What to make of the markets today? We just wrapped up the second quarter, and the S&P 500 registered its best quarter in 70 years, gaining 20%. It was even more impressive as the gains came on the rebound from the worst losses since the Great Depression. We’ve had recessionary pressures thanks to COVID-19, and the sudden burst of positive sentiment, as it became clear that this time, there really is pent-up demand after a collapse.

Looking at the historical pattern of stock market performance following bearish quarters, SunTrust Robinson chief market strategist Keith Lerner sees reason for continued optimism.

“The weight of the evidence in our work still suggests that we are in a bull market… While the fits and starts in the economy and other factors will likely lead to periodic market setbacks, our work suggests this bull market continues to earn the benefit of the doubt, and we retain a positive 12-month outlook,” Lerner noted.

Lerner has backed up by some solid data – and not just the S&P’s past performance patterns. In May, we saw jobs surge as states began to reopen and people went back to work. Retail sales bounced back over 8%, and durable goods orders, a key metric for industrial activity, jumped 15%. With June’s data due out over the course of the coming week, investors are hoping for more good news.

In the meantime, for investors seeking the highest possible upside, we’ve used the TipRanks database to pull up three penny stocks whose potential starts at 105%. These are stocks priced below $5 per share, so even a small gain in absolute terms can translate to a huge percentage gain in share value.

Kaleyra (KLR)

We’ll start with a cloud computing company, Kaleyra. This company offers cloud-based communications platforms, including SMS, voice calling, and data insights, through SaaS model. Kaleyra entered the NYSE last year, after it was purchased by GigCapital in a Silicon Valley acquisition move. The combined entity took on the Kaleyra name.

The coronavirus crisis pushed Kaleyra’s earnings negative in Q1, after the company saw a net profit the quarter before. It’s important to note that Kaleyra is heavily involved in the European market, and its European operations are based in the northern Italian city of Milan, in a region that was hit harder than most by the COVID-19 pandemic.

The company was able to use the crisis to its advantage, offering free texting services to Italian EMS services. It was a smart move that generated goodwill, an important offset to the grim quarterly earnings. Quarterly revenues were a different story. The top line sales hit $33.6 million in Q1, up 21% year-over-year.

With a price tag of $3.95 per share, analysts believe that now is the time to pull the trigger.

Oppenheimer’s 5-star analyst Timothy Horan sees Kaleyra with a clear path forward as the pandemic begins to ebb. Horan writes, “The company’s platform is well-positioned for a number of secular trends that have been accelerated by COVID-19: 1) cloud adoption and digital transformations embed more communications into workflows and applications, 2) growing mobile usage as the number of LTE smartphones more than doubles over the next four years, and 3) increased personalization and automated interaction with customers/ users across every industry.”

“KLR should gain market share in the fast-growing CPaaS sector with its trusted-partner focus. The key is gaining traction with US customers and selling higher value voice/applications. With a below-$200M market cap, we consider the company speculative, appropriate for high-risk-tolerant investors. Positively, Kaleyra has landed world-class customers recently—Facebook, AT&T, Amazon— and we expect major financial services companies soon,” the top analyst concluded.

To this end, Horan rates KLR a Buy along with a $12 price target, suggesting an impressive 204% upside potential for the coming year. (To watch Horan’s track record, click here)

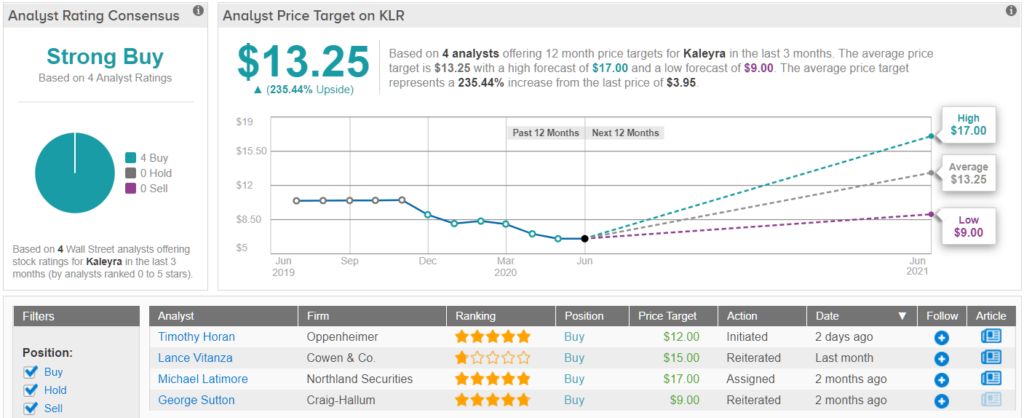

The analyst consensus on KLR, a Strong Buy, is unanimous, with all four recent reviews giving the stock a thumbs up. On top of this, KLR’s $13.25 average price target implies a hefty upside of 235%. (See KLR stock analysis on TipRanks)

Orion Energy Systems (OESX)

Next on our list is Orion Energy Systems, a “green” manufacturing company that specializes in LED lighting products. The company offers a range of illumination solutions for both indoors and outdoors, and was cited by President Obama in 2009 and 2011 as a leader in the move toward a green economy.

Orion closed out its fiscal year 2020 in its last quarterly report, and showed an impressive 129% annual gain in revenue, to $150.8 million. And, despite the coronavirus-inspired lockdowns, Orion was able to finish the fiscal year with solid liquidity, in the form of $28.8 million in cash on hand.

With the price per share landing at $3.42, some members of the Street see an attractive entry point.

Covering this stock for H.C. Wainwright, analyst Amit Dayal likes what he sees, writing, “We expect revenues to bounce back to $159.7M in FY2022, as the company completes work at 600 remaining locations of its largest customer… We expect FY2021 gross margins to be 22.0%, lower compared to 24.6% in FY2020 as a result of lower revenues, but expect these to grow to over 27.0% during FY2022 and beyond…”

The analyst places a Buy rating on the shares, and his $7 price target implies 105% upside growth in the coming year. (To watch Dayal’s track record, click here)

Wall Street agrees with Dayal, giving OESX a unanimous Strong Buy consensus rating based on 3 Buys. The stock’s $7.58 average price target suggests room for a robust 124% one-year upside potential. (See Orion Energy stock analysis on TipRanks)

S&W Seed Company (SANW)

We round off our list in the agricultural sector, where S&W Seeds is a small-cap player in the world of agribusiness commodities. The company grows and processes a variety of products, including alfalfa, small grains, and wheat, along with sorghum, sunflower, and stevia. In addition to growing the seeds, S&W breeds the varieties it sells.

S&W’s operations and customers are mainly located in the US, but during the first quarter, the company expanded its international reach through the acquisition of Australia’s Pasture Genetics in a deal worth $13.5 million ($20 million in Aussie currency).

Roth Capital analyst Gerry Sweeney sees S&W Seed in a strong competitive position: “While COVID muddies the waters going forward and may create headwinds, we remain optimistic regarding 4Q and F2021 results as core growth remains strong. S&W continues to position itself as middle market seed company with alfalfa, sorghum, sunflower and other varieties. In addition, the Pasture Genetics acquisition bolsters S&W’s distribution platform in Australia and provides cross selling opportunities.”

Sweeney’s $5 price target implies a 120% upside potential for the stock in the coming year, and fully backs his Buy rating. (To watch Sweeney’s track record, click here.)

Overall, SANW is selling for $2.27 per share, and the average price target of $5.33 indicates it has room to grow 134% this year. The stock’s Strong Buy analyst consensus is our third in a row based on a unanimous 3 Buy ratings. (See SANW stock-price forecast on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.