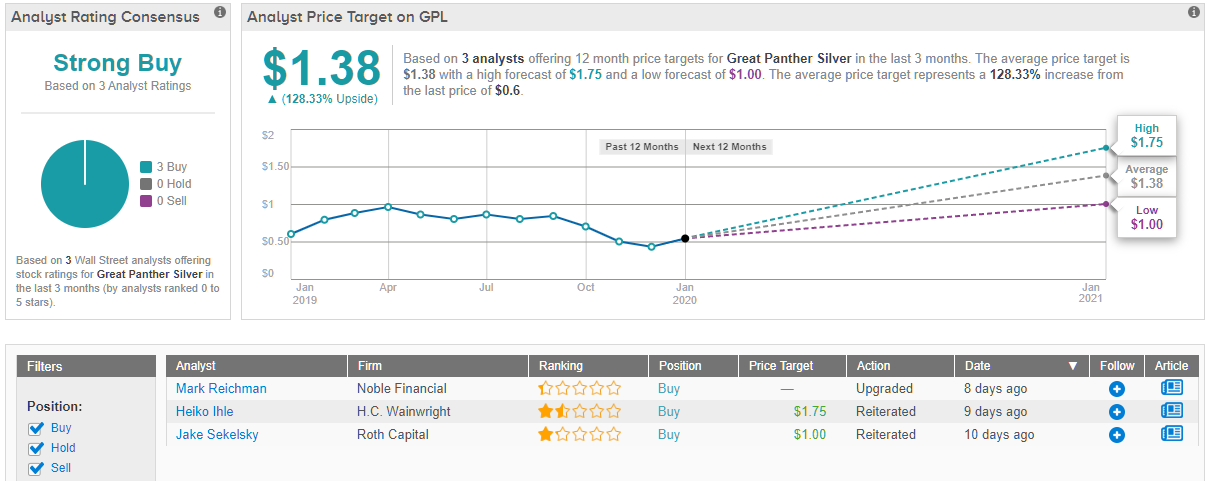

What does Wall Street have to say? It has been relatively quiet when it comes to analyst activity. That being said, the two other analysts that published a review in the last three months were also bullish, making the consensus rating a unanimous Strong Buy. To top it all off, the $1.38 average price target suggests that 128% upside could be in the cards. (See Great Panther stock-price forecast on TipRanks)

Auryn Resources, Inc. (AUG)

The last penny stock on our list is another player in the metal mining and exploration space. Auryn currently has seven projects including two flagships: the Committee Bay high-grade gold project in Nunavut and the Sombrero copper-gold project in southern Peru. With the price per share landing at $1.27, Heiko Ihle of H.C. Wainwright tells investors to get on board before it takes off.

After the company broke the news that the intrusives related to mineralization at its Sombrero project in Peru are from the same metallogenic event that previously created many of the top deposits in the Andahuaylas-Yauri belt, Ihle likes what he’s seeing. “We believe that the Sombrero project could host a world-class deposit within its 130,000-hectare land package,” he commented.

Additionally, the analyst sees the Curibaya site as particularly promising. The asset’s initial sampling program delivered solid results, including 7,990 grams per tonne (gpt) silver, 17.65 gpt gold and 6.97% copper. According to Ihle, this outcome demonstrates the magnitude of precious and base metal grades at Curibaya.

“As Auryn’s surficial data at Curibaya continues to line up, the firm intends on further refining its drill targets through geophysical surveys to provide the necessary resolution for subsurface drilling. Auryn plans to apply for drill permitting at the end of 1Q20 with the ultimate goal of drilling the project in 4Q20,” the analyst noted.

Given that 2020 could see some important discoveries for AUG, it makes sense, then, that the analyst takes a bullish approach, leaving both a Buy rating and the $2 price target as is. Should the target be met, shares could be in for a 57% twelve-month climb. (To watch Ihle’s track record, click here)

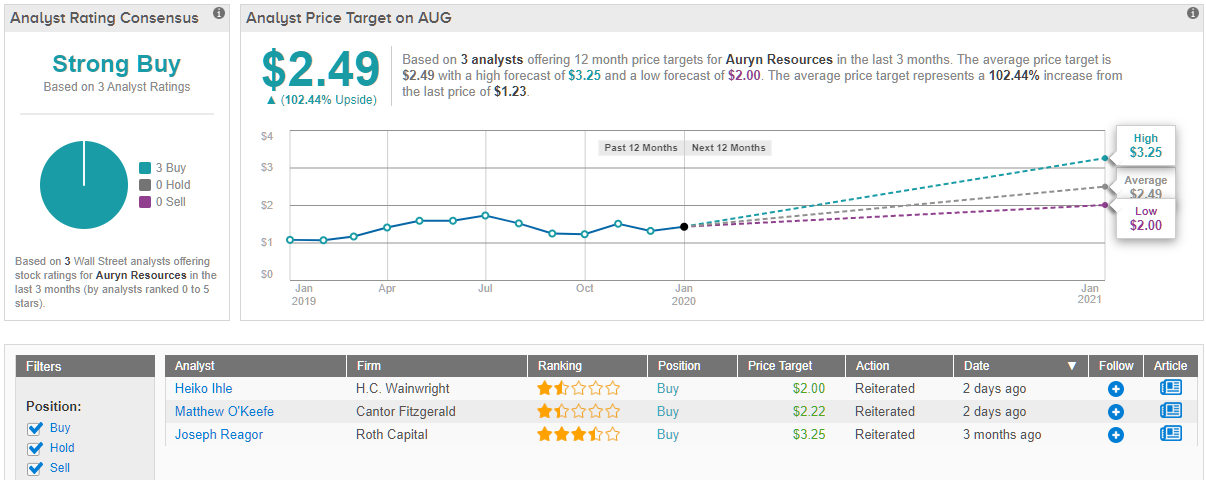

All in all, the rest of the Street has been impressed by AUG. Out of 3 total analysts, 102% see the stock as a Buy, making the Street consensus a Strong Buy. At $2.49, the average price target suggests 96% upside potential, surpassing Ihle’s estimate. (See Auryn price targets and analyst ratings on TipRanks)