- EUR/USD has been struggling to recover from last week's substantial falls.

- Coronavirus concerns, inflation figures, and tensions ahead of the presidential debate could keep the pair down.

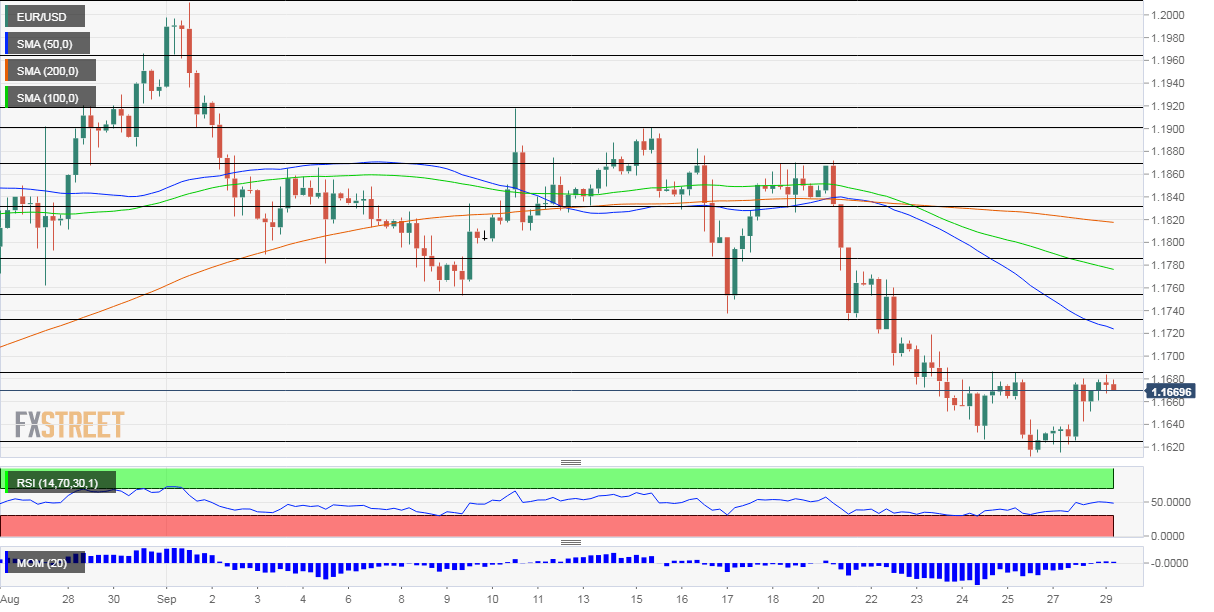

- Tuesday's four-hour chart is showing bears are in the lead.

