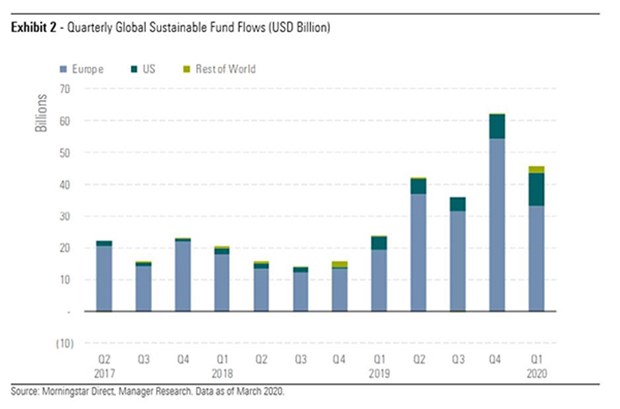

Investors continued to pour money into sustainable funds in the first three months of 2020, even as the coronavirus pandemic unfolded. Investors across the globe put $45.6 billion into funds focused on environmental, social and governance (ESG) in the first quarter of the year. This compares with global outflows of $384.7 billion for the overall fund universe.

Total assets in sustainable funds stood at $841 billion at the end of March. While that's down 12% from the all-time high of $960 billion reached at the end of 2019, assets in the wider fund universe took a greater hit, declining by 18% is the Covid-19 crisis.

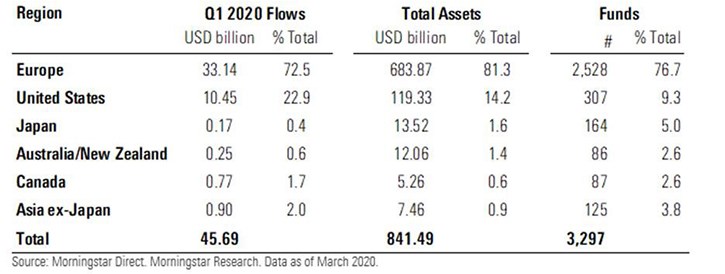

Europe continues to dominate sustainable investing and is home to 76% of sustainable funds and 81% of assets. But interest is growing further afield, with 102 new fund launches in the first three months of the year and 24 funds rebranded to a sustainable mandate.

In the latest Global Sustainable Fund Flows report, Morningstar analysed inflows across 3,297 open-ended funds and ETFs using ESG criteria in their investment strategy, pursuing a sustainability-related theme, or seeking to make a positive impact alongside a financial return. This cohort does not include fund using only exclusionary or negative screens in their investment strategy.

The below chart shows inflows into sustainable funds by region, as well as the number of sustainable funds and assets under management in each jurisdiction.

The global sustainable universe attracted $45.6 billion in net flows in the first quarter of 2020. Europe took in the bulk of these flows (72.5%), although less than in previous quarters. The US accounted for close to 23% of inflows in the quarter. Flows across the rest of the world were considerably lower, but represented a higher proportion of total flows than previous quarters. Overall, global inflows were down 27% from Q4 2019 but still up 90% on Q1 2019.

The continued inflows in first-quarter 2020 speak of the stickiness of ESG investments. Investors in sustainable funds are typically driven by their values, invest for the long-term, and seem to be more willing to ride out periods of bad performance.

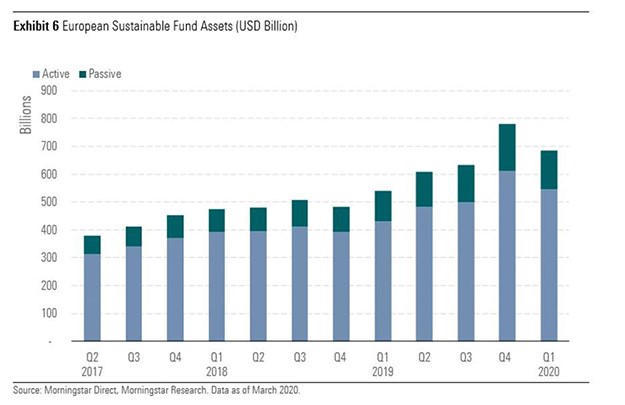

The past three years have seen a steady increase in assets in sustainable funds. Assets remain dominated by European funds, accounting for more than 80% of the global sustainable fund universe owing to the long history of responsible investing and the favourable regulatory environment in Europe. With 2,528 sustainable funds currently available, Europe is by far the most developed and diverse ESG market.

Despite the Covid-19 market sell-off in March, the European sustainable funds universe attracted inflows of $33 billion in the first quarter of 2020.This contrasts with the $163 billion in outflows suffered by the overall European fund universe.

Assets in European sustainable funds dropped in first-quarter 2020, now totalling $684 billion, down 12% from a record high of $779 billion at the close of 2019. This compares with a 16.2% reduction in assets for the overall European fund universe.

Among the best-selling sustainable funds in the first quarter were BlackRock ACS World Low Carbon Equity Tracker, Pictet - Global Environment Opportunities, Anima Investimento Circular Economy, Eurizon Absolute Green Bonds, and Nordea 1 - Global Climate & Environment, claiming $3.8 billion in combined flows. This is testament to the growing awareness among investors of the risks and opportunities arising from climate change. We expect flows into climate-aware funds to continue their upward trajectory in the coming years, supported by significant regulatory developments, including the EU Action Plan on Sustainable Finance.

The quarter saw 72 new sustainable funds come to market, including Lyxor MSCI USA Climate Change ETF, NN (L) Corporate Green Bond I Cap EUR, and PIMCO GIS Climate Bond. And asset management firms also continued to convert existing funds to a sustainable mandate. For example the Schroder Strategy fund is now the Schroder Sustainable Strategy fund and Amundi Funds European Equity Target Income became Amundi Funds European Equity Sustainable Income.