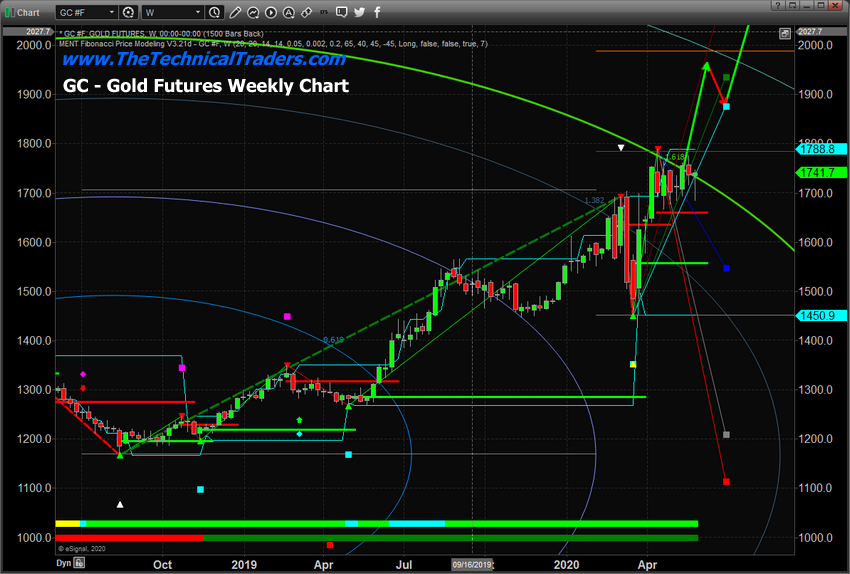

While the U.S. stock market has rallied over the past 5+ weeks, gold has stalled near $1730 to $1740. We issued a research post suggesting the GREEN Fibonacci Price Amplitude Arc was acting as major resistance and once that level is breached, we expect a big upside move in gold. Currently, gold has reached just above the Green Price Amplitude Arc and this week may be a critical moment for both gold and silver in terms of a momentum base.

Gold Futures Weekly Chart

Gold has continued to move high in a series of waves – moving higher, then stalling/basing, then attempting another move higher. This recent base near $1740, after the deeper price rotation in February/March, confirms our 2018/2019 predictive modelling research suggesting that $1,750 would be a key level in the near future. Part of that research suggested once $1,750 is breached, then a bigger upside move would take place targeting levels above $2,400 – eventually targeting $3,750.

April 25, 2020: Fibonacci Price Amplitude Arcs Predict Big Gold Breakout

This consolidation after the COVID-19 event near $1,750 is a very real confirmation for our researchers that the upside breakout move is about to happen. How soon? It could begin to break out next week of the following week? How high could it go? Our upside target is $2,000 to $2,100 initially – but gold could rally to levels near $2,400 on this next breakout move.

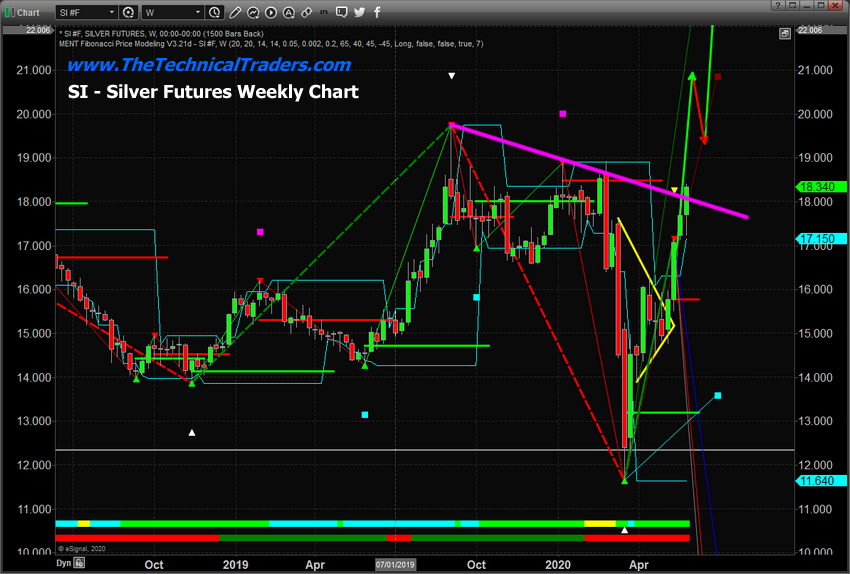

Silver Futures Weekly Chart

While gold has been consolidating near $1,740, silver has exhibited an incredible upside price move after a very clear Flag/Pennant formation (highlighted in YELLOW on the chart below). The current upside price rally in silver appears as though it may breach the MAGENTA downward sloping trendline and this breakout move may prompt a rally to levels near or above $21 over the next few weeks.

Eric Sprott is very excited about silver and miners. Also, he talks about the demand for physical delivery, which is way out of whack and how something could finally give which would be metals go parabolic.

We've been suggesting that metals will transition into a moderate parabolic upside price trend as the global markets deal with concerns related to economic activity, debt, solvency, and continued operational issues. For skilled technical traders, this setup in metals may be a very good opportunity for skilled technical traders to establish hedging positions in ETFs or physical metals before the breakout really solidifies.

Concluding Thoughts:

Longer-term, we believe metals could continue to rally for quite a while, yet we understand skilled technical traders want to time entries to limit risks. We believe skilled technical traders should consider hedging their portfolio with a moderate position in metals/miners at this time – allowing traders to trade the remaining portion of their portfolio in other sectors/stocks.

If the U.S./global markets continue to struggle to move higher over the next 60 to 90+ days, metals/miners should continue to push higher – possibly entering a new parabolic upside price move.

The deep washout low in silver was an incredible opportunity for skilled traders to jump into silver miners and silver ETFs at extremely low price levels. Now, with silver at $18.40, it's time to start thinking about $21+ silver and $2,100+ gold.