Among the world’s 20 biggest oil-producing countries, there’s only one that has--as far as anyone really knows--escaped the coronavirus, but it’s got problems that are just as big.

Taking stock of the pandemic from the perspective of oil-producing nations is important because COVID-19 adds another major layer of uncertainty to the already devastating oil price/market share war between Saudi Arabia and Russia.

And while Libya has no “known” cases, and Russia is popping champagne corks over the West’s panic, Iran is reeling under a triple threat, Iraq just had a big operational scare, the UAE is clamping down, and the Saudis are perhaps taking measures that are too mild, too late.

It will all continue to affect oil, not simply from an economic growth and demand perspective, but an operational standpoint, too. It’s not the ideal atmosphere in which two stubbornly unaccountable world leaders should be playing at a pricing war. The coronavirus may force their hands before they’re ready.

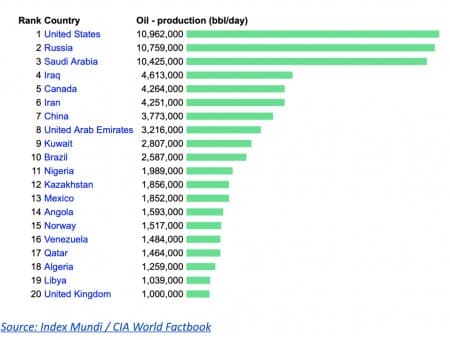

Top 20 Oil-Producing Countries as of 2019:

(Click to enlarge)

Source: Index Mundi / CIA World Factbook

But in the meantime, this is what the Oil-COVID-19 playing field looks like, and how the infection is spreading:

Africa

For once, Africa is probably the only place on the planet to be, and it’s also home to four large oil-producing countries: Nigeria, Angola, Algeria, and Libya.

Nigeria has banned entry for travelers from 13 countries as it grapples with containment, though its 12 confirmed cases as of Thursday represent a more delayed spread of the virus to Africa in general.

Then we have Libya, where there are no confirmed cases of coronavirus, and no real facilities to contain an outbreak if there is, but where oil production is already halted over a new phase in an ongoing civil war.

Libya is currently producing 91,221 bpd, as production has been halted due to the ongoing civil war between the Government of National Accord (GNA) and the eastern-based Libyan National Army (LNA) led by General Khalifa Haftar. This is now an international proxy war, with external forces lining up on opposing sides, hedging their bets on who will come out on top with the oil in hand. Financial losses due to the forced halt of oil production since mid-January are now estimated at over $3.36 billion by the National Oil Company (NOC) of Libya.

To contain an outbreak of the pandemic in Libya, the GNA on Monday suspended all flights at the Misrata Airport for three weeks, and border crossings have been ordered to close.

Algeria confirmed its 8th death from coronavirus on Thursday, with a total of 82 cases, but what observers will be watching is how this affects the year-long mass protest against kleptocratic rule, much of which had to do with the state-run oil company, Sonatrach.

Angola registered its first case of coronavirus on Wednesday.

The GCC

The worst case in the Gulf presently is gas giant Qatar, with 452 COVID-19 cases as of Thursday. Foreigners are now banned from entry. Most of the cases are said to be related to migrant workers.

Saudi Arabia, the OPEC giant facing off with Russia in a devastating oil price war, had 238 cases of coronavirus as of Wednesday, with 67 new cases that same day.

The UAE has 140 cases, with 27 new cases just confirmed today, and it has banned citizens from traveling abroad.

Kuwait has 148 cases, with 6 new cases reported Thursday. Foreign flights have been cancelled, employees have been sent on two-week holidays, and educational institutions have been shut down, along with public markets and shopping malls.

China

China, where the virus originated, has turned a corner, with no new local infections as of Thursday. To date, the virus has killed 3,245 people in China.

Iran

Outside of China, the hardest hit is Iran, which is also suffering under U.S. sanctions and ridiculously low oil prices thanks to Russia and Saudi Arabia. As of Wednesday, Iran’s death toll due to coronavirus had surpassed 1,135, spiking 15% overnight. In total, Iran now has 17,631 coronavirus cases confirmed across the country.

Iraq

In Iraq, which was already reeling from a very undefined proxy war between the United States and Iran, the industry will be twitching a bit over the decision Tuesday to halt production of 95,000 bpd from the southern Gharraf oilfield after Malaysian giant Petronas evacuated its staff over coronavirus concerns. Petronas simply evacuated, apparently without even giving Baghdad a heads-up, and because Petronas is the operator, there was no time to prepare a new operational plan.

Russia

Russia is still basking in what it appears to think is divine intervention to justify the greatness of Putin--wonderfully portrayed in this must-read Moscow Times commentary--with reportedly fewer than 100 infected.

Moscow is currently living the high life, watching a parody of Soviet-era scrabbling for staples in the West, and still pretending it’s not shooting itself in the foot by taking on the Saudis (and, for good measure, U.S. shale) in a war for market share.

Kazakhstan

Two cities in oil-giant Kazakhstan are now on lockdown, as of Tuesday, after an overnight doubling of the number of cases to 33.

North America

ADVERTISEMENT

Canada’s COVID-19 death toll now sits at nine, compared to more than 150 deaths in the United States as of Thursday morning. Alberta’s oil industry is what some analysts are calling on its deathbed, with the price of Western Canadian Select trading at just $5.40 on Thursday, a loss of 50% in a single day--a price point that is entirely unsustainable for the industry and well below Canadian breakevens.

U.S. coronavirus cases soared 40% in just 24 hours as of Thursday, and the total number of confirmed cases had surpassed 10,000.

Europe

North Sea oil giant Norway, while taking potshots at the unpreparedness in the U.S., has 1,442 COVID-19 cases as of Wednesday and has moved to invoke emergency powers, close borders, schools, and other public and private institutions.

The UK, which failed to digest the seriousness of the situation in Italy, where the death toll has officially outpaced China’s, has 2,626 confirmed cases, with the death toll now standing at 103.

Related: Big Oil Is Literally Burning Cash In The Permian

South America

Venezuela, home to the world’s largest oil reserves, is under a nationwide quarantine due to the virus. What’s particularly worrisome about Venezuela is that their entire health system has essentially collapsed and they have an insufficient number of doctors and not enough medical equipment--or even soap and water.

It’s hard to assess just how serious the situation is in Venezuela due to media blackouts, but the IMF refused a loan to Venezuela to deal with the virus.

As of Wednesday, Venezuela was reportedly grappling with 33 cases of the virus.

Brazil, which produces roughly 3 million barrels of oil per day, on Thursday moved to restrict foreign visitors coming from Venezuela, Argentina, Bolivia, Peru, Colombia, Suriname, and French Guiana. It’s state-run oil firm, Petrobras, has already had employees test positive for the virus and are scaling back meetings and screening “collaborators” at airports before arriving at production platforms.

In Mexico, populist president AMLO (Andres Manuel Lopez Obrador) is playing things cool, insisting that the threat of the pandemic is exaggerated. AMLO is not moving to close down anything and is instead relying on good luck charms, even with 118 confirmed cases of COVID-19.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Could Crash To $10 As World Runs Out Of Storage

- April Could Be Worst Month Ever For Oil

- Russia Needs Higher Oil Prices, But Won't Surrender