Once upon a time, Chesapeake Energy (CHK) was a rising star of the energy world, snapping up assets and blazing a trail towards a fracking future, in which it would supply oil markets around the world.

Sea changes in the prices of oil and natural gas, however, combined with a too-aggressive acquisition spree and the debt loads that came with it have all but destroyed Chesapeake Energy’s equity value. Over the past five years, the stock has tumbled from a split-adjusted high of more than $3,300 a share, to just $16.38 per share as of Wednesday’s close — vaporizing 99.5% of the stock’s value.

Now, you may not remember Chesapeake stock ever costing “3,300” a share — and there’s a reason for that. Fact is, Chesapeake stock never actually got anywhere near that high. What it did do was fall so very low that, after close of trading on Tuesday, the company was forced to undergo a 200-for-1 “reverse” share split, whereby for every 200 shares of the oil company someone owned on Tuesday, they would own just one single share on Wednesday. In so doing, Chesapeake managed to grow its apparent share price 200x — and so historical charts of its past stock prices have adjusted accordingly, taking all the old prices, and multiplying them by 200.

Why did Chesapeake do this? Well, consider that just before the shares reverse-splitted, Chesapeake stock had fallen to a share price of just $0.13. That’s far too cheap to retain a listing on the NYSE, and so, in order to avoid becoming delisted, the company engineered the reverse split, lifting its share price from $0.13… to $26.00 per share. In so doing, Chesapeake also sidestepped a provision which would have made $1 billion worth of its preferred stock “puttable” (i.e. “shortable”) upon delisting.

But here’s the problem with reverse splits: When a company does one, it’s a very clear sign to investors that something has gone very seriously wrong. Management is basically admitting that it has no confidence that its stock price is going to “bounce back” on its own, and sees the reverse split as its only option of regaining a respectable share price.

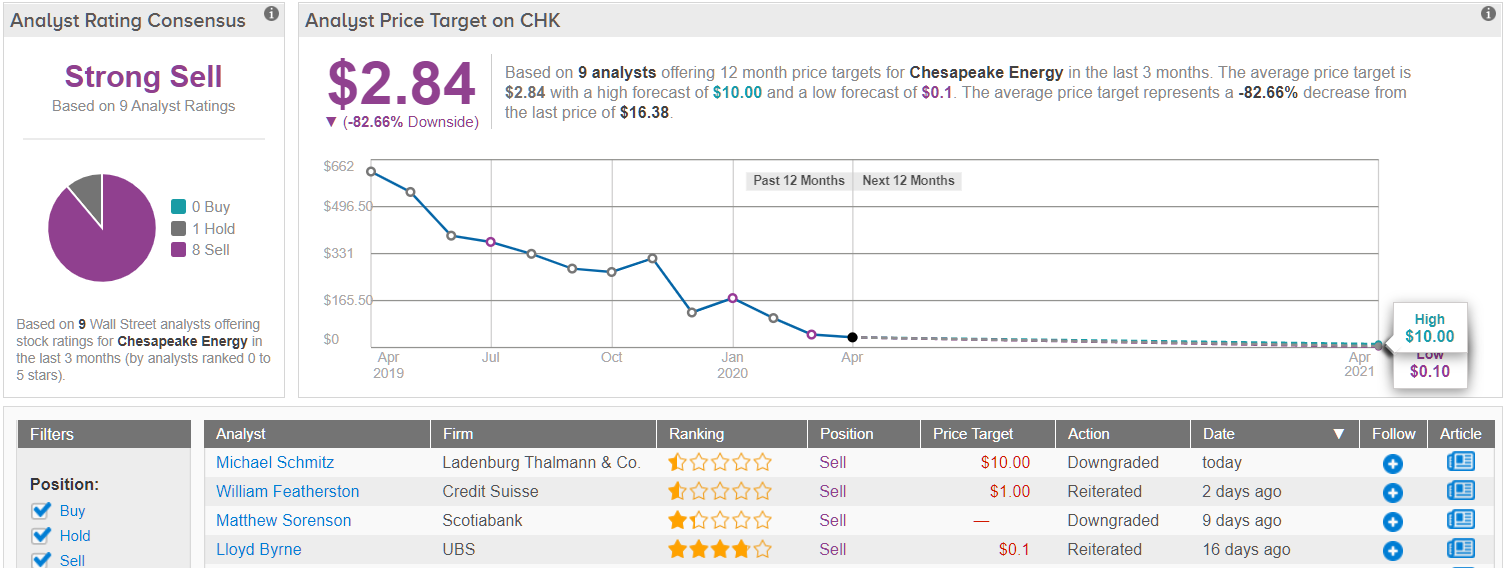

And management is probably right about that. As Credit Suisse analyst William Featherston commented Tuesday, the “collapse in oil prices” will probably prompt Chesapeake to cut daily oil production 22% before the end of this year, and a further 20% in 2021. Chesapeake’s capital spending will fall in tandem, but probably not fast enough to prevent the company burning $270 million in negative free cash flow this year — and $700 million in 2021. To this end, Featherston reiterated an “underperform” rating on Chesapeake shares while adjusting his price target to $1.00 (from $0.05). (To watch Featherston’s track record, click here)

Scotiabank analyst Matthew Sorenson still sees hope that Chesapeake will be free cash flow positive this year (+$20 million). But by 2021, even Sorenson projects negative free cash flow of $680 million — in line with Featherston’s estimates. Considering Chesapeake’s “onerous financial leverage” ($9.5 billion worth of debt, and only $6 million in cash on hand), this probably means Chesapeake is going to “breach … its credit facility’s leverage covenant” later this year — which could presage a bankruptcy filing. Accordingly, Sorenson rates the stock “underperform.”

None of this comes as a huge surprise to us, however. TipRanks’ stock analysis engine has long expected Chesapeake Energy to “underperform,” based largely on the consensus of eight vetted analyst ratings which, combined, rate Chesapeake a “strong sell.”

These same analysts by the way, now predict that within a year, even Chesapeake’s post-reverse-split stock price gains will evaporate, and this stock that sells for “$16” today, will soon be worth less than $3.00 a share — and be a penny stock once again. (See Chesapeake stock analysis on TipRanks)