The coronavirus pandemic crisis dealt a hard blow to the airline industry. Disruptions to trade and travel, social lockdown policies, and increased border restrictions were only the beginning of the troubles. Even though income collapsed, the airlines still had to maintain aircraft and hangars, pay leases on equipment and airport space, and meet their debts.

But the virus is starting to wane, and economies are coming back – and travel is starting to resume. The big question for the airlines is how many people are willing to book flights? There is no doubt that the pandemic will have cost the industry some potential passengers, people simply no longer willing to fly, but for many others, travel will remain essential.

How the industry will look in 2021 is still not clear, as Morgan Stanley transportation expert Ravi Shanker notes: “While the rising industry tide will lift all boats, we recognize that we are not out of the woods yet and that there is likely to be significant volatility in the next six months as the recovery takes shape.”

This does not stop Shanker from rating the airline stocks, nor does it stop him from choosing three tickers that are primed for strong gains as the industry comes back to life.

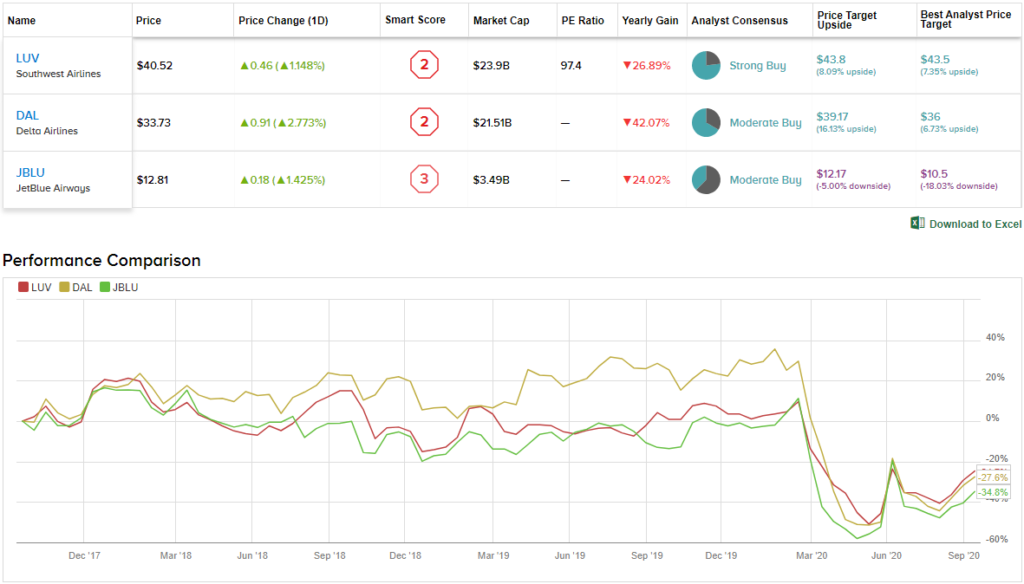

Using TipRanks’ Stock Comparison tool, we were able to evaluate these 3 airline players alongside each other to get a sense of what the analyst community has to say.

Southwest Airlines (LUV)

First on the list is Southwest Airlines, arguably the best airline operating in the US. Southwest has built its reputation on good customer service, and leveraged that to become the world’s largest budget airline. Its success has made it a long-time component of the S&P 500 index, and brought it 47 consecutive profitable years.

The travel restrictions put in place to combat the pandemic hurt the airline badly in 1H20. EPS turned negative in Q1, and the in Q2 the loss reached $2.67 per share despite the partial recovery that started in May and June.

That was the bad news. On the positive side, Southwest managed to finish the second quarter with plenty of cash on hand – over $14.5 billion in cash and cash equivalents combined. The company also has over $12 billion in ‘unencumbered assets,’ mostly wholly owned aircraft. The healthy liquidity situation has been a boon to Southwest; of the major American airlines, this is the only one with an investment-grade credit rating.

Morgan Stanley’s Shanker believes that Southwest is well-positioned to take off as restrictions ease heading into next year. He writes, “LUV is arguably the highest quality airline in the US… As a largely US domestic medium haul airline, we believe its network is in a sweet spot for a COVID rebound and it has… a loyal customer base.” He adds that the airline is especially “able to capitalize on share gain or M&A opportunities as other airlines falter/lag.”

