EUR/USD: Non-farm Payrolls To Spark A Rally? Fundamentals, Technicals Improving, 1.1350 Eyed

- EUR/USD has been edging up as optimism about a coronavirus vaccine outweighed cases.

- All eyes are on US Non-Farm Payrolls, which are set to continue recovering.

- Thursday’s four-hour chart several bullish developments for the currency pair.

What cannot go down, must go up – EUR/USD has been rising above the uptrend support line and is moving up amid several positive developments.

Vaccine hopes: Pfizer (PFE) and BioNTech (BNTX) have reported promising results in their first trial of four COVID-19 vaccines. The two firms said subjects developed antibodies and will proceed with testing of the most successful candidates. Moreover, they are reading the mass production of vaccines, potentially accelerating the deployment of immunization, once it is approved.

Face masks reaching the top? President Donald Trump seemed to have endorsed wearing face masks, saying he would do it and he does it. The U-turn from the Commander-in-Chief – who previously mocked rival Joe Biden for wearing one – may help mitigate the disease. Goldman Sachs (GS) estimated that face covers could significantly substitute lockdowns and boost Gross Domestic Product by as much as 5%.

It comes as Republican governors and other party members – including Vice President Mike Pence – said masks are necessary. A picture is worth a thousand words and an image of Trump wearing a mask – like a “Lone Ranger” as he said – may further boost markets.

Record US COVID-19 cases: The need for protection comes amid yet another record day of US cases – over 50,000. Texas has suffered the highest death rate in six weeks as hospitals in Houston are already above normal capacity. Arizona, Florida, and California are additional hotspots.

Consumers have significantly slowed down their activity even before the new restrictions and places that seem to have the virus under control are either re-closing or delaying the reopening. That includes New York City, the financial capital of the world, where indoor dining remains prohibited.

Investors are currently shrugging off the US COVID-19 situation – or in EUR/USD’s case, encouraged by Europe’s success in mitigating the disease. The old continent has opened up to visitors from outside the Schengen zone, in another step marking a return to normal.

Eurozone employment figures for April are set to show a modest increase to 7.7% amid furlough schemes, yet the focus is on America’s jobs report.

Non-Farm Payrolls focus

Due to America’s long Independence Day weekend, the data is out on Thursday instead of Friday.

Economists expect the all-important US labor market figures to show an increase of three million in June, following the increase of 2.509 million in May. The recovery comes off low points after America lost around 20 million positions in April.

The Unemployment Rate carries expectations for a drop from 13.3% to 12.3% and is of political importance ahead of the presidential elections due in four months. Investors will also pore onto the participation rate, which surged after crashing in April and the U-6 underemployment or“real unemployment rate” – which is a broader measure of joblessness and stood above 20% in May despite the improvement.

The cautious look

It is essential to note that the Non-Farm Payrolls surveys were taken in the week ending on June 12, before the most recent surge in COVID-19 cases and the consequent lockdowns. ADP’s private-sector jobs report showed an increase of 2.369 million positions, weaker than expected.

The employment component of the ISM Manufacturing Purchasing Managers’ Index remained below 50 – indicating contraction – and well below the upbeat headline figure in that survey.

Overall, the market mood is upbeat and an increase in US jobs may keep it that way – pushing stocks higher and the safe-haven dollar lower. However, investors may return to fear about the virus, especially if labor figures miss expectations.

EUR/USD Technical Analysis

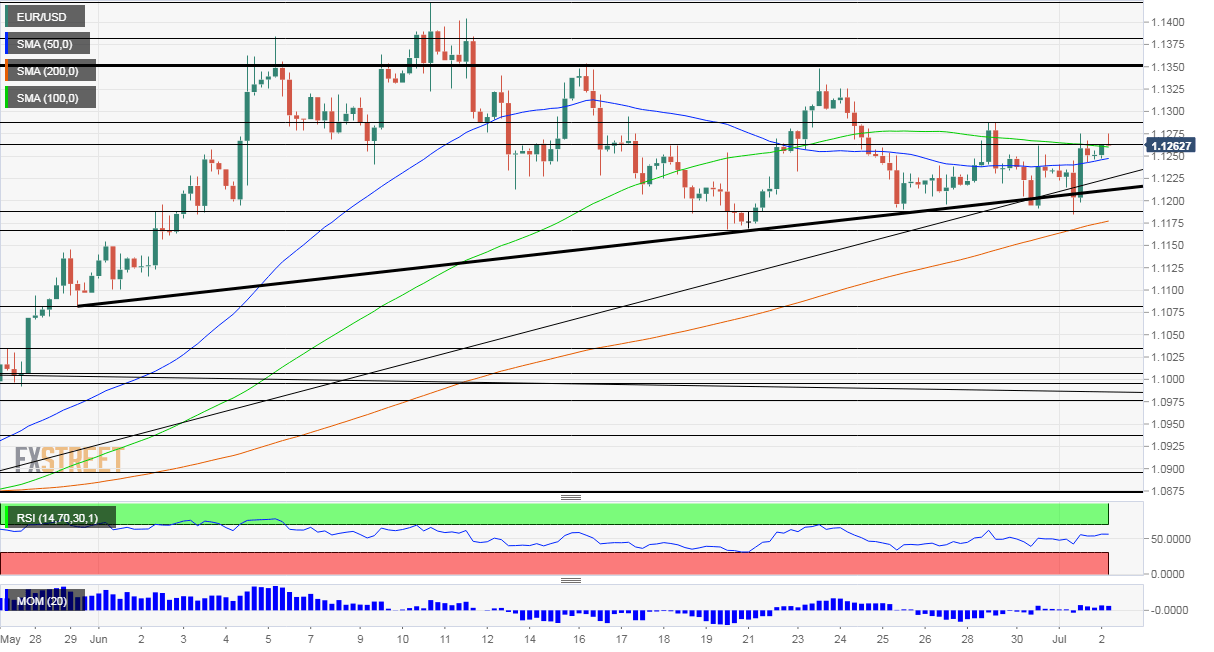

Euro/dollar has dipped below the uptrend support line that has been accompanying it for around a month and topped the 50 and 100 Simple Moving Averages on the four-hour chart. Moreover, momentum has turned positive, also supporting the bullish case.

Initial resistance awaits at 1.1290, the weekly high, but the bigger prize is 1.1350 – a double-top touched in recent weeks. Further up, 1.1380 and 1.1420 await EUR/USD. (FXE)

Some support awaits at 1.1250, which is where the 50 SMA hits the price. It is followed by the uptrend support line, coming out at around 1.1220, and then by 1.1185, a weekly low. The next lines are 1.1165 and 1.1075.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more