EUR/USD Current Price: 1.1738

- US CB Consumer Confidence unexpectedly surged in September.

- Focus shifts to the first US presidential debate to take place during Asian trading hours.

- EUR/USD is trading at one-week highs and biased higher after reclaiming 1.1700.

The EUR/USD pair surged this Tuesday to 1.1745, its highest in a week, as the market started the day in risk-on mood, which in turn weighed on the greenback. The positive sentiment faded as the day went by, amid caution ahead of the US first presidential debate, and mounting concerns about the spread of COVID-19 as Autumn kicks in in the North Hemisphere. So far, the US seems to be better positioned within the pandemic, as the number of contagions has stabilized lately. In Europe, however, new restrictive measures are coming into place, and even German’s Chancellor, Angela Merkel, warned about the seriousness of the situation in Berlin.

In the data front, the EU published the September Economic Sentiment Indicator, which improved to 91.1 from 87.5 in the previous month. Germany released the preliminary estimate of September inflation, which was worse than anticipated, printing at -0.2% YoY. As for the US, the country has just published the August Goods Trade Balance, which showed that the deficit was of $-82.94B, worse than the previous $-80.11B. A positive surprise came from the CB Consumer Confidence report, which jumped to 101.8 in September, its highest level since the pandemic started.

This Wednesday will start with the mentioned presidential debate. Later in the day, Germany will publish August Retail Sales, foreseen at 4.2%. ECB’s President Lagarde is due to speak in the Institute for Monetary and Financial Stability, in Frankfurt. The US will publish several macroeconomic reports, although the most important will be the ADP survey on private jobs’ creation, foreseen at 648K from 428K in August.

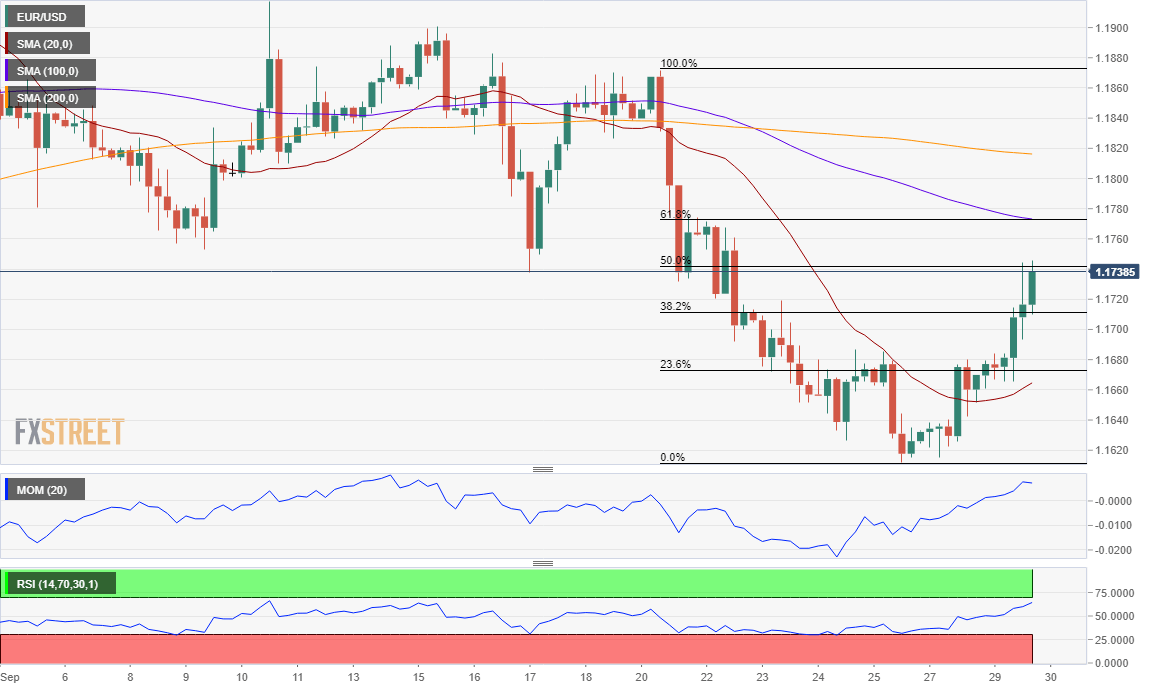

EUR/USD short-term technical outlook

The EUR/USD pair holds on to most of its intraday gains, near the 50% retracement of its latest daily decline. It’s technically bullish according to the 4-hour chart, as it keeps advancing above it 20 SMA, which turned marginally higher below the current level. Technical indicators, in the meantime, maintain their upward slopes well into positive territory, keeping the risk skewed to the upside. Further gains are to be expected on a break above 1.1780, where the pair has the 61.8% retracement of the mentioned slide.

Support levels: 1.1710 1.1660 1.1610

Resistance levels: 1.1780 1.1825 1.1870

View Live Chart for the EUR/USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.