More Upside After A Triangle On Ripple

Ripple is trading bullish since June, and as we can see price is unfolding an impulsive move. We see completed first leg i, corrective leg ii, and an extended leg iii, so latest sideways price activity can belong to a corrective wave iv. Characteristics of the price activity since the beginning in August can be linked to a triangle pattern, a continuation pattern, which unfolds prior to the final leg; leg v of C/3 in our case.

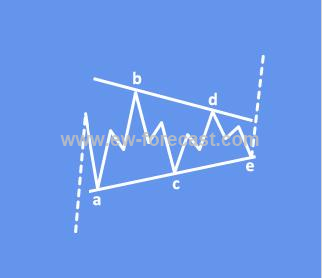

We see a running triangle unfolding, which is now unfolding sub-wave (d), that can face resistance at the upper triangle line and Fib. ratio of 61.8 (0.2900/0.3000 level), and a reversal into a final leg (e) of a triangle. That said, once all five legs within a triangle fully develop, and we see a bullish advance above the upper triangle line, and above the 0.3200 level, that is when wave v of C/3 may be underway.

XRP/USD, 4h

A Triangle is a common 5-wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature. Triangles move within two channel lines drawn from waves A to E, and from waves B to D. A Triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide into a 3-3-3-3-3 form.

Triangles can occur in wave 4, wave B, wave X position, or in some very rare cases also in a wave Y of a combination.

Running triangle in uptrend:

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.