Canadian Dollar Forecast: USD/CAD, CAD/JPY & NZD/CAD Levels

The Canadian Dollar has long shared a degree of positive correlation with crude oil, affording the currency a growth-sensitive tilt in the lens of broader macroeconomic markets. Consequently, many CAD pairs suffered in the wake of the coronavirus outbreak and different crosses have recovered to differing degrees in the months since. USD/CAD was no exception as the pair rocketed higher in February and March, only to eventually bleed lower in the following months.

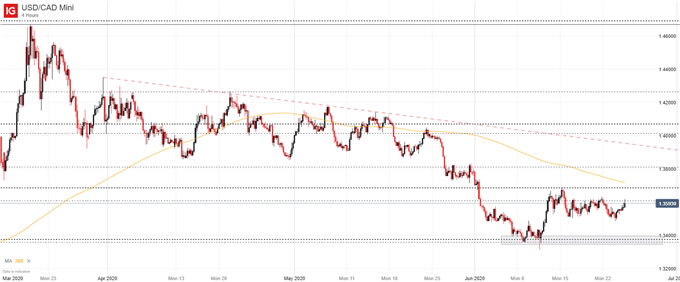

USD/CAD PRICE CHART: 4 - HOUR TIME FRAME (MARCH 2020 – JUNE 2020)

(Click on image to enlarge)

With the larger downtrend still intact, recent shifts in risk appetite have seen USD/CAD hold above support near the 1.34 mark with the pair consolidating over the last few days. With equity markets falling under fire on Wednesday, it is hardly surprising the “safer” US Dollar was appreciating compared to the Canadian Dollar – a theme that will likely remain for weeks to come as bouts of risk aversion reemerge.

While past price action has seen USD/CAD decline, the subsequent consolidation might allow bulls to make a more concerted effort higher, particularly if risk aversion persists in the days ahead. With that in mind, the pair may continue lower in the longer-term and any venture beneath the 1.34 mark would open the door to further losses from a technical perspective. Still, sentiment hangs in the balance so the possibility of brief USD/CAD rallies are not out of the question.

CAD/JPY FORECAST

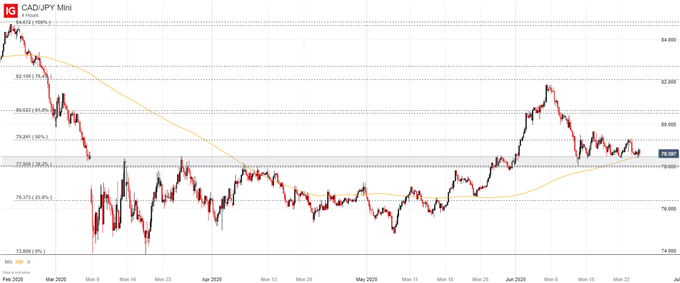

Another pair highly susceptible to risk trends is CAD/JPY. With the Japanese Yen often benefiting from uncertainty, CAD/JPY has yet to recover from the turmoil following the June 10 Fed meeting. As a result, the pair rests on horizontal support and the 200-period moving average at 78 and 78.59 respectively. Together the two levels should look to keep the Canadian Dollar afloat, but a journey beneath could indicate an appetite to go lower.

CAD/JPY PRICE CHART: 4 – HOUR TIME FRAME (FEBRUARY 2020 – JUNE 2020)

(Click on image to enlarge)

Conversely, resistance might be offered by the nearby Fibonacci level at 79.24, followed by 80.52 and the recent swing high around 81.87. While a continued improvement in economic activity should bolster the Canadian Dollar in the longer run, the current technical layout reveals a slightly more attractive opportunity for bearish trade ideas as a break beneath 78 would be a fairly substantial technical development that might allow for losses to accelerate.

NZD/CAD FORECAST

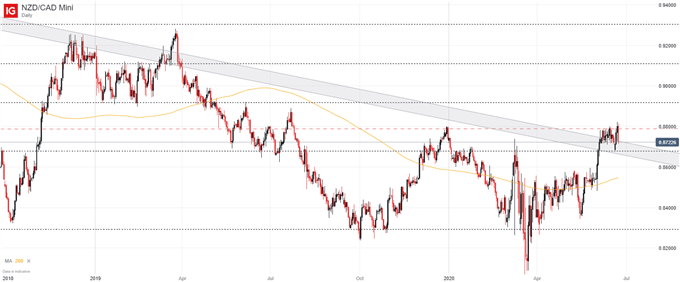

Shifting our focus to NZD/CAD, a lot of chop can be seen, only to culminate in very little progress for either pair in the year-to-date. Still, the lack of progress is not from a lack of trying as NZD/CAD recently broke above a descending trendline that has kept the pair contained since November 2016. What looked to be the beginning of a breakout has now been called into question following fairly dovish remarks from the RBNZ, which leaves NZD/CAD vulnerable to a deeper reversal.

NZD/CAD PRICE CHART: DAILY TIME FRAME (OCTOBER 2018 – JUNE 2020)

(Click on image to enlarge)

That being said, a continued push lower would see NZD/CAD attack the Fibonacci level around 0.8675 and the descending channel itself which should provide some degree of influence at this stage. Thus, the break out is not dead yet, but it is severely threatened and a confirmed daily close beneath the trendline could pave the way for losses to accelerate.

On the other hand, a rebound higher could be an early indication that the longer-term NZD/CAD downtrend has finally been broken which might allow for a series of bullish attempts higher in the weeks to come.