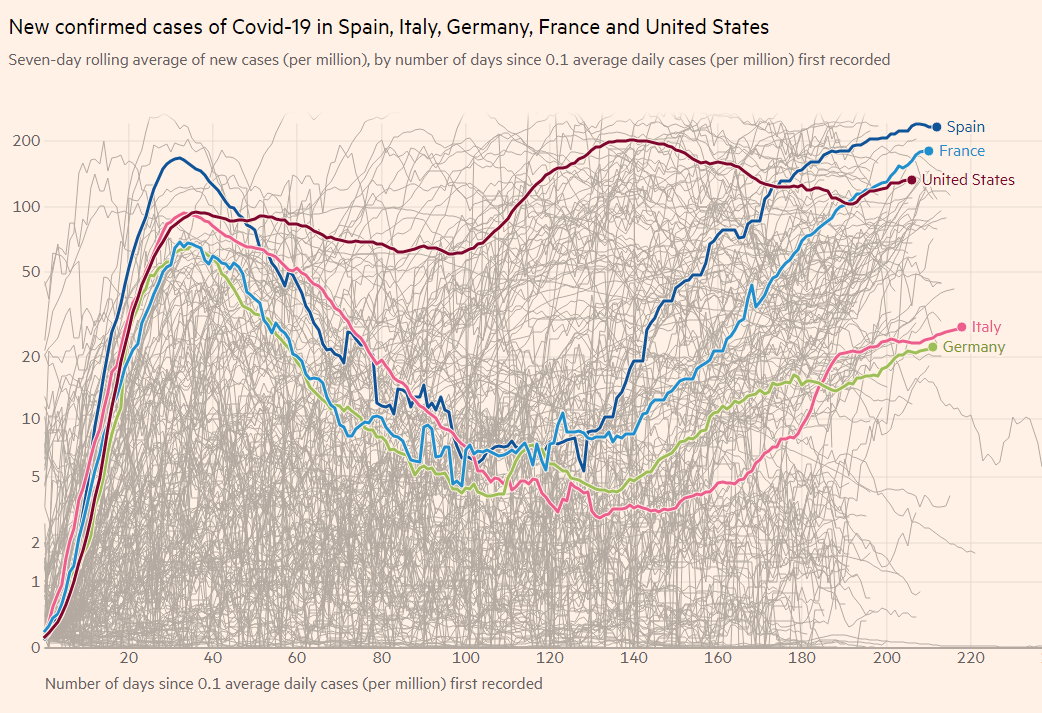

One million coronavirus deaths – the world has reached that grim milestone and the focus on Europe is weighing on sentiment. That is only one of the reasons preventing EUR/USD from recovering and may bring it down to new lows.

After last week's downfall, the recovery looks like the "dead-cat bounce" pattern that often characterizes EUR/USD trading.

Christine Lagarde, President of the European Central Bank, expressed concern about the virus and the impact on the economy. Will the Frankfurt-based institution provide more stimulus? Reportedly, that is fiercely debated and the ECB remains split between hawks and doves.

The bank also has to deal with weak inflation, and new statistics published on Tuesday are adding to the case for more accommodation that may weigh on the euro. Spain – with its capital Madrid being Europe's "ground zero" for the second wave – reported an annual drop of 0.4% in its Consumer Price Index in September. Germany publishes its figures later in the day, and they are expected to remain depressed as well.

COVID-19 infections remain elevated in the US as well, but the dollar's safe-haven status means it gains from such concerns.

Source: FT

Moreover, the Federal Reserve seems reluctant to provide more stimulus. Most officials, including Chairman Jerome Powell, urged the government to provide more stimulus. Vice-Chair Richard Clarida and several other officials will speak on Tuesday and are likely to continue signaling that the ball lies in elected officials' court.

Some hope for a deal between Republicans and Democrats pushed stocks higher and the dollar lower – but that is beginning to fade.

Lawmakers are gearing up for a battle around the nomination of a new Supreme Court Justice as the clock ticks down toward the elections – and the first presidential debate. Incumbent Donald Trump faces challenger Joe Biden on Wednesday at 1:00 GMT. The former Vice President is leading in the polls but is considered an underdog when it comes to debating.

Will Trump close the gap with Biden? That would add uncertainty and potentially boost the safe-haven greenback as investors continue dreading the nightmare scenario of an inconclusive election and a constitutional crisis.

2020 Elections: How stocks, gold, dollar could move in four scenarios, nightmare one included

Ahead of the debate, the Conference Board's Consumer Confidence gauge is set to show an ongoing recovery, in line with other economic indicators.

See US CB Consumer Confidence Preview: Neither happy nor sad

Overall, concerns about the situation in Europe and uncertainty about the elections may push EUR/USD down.

EUR/USD Technical Analysis

While momentum on the four-hour chart has flipped to positive, it remains weak. Moreover, EUR/USD is trading below the 50, 100, and 200 Simple Moving Averages, adding to the bearish case.

The daily low of 1.1660 is only weak support. It is followed by 1.1625, a swing low from last week, followed by September's trough of 1.1615. Next, 1.1550 and 1.1480 date back to August.

Some resistance awaits at 1.1685, the daily high. It is followed by 1.1730, which provided support last week, and then by 1.1755, a cushion from mid-September. Next up, 1.1785 and 1.1830 are the next lines to watch.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.