Silver Forecast: Markets Continue To Build Base

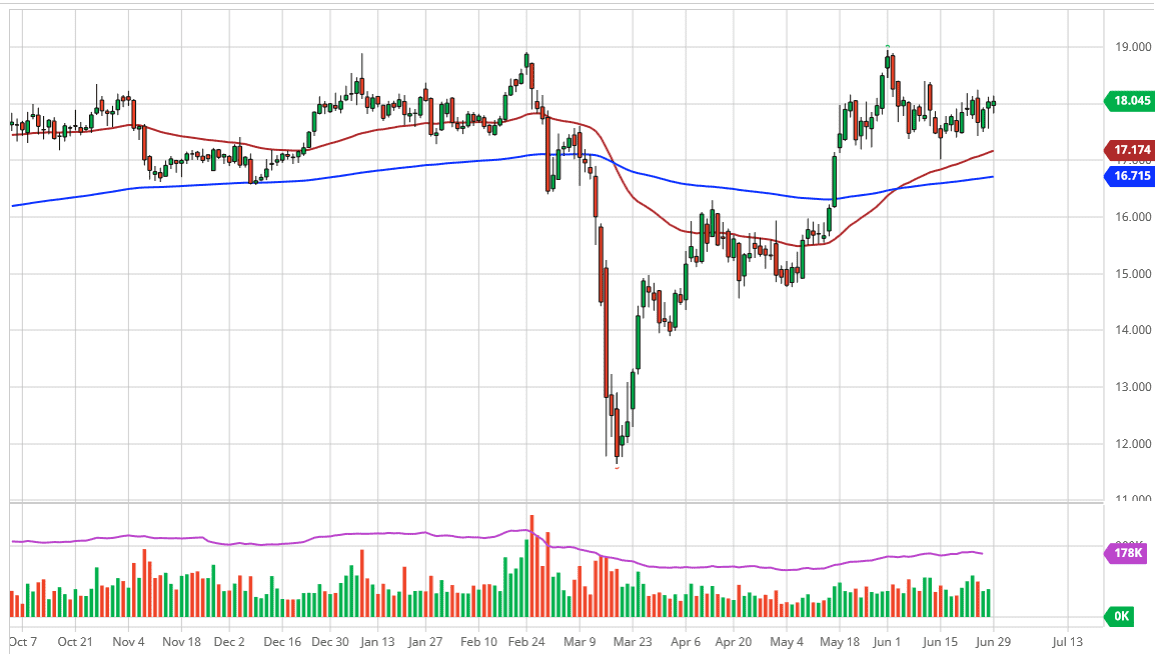

Silver markets went back and forth during the trading session on Monday, as we continue to see a lot of noise in this market. The $18 level is a bit of a fulcrum for the price, so it is not a huge surprise to see that it has offered itself as a bit of a magnet for the price during the session. All things being equal though, it does look like buyers are stepping into this market every time we pull back. Because of this, I think that the market is likely to see a lot of buyers on dips, extending all the way down to at least the $17 level.

The 50 day EMA is currently hanging around the $17.17 level, reaching to the upside and it is likely that we are going to go higher. I think at this point the market will see a bit of support extending down to the 200 day EMA, which is near the $16.71 level. Silver of course has been grinding sideways for a few weeks so it does make sense that we could see a bit of noise in the meantime, but I do think that ultimately, we go higher. After all, the fundamentals do suggest that metals should have a fairly decent Ron based upon central bank quantitative easing.

Silver will lag gold, but eventually, the pressure becomes far too extensive for silver to ignore it, and it will rally right along with gold. Silver does have the industrial component, which unfortunately this point is not going to be helping the cause. With that in mind, I think that this is a purely anti-central bank play, and while the silver market does benefit from loose monetary policy, it is not quite the gainer that gold will be.

To the upside, I believe that the $19 level is going to be a major resistance barrier, but if we can clear their it is likely that we then go looking towards the $20 level, which of course is a large, round, psychologically significant figure. With that, the market is likely to see a lot of fighting in that general vicinity but given enough time the market could probably break above there and then go looking towards the $50 level over the longer term as we had seen during the Great Financial Crisis. With this, I think you remain in a “buy on the dips” mentality.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more