EUR/USD: New Quarter, New Gains? Double-bottom Provides Support, NFP Hints Awaited

Caring about coronavirus? Another record number of daily US cases has failed to stop stocks from closing higher on the last day of the second quarter – which concluded with the strongest bounce since 1998. The safe-haven US dollar came under pressure as equities advanced, allowing EUR/USD to bounce.

Investors are also ignoring US top epidemiologist Anthony Fauci – who warned that the US does not have COVID-19 under control. Jerome Powell, Chairman of the Federal Reserve, reiterated that without defeating the disease, returning to pre-pandemic output is unlikely.

The list of states suffering from rising infections, re-closing parts of the economy, or halting the reopening is growing – with the latest limitations coming from Colorado and Idaho. The EU is opening its borders to visitors but is shunning high-spending US tourists amid the disease.

While the deterioration in coronavirus began in mid-June, figures from earlier in the month look upbeat, encouraging investors. The Conference Board’s Consumer Confidence gauge surprised with a buoyant bounce to around 98 points, beating expectations.

The first day of the new quarter features top-tier US indicators – two hints toward the Non-Farm Payrolls report due out already on Thursday. First, ADP’s private-sector labor statistics are projected to show a bounce of around three million jobs. While the firm significantly missed in May – reporting a loss of positions while the official NFP printed a surge – figures for June will likely rock markets.

The second release is the ISM Manufacturing Purchasing Managers’ Index, which carries expectations for a rebound to just under 50 – representing minor contraction. If it tops that threshold, it could further boost markets. For the Non-Farm Payrolls figures, investors will eye the employment component.

The busy day is far from over, with the Fed’s meeting minutes awaited. The protocols document deliberations within the world’s central bank when it made its June decision.

Policymakers vowed to keep interest rates low and stabilized the bond-buying scheme at around $4 per day. The minutes may show if policymakers are upbeat about the recovery or worried about long-term damage to the economy.

US politics are gaining more traction as further opinion polls have shown challenger Joe Biden is leading against incumbent President Donald Trump by around ten points. Voters are displeased with the direction of the country and apart from replacing the man at the White House, they may vote in a Democratic majority in the Senate – a nightmare scenario for markets.

Back in the old continent, coronavirus seems under control and the flights from several countries are resuming from Wednesday, including from China. The Caixin Manufacturing PMI for June continued showing the world’s second-largest economy is recovering. German retail sales also surprised to the upside with a surge of 13.9% in June, smashing expectations. Markit’s final eurozone PMIs for June will likely confirm the initial figures pointing to a recovery.

Overall, conditions are in place for EUR/USD to advance, yet the US coronavirus situation may limit any advance.

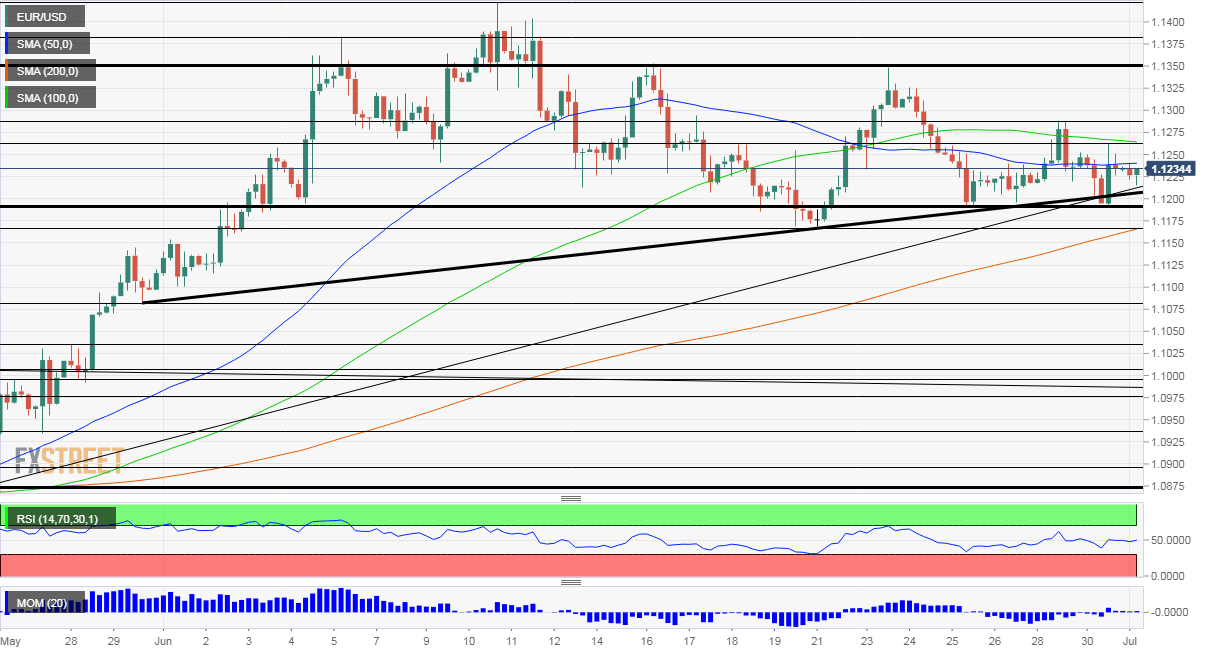

EUR/USD Technical Analysis

(Click on image to enlarge)

Euro/dollar has returned to trading above the uptrend support line after a quick dip. It received support at 1.1190 – which is now a robust double-bottom. Momentum on the four-hour chart has all but disappeared and the Relative Strength Index is balanced at around 50.

Initial resistance awaits at 1.1265, which was a swing high on Tuesday and where the 100 Simple Moving Average hits the price. The next cap is a 1.1285, the weekly high. It is followed by 1.1350, a double-top from June.

Below the double-bottom of 1.1190, the next cushion is close – 1.1165, a low point earlier in June. Further down, the next support line is only at 1.1075, dating back to early last month.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more