Some much-needed optimism has made its way to the Street. The expectation that a vaccine against COVID-19 will be “widely distributed” by the middle of 2021 prompted an estimate revision from Goldman Sachs. Giving its projections for 2021 U.S. GDP a lift, the figure moves up from 5.6% to 6.2%.

“We now expect that at least one vaccine will be approved by the end of 2020 and will be widely distributed by the end of 2021 Q2,” Goldman Sachs’ chief economist Jan Hatzius wrote in a note to clients. As for unemployment rates, the firm also anticipates an improvement, supported by its belief that consumer services spending will ramp up in the first half of 2021 “as consumers resume activities that would previously have exposed them to COVID-19 risk.”

Hatzius does, however, note that even though he thinks a $1.5 trillion stimulus package will “become law by the end of August,” there’s a risk that further legislation won’t be enacted.

With Hatzius’ take in mind, we checked out three stocks that have scored rave reviews from Goldman Sachs. Impressing the firm’s analysts, they believe that each could deliver major returns for investors. According to TipRanks’ database, all three tickers have also been assigned Buy ratings by analysts from other firms.

Relay Therapeutics (RLAY)

Focused on developing targeted oncology therapies through careful selection of drug candidates, Relay Therapeutics hopes to address targets that were previously undruggable. After its impressive July 16 Wall Street debut, which saw the first trade land 75% above the IPO price and resulted in $400 million raised, Goldman Sachs is pounding the table.

Representing the firm, five-star analyst Salveen Richter highlights RLAY’s patented Dynamo platform that integrates experimental and computational techniques (utilizing the Anton 2 supercomputer) to understand protein motion and structure for intractable drug targets as setting it apart. While acknowledging the massive share price movement after the IPO, the analyst sees plenty of potential catalysts over the next year.

First and foremost, initial clinical data from its lead program, RLY-1971 (SHP2 inhibitor), is slated for release in 1H21. These results are expected to provide more clarity on the therapy’s profile, with its efficacy and tolerability possibly differentiating it from Novartis’ TNO-155 and Revolution Medicines’ RMC-4630, and its potential as a monotherapy. That said, Richter believes focus will “quickly shift to the company’s strategy for combinatorial approaches in tumors driven by mutations sensitive to SHP2 signaling.”

“We are positive on this strategy for RLY-1971 to avoid bypass mechanisms and to more quickly support transition to earlier line settings or improve the therapeutic profile per extended durability. While we await details on potential combinations, we note RLAY’s interest in KRASG12C driven tumors where early preclinical work has shown benefit of RLY-1971 against this mutation,” the analyst commented. To this end, she estimates 2035 GSe peak sales of $6 billion.

On top of this, the Phase 1 trial of RLY-4008 is set to kick off in 2H20, meaning that the first clinical data from this program will likely come in 2021. “Given the robust preclinical evidence demonstrating better efficacy and tolerability of RLY-4008 than available therapies, we expect the data to provide insights into whether the Dynamo platform’s ability to identify novel binding sites and associated mutant-selective drug candidates translates into an improved clinical profile,” Richter noted. For this candidate, GSe peak sales could land at $2.1 billion in 2035.

If that wasn’t enough, IND-enabling studies evaluating RLY-PI3K1047 are expected to begin in 2021, implying that the first proof-of-concept data could become available later in the year. According to Richter, peak sales for this therapy could also come in at $2.1 billion in 2035.

Based on all of the above, Richter joined the RLAY bulls. To this end, she initiated coverage with a Buy rating and set the price target at $64. Should her thesis play out, a potential twelve-month jump of 95% could be in the cards. (To watch Richter’s track record, click here)

For the most part, other analysts don’t beg to differ. Out of 4 total reviews published in the last three months, 3 analysts rated the stock a Buy while only 1 said Hold. Therefore, RLAY is a Strong Buy. The $49.33 average price target implies shares could climb 50% higher in the coming year. (See Relay Therapeutics stock analysis on TipRanks)

Pandion Therapeutics (PAND)

Pandion Therapeutics also IPO’d recently, one day after RLAY, with the stock sprinting out of the gate. Opening for trading at $27, $9 above the IPO price, the company has caught the attention of Wall Street’s analysts, with Goldman Sachs telling investors not to miss out on an opportunity.

Firm analyst Paul Choi cites its TALON (Therapeutic Autoimmune reguLatOry proteiN) drug design platform, which enables the modular design of candidates to target key control nodes within the immune system, as a key component of his bullish thesis. These assets are systemic therapies and bispecific antibodies that combine an effector molecule with a tissue-targeted tether to guide the delivery of a drug to specific organ systems where various autoimmune diseases manifest.

Looking at its lead candidate, PT101 is a systemic IL-2 mutein currently in development for the treatment of ulcerative colitis (UC). “While we acknowledge the competitive landscape within UC, we believe there remains a need for alternative mechanisms of action given the limited efficacy of and adherence to currently available drugs. Moreover, we see the potential for PT101 to be a best-in-class IL-2 mutein with broad applicability in other autoimmune indications,” Choi explained.

