- EUR/USD keeps the positive note unchanged above 1.1700.

- German flash CPI came in at -0.2% MoM in September.

- Attention stays on the presidential debate, US key data.

EUR/USD remains well into the positive territory and manages to reclaim the key barrier at 1.1700 the figure and above on Tuesday.

EUR/USD now looks to US data, politics

EUR/USD adds to the optimism seen at the beginning of the week and pushes further north of the key resistance region around the 1.1700 mark.

The renewed offered tone in the buck is helping the sentiment not only around the euro but also in the rest of its riskier peers.

In the meantime, investors’ focus of attention stays on the rising cases of coronavirus across the world and the potential impact on the economy, as many countries have already resumed partial lockdowns and social restrictions.

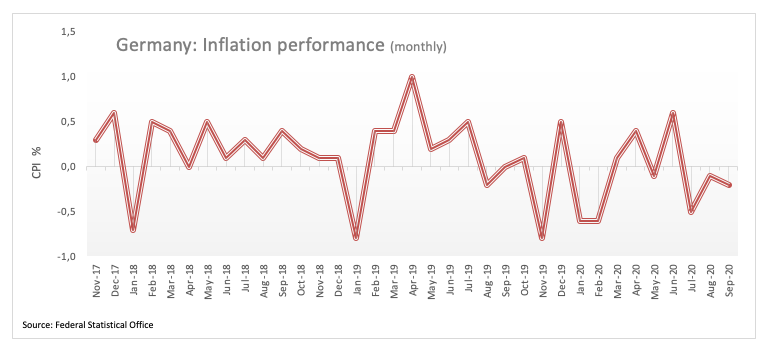

In the domestic calendar, German flash inflation figures now see the CPI contracting at a monthly 0.2% in September. Year-on-year, consumer prices are also expected to drop 0.4%. Earlier in the session, the final print of the Consumer Confidence in the euro area measured by the European Commission matched the first estimate at -13.9 for the month of September, while the Spanish CPI is seen rising 0.2% inter-month and contracting 0.4% from a year earlier.

Across the pond, the focus of attention will be on the presidential debate between President Donald Trump and Democrat candidate Joe Biden. In the data space, the Conference Board will publish its always-relevant Consumer Confidence measure. Further data will see the S&P/Case-Shiller Index, advanced Trade Balance results and speeches by New York Fed John Williams (permanent voter, centrist) and Philadelphia Fed Patrick Harker (voter, hawkish).

What to look for around EUR

EUR/USD is looking to extend the rebound from 2-month lows in the 1.1610 region so far this week. Despite the move, the pair’s outlook still remains constructive and bearish moves are deemed as corrective only. Further out, the positive bias in the euro remains underpinned by auspicious results from domestic fundamentals (which have been in turn supporting further the view of a strong economic recovery after the slump in the activity during the spring), the so far calm US-China trade front and the steady – albeit vigilant- stance from the ECB. The solid position of the EMU’s current account coupled with the favourable positioning of the speculative community also lends support to the shared currency.

EUR/USD levels to watch

At the moment, the pair is advancing 0.33% at 1.1702 and a breakout of 1.1714 (weekly high Sep.29) would target 1.1760 (55-day SMA) en route to 1.1917 (high Sep.10). On the flip side, immediate contention is seen at 1.1612 (monthly low Sep.25) seconded by 1.1495 (monthly high Mar.9) and finally 1.1447 (50% Fibo of the 2017-2018 rally).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.