Merrill Lynch downgraded Apple’s stock rating to Hold from Buy citing more balanced risk-reward at current levels.

However, Merrill Lynch analyst Wamsi Mohan lifted Apple’s (AAPL) price target to $470 (7.1% upside potential) from $420. Mohan believes that Apple shares are “already trading at the highest premium to SPX in 10 years and consumer staples multiples,” and he foresees multiple risks, including pressure on unit volumes and product gross margins.

On July 30, Apple reported better-than-expected earnings of $2.58, versus analysts’ estimates of $2.04 per share. Revenues of $59.7 billion also exceeded the Street estimate of $52.3 billion. The results were driven by “double-digit growth in both Products and Services and growth in each of our geographic segments,” according to Apple CEO Tim Cook.

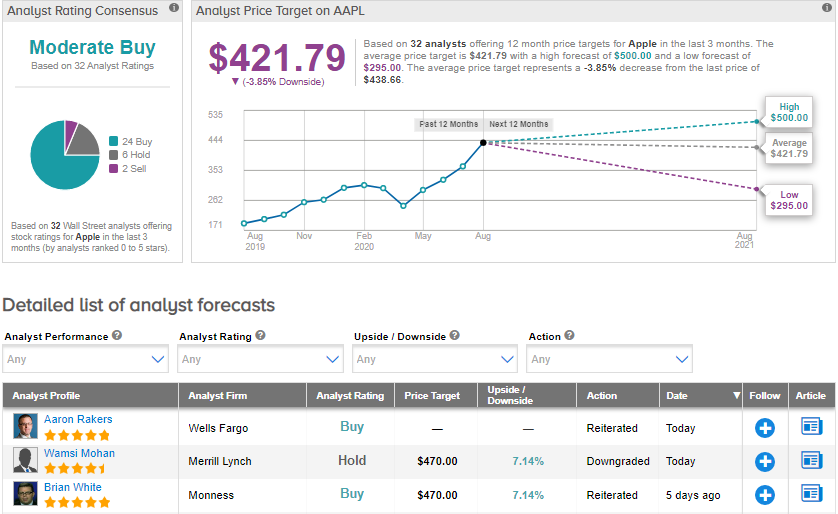

The Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 24 Buys, 6 Holds, and 2 Sells. The average price target of $421.79 implies downside potential of 3.9% to current levels. (See AAPL stock analysis on TipRanks).

Related News:

Apple Up 6% On Blowout Quarter; Strong iPhone Demand

Apple Snaps Up Canadian Payment Startup Mobeewave For $100M – Report

LivePerson Spikes 15% On Raised Profit Guidance; Needham Almost Doubles PT