Here's what you need to know on

Markets:

BTC/USD pair is exchanging hands at $9,765 after a bearish Asian session on Monday. There was a struggle over the weekend to break that barrier at $10,000. However, increased volatility levels and the demoralized bulls saw Bitcoin price fall to levels under $9,600. An intraday low of $9,591 has been hit on the day followed by a minor recovery falling short of the resistance at $9,800.

The ETH/USD pair closed the week above $275, which was a positive gesture as many analysts had predicted a smooth sail towards $300. Unfortunately, the ride above $280 remained a pipe dream as Ethereum price plunged to $266.01 (intraday low). At the time of writing, Ethereum is trading at $268 after losing 2.56% of its value on the day.

XRP/USD, on the other hand, is teetering 3.61% lower on Monday. Attempts to advance towards $0.30 failed short of $0.28. An intraday high of $0.2851 marked the end of the journey north. Meanwhile, support at $0.27 remains intact with sideways trading in the range between $0.27 and $0.28 likely to take over.

Among the top 100 cryptocurrencies the worst hit coins include Ethereum Classic $9.41 (-4.07), EOS $4.23 (3.84%), NEO $13.86 (-3.57%), Litecoin 76.66 (3.94%), Bitcoin Cash $390.05 (3.26%), Monero $83.02 (-2.89%) and Bitcoin Gold $10.26 (-2.2%).

Chart of the day:

BTC/USD daily chart

Market

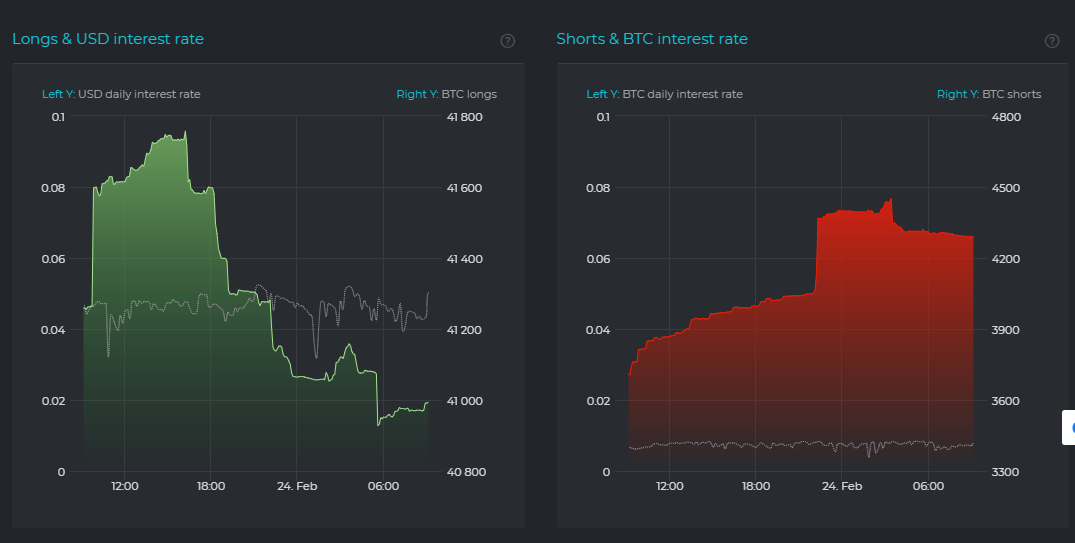

$40 million Bitcoin longs liquidated on BitMEX

As Bitcoin price dived further below $10,000, longs traders on BitMEX, a leading BTC margin trading platform was in action. Data my Datamish.co, a platform that tracks BTC margin trading on BitMEX indicates that over $40 million BTC longs had been liquidated in the last six hours compared to the $4290 shorts liquidated on the same exchange.

Gold prices hit seven-year high as Coronavirus fears mount

Gold is exploding in gains while Bitcoin remains relatively bullish amid fears that the Coronavirus may become a global pandemic. The virus, otherwise known as COVID-19 started in China, however, its effects and dangers are fast spreading to other countries. Experts and analysts believe that Bitcoin, gold, and silver are in the green due to the spread of the virus. For instance, top analyst Mati Greenspan said in a tweet towards the end of last week:

Took a short position on the Nasdaq and long Gold before the weekend.

Small money big leverage. Guessing with the spread of Coronavirus and #FeelTheBern gaining ground, those positions will open in the money tonight.

The gold price has hit a seven-year high logged in 2013 at $1,681/ounce. Silver has not been left behind as it has short up significantly. Greenspan later said that the position closed in profit following the breakout on Monday.

The death toll due to the virus hit 2,442 by Sunday while 76,936 infections had been reported in China and around the world. Italy is dealing with 144 cases, US 35 and Iran 43 respectively.

Industry

Ripple seems to have recognized that the XRP Ledger is missing out on use cases related to the ability to support complex smart contracts. In line with this, Xpring, Ripple’s investment and incubation arm has said that it plans on building a financial bridge between XRP and Ethereum (ETH). The bridge will ensure that value is transferred easily between the two platforms. Ripple claims that XRP has the highest liquidity among other cryptos while Ethereum excels in smart contracts support.

We think the XRP to ETH and ERC-20 tokens bridge is important since XRP is one of the most liquid crypto currencies in the world, but doesn’t have a compute layer to support complex smart contracts for the growing Decentralized Finance (DeFi) market on Ethereum.

Regulation

The recent G-20 summit that saw 20 Finance Ministers and Central Bank Governors converge in Riyadh urged that nations move on with the implementation of FATF standards on cryptocurrencies and virtual assets. The group reaffirms its stance in October 2019 regarding the evaluation of ‘global stablecoins’ and other related risks before they are allowed to hit the market.

We look forward to the consultation report from the FSB on addressing regulatory issues of so-called ‘global stablecoins’ – April 2020, a report from the IMF on the macroeconomic implications including monetary sovereignty in its member countries – July 2020, and a report from the FATF on the risks to AML and CFT– July 2020.

Quote of the day

FSB members recognise the speed of innovation in the area of digital payments, including so-called ‘stablecoins’. We are resolved to quicken the pace of developing the necessary regulatory and supervisory responses to these new instruments.

Financial Stability Board (FSB) Chair Randal Quarles

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

-637181239138997687.png)