Copper Price Outlook: Prices Supported By Outsized Market Imbalances

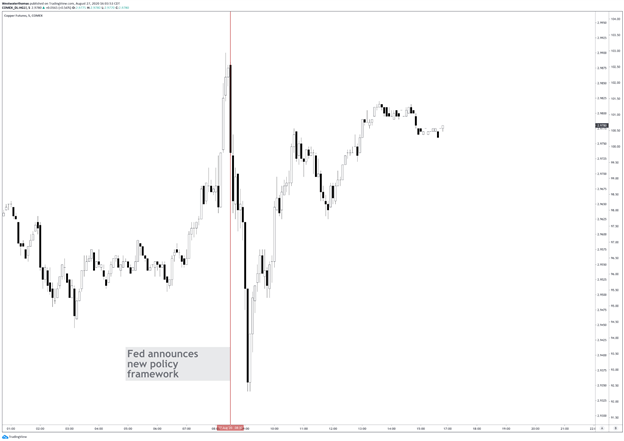

Copper prices gyrated Thursday, along with gold and the US Dollar, following remarks from Fed Chair Powell regarding changes to the Fed’s monetary policy framework. The red metal has made notable advances since plunging to a multi-year low earlier this year, in line with weakness seen across other assets — which typically act as a barometer for economic activity — such as lumber and oil. Copper futures are now trading in green territory Wednesday afternoon following the close of the New York trading session where US equities saw a volatile session.

COPPER FUTURES 5-MIN PRICE CHART

(Click on image to enlarge)

Chart created in TradingView by Thomas Westwater

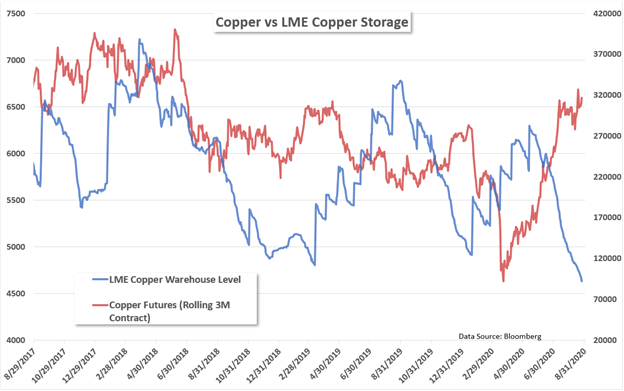

The recent bounce back in economic activity across the globe helped drive copper to a multi-year high last week as policies to fight the COVID pandemic continue to scale back. And underlying supply and demand imbalances appear bullish for a continued run higher. Just last week, the London Metals Exchange stockpiles dropped to the lowest level since 2007, sending copper futures above $3.00 per lb., the highest price point since June of 2018. The current LME warehouse level for copper stands at 92,025 tonnes, just above the 2007 low.

COPPER VS LME COPPER WAREHOUSE STORAGE

(Click on image to enlarge)

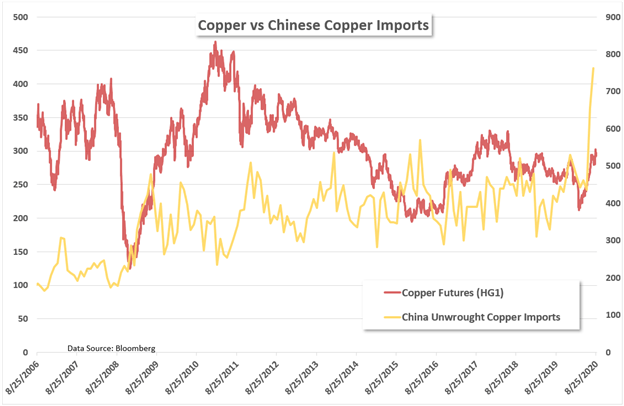

China, the world’s largest importer of copper, is a major variable on the demand side for copper. Chinese imports have now recorded two consecutive months of copper imports, with just over 762k metric tons of unwrought copper imported for July according to China’s General Administration of Customs. Arbitrage opportunities helped propel this figure on top of increasing factory production in the country as massive stimulus efforts in the country drive construction and infrastructure.

COPPER VS CHINESE COPPER IMPORTS

(Click on image to enlarge)

Along with Chinese demand, added supply-side issues resulting from the COVID pandemic has led to many mining operations in copper-producing countries to shutter. Even with policy restrictions lifting in many copper-producing nations, supply shortfalls will likely persist as mining operations can take weeks and sometimes months to return to full capacity. While market imbalances are supportive of prices currently, it will be key to continue to observe the global economic recovery, alongside the ongoing supply and demand imbalances to gauge a probable direction for the industrial metal.

Disclosure: See the full disclosure for DailyFX here.