Adding to the good news, PAND has a PD-1 agonist, PT627, progressing through lead optimization studies. PD-1 has been found to play a key role in the immune system, but its activity is often lower in patients with autoimmune diseases. Therefore, Choi argues there’s “an emerging role for PD-1 agonism in the autoimmune landscape, and note that PT627 offers a potentially differentiated approach via soluble vs. systemic activity compared to other PD-1 agonists in development.”

If that wasn’t enough, PAND also wants to develop bifunctional antibodies targeting proteins expressed on specific organ systems. According to Choi, this tissue-tethered program is a “novel approach to localized treatment of autoimmune disease” that would provide a localized and potentially safer approach to immunomodulation.

The two assets in development to target MAdCAM, a protein constitutively expressed in the gut and diseased liver, are PT001 (MadCAm-tethered PD-1 agonist) and PT002 (MadCAm-tethered IL-2). Choi added, “While we are generally positive on the company’s identified assets, the long-term potential of PAND’s platform is driven by its tissue-tethered approach, in our view.”

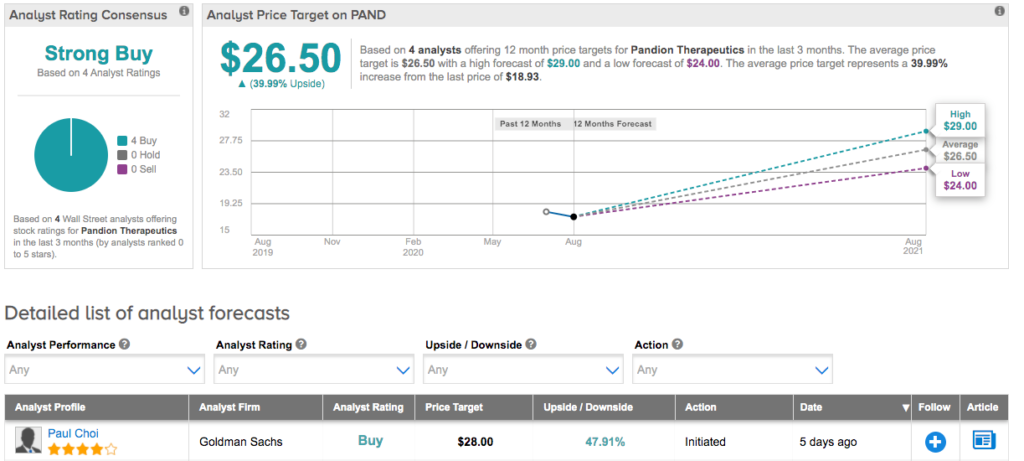

In line with his optimistic take, Choi kicked off coverage by putting a Buy rating and $28 price target on the stock. The four-star analyst’s target suggests upside potential of 48%. (To watch Choi’s track record, click here)

Do other analysts agree? They do. Only Buy ratings, 4, in fact, have been issued in the last three months, so the consensus rating is a Strong Buy. Given the $26.50 average price target, shares could rise 40% in the next year. (See Pandion Therapeutics stock analysis on TipRanks)

Frequency Therapeutics (FREQ)

By activating the body’s innate healing ability, Frequency Therapeutics wants to provide new treatment options for patients battling degenerative diseases. With more clarity on the company’s clinical activity, Goldman Sachs thinks that now is the time to pull the trigger.

Analyst Paul Choi, who also covers PAND, tells clients that FREQ’s recent update has made him more confident about its long-term growth prospects. According to management, the Phase 2a study of FX-322, its potential regenerative treatment for sensorineural hearing loss, is now set to wrap up in Q4 2020, with initial data slated for release in Q2 2021.

Given that the pace of enrollment was impacted by COVID-19, Choi believes the updated timing is “expected and understood.” He added, “We are encouraged to have renewed visibility on the data timing and note that FREQ is well-capitalized through the data readout. We continue to view these results as a potential inflection point for the stock as we look for the results to be incremental to the prior Phase 1 study and to elucidate further the appropriate dosing schedule for FX-322.”

When the data is published, Choi will be watching to see if FX-322 shows a consistent treatment effect and if additional doses benefit the magnitude of effect, especially on words-in-noise measures. He will also be focused on any update regarding the durability of clinical response. It should be noted that FREQ already released preliminary findings earlier in the quarter that showed “sustained benefit on key measures of hearing loss.”

To this end, the full manuscript from the Phase 1 study in mid-2020, Phase 2 enrollment update in Q4 2020 and Phase 2 data in Q2 2021 all reflect potential catalysts that could catapult shares higher.

All of this keeps Choi with the bulls. As a result, the analyst continues to assign a Buy rating and $34 price target to the stock. This target conveys his confidence in FREQ’s ability to gain 55% in the next twelve months.

Based on 2 Buys and a lone Hold, the word on the Street is that FREQ is a Moderate Buy. At $32.33, the average price target indicates 48% upside potential. (See Frequency Therapeutics price targets and analyst ratings on TipRanks)

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.