In line with his optimism, Shanker rates LUV an Overweight (i.e. Buy). His $54 price target implies a 33% upside for the stock in the coming year. (To watch Shanker’s track record, click here)

With 10 “buy” ratings against just 3 “holds,” LUV shares have earned their Strong Buy consensus rating. The stock is selling for $40.50, and the average price target of $43.80 implies that there is room for 8% upside growth. (See LUV stock analysis on TipRanks)

Delta Airlines, Inc. (DAL)

The next airline on today’s list is Delta Airlines. Even after the coronavirus hit the industry, Delta’s position among the world’s largest airlines is secure; with $21.5 billion in market cap, $47 billion in total revenue last year, and ranks second in total number of passengers carried, fleet size, and revenue per passenger-mile. The airline routes its flights through nine hubs, with Atlanta being the largest.

All of that just goes to show the extent of the hit that the pandemic dealt. Delta reported a net loss per share of $4.43 in Q2, and quarterly revenues of $1.2 billion. The company described the magnitude of the pandemic crisis as “truly staggering.”

Fortunately for Delta, the company’s sheer size has given it resources to survive the corona crisis. The company took steps in the spring to improve liquidity, drawing on its $3 billion credit facility in March and, in April, issuing $1.5 billion in senior secured notes and opening an additional $1.5 billion in credit. More recently, Delta announced earlier this month that it will be opening another offer of secured notes and entering a new credit facility, with the two total $6.5 billion. That Delta can contemplate such a move despite the deep recent losses, is testament to the company’s fundamental strength as a leader in an essential industry.

Shanker rates Delta as another Overweight (i.e. Buy), writing, “DAL has some of the strongest customer satisfaction numbers among the other Legacy peers… With ample liquidity, we see limited liquidity risk here. Additionally, we continue to see DAL’s international alliances and partnerships as strategic assets…” Shanker describes the airline as “our preferred Legacy carrier.” His $50 price target indicates confidence in a 48.5% one-year upside.

Overall, the analyst consensus on Delta is a Moderate Buy, based on 7 review which include 5 Buys and 2 Holds. The stock’s trading price is $32.82; the average price target of $39.17 suggests it has room for 16% upside growth in the next 12 months. (See DAL stock analysis on TipRanks)

JetBlue Airways Corporation (JBLU)

Last up from out list of Morgan Stanley airline picks is JetBlue, another major name among the budget carriers. JetBlue is the seventh largest US airline, as ranked by passengers carried. The company, before the crisis, operated over 1,000 daily flights to destinations in the US and Latin America.

Unsurprisingly, earnings took a hit in the second quarter due to the effects of the pandemic. JetBlue reported a loss of $2.02 per share, on revenues of $215 million. The top line is down 89% since the end of 2019.

On some positive notes, JetBlue was the first major US carrier to implement a UV cabin cleaning system in response to the viral pandemic. The company undertook this step back in July, and boasts that it can use the system to clean an airliner cabin in just 10 minutes. And more recently, in response to the scaling back of the crisis, JetBlue announced that it will open 24 additional routes by year’s end. Destinations include Florida and the Caribbean and are scheduled to open in November and December.

In his review of this stock, Shanker was impressed by JetBlue’s ability to take early advantage of the travel industry’s gradual reopening.

“We like JetBlue’s significant exposure to the ‘Medium Haul’ US domestic market, which we believe is likely to be the first to return. Additionally, JBLU’s ‘snowbird’ network provides a significant upside as leisure travel returns,” the analyst opined.

With those advantages in mind, Shanker rated JBLU as Overweight (i.e. Buy), and his $16 price target implies an upside potential of 26% for the year ahead.

Overall, Wall Street is still cautious on JetBlue, based on 3 Buy ratings and 5 Holds issued in the past 3 months. With an average price target of $12.17, the Street anticipates shares to stay range-bound for now. (See JBLU stock analysis on TipRanks)

To find good ideas for airline stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.