Disney (DIS) and Netflix’s (NFLX) trajectories could hardly have been more different in 2020.

For the House of Mouse, 2020 has been a rough ride, as the company came to terms with the pandemic’s devastating effects. COVID-19’s spread has resulted in shuttered theme parks, a lack of sports programming on ESPN and employee layoffs, with its live film production also paused. To this end, the market hasn’t been kind. Shares are down by 12.5% year-to-date.

Netflix, on the other hand, has used the pandemic as a springboard. The stay-at-home measures helped fuel a record number of new subscribers during the first quarter, the height of the crisis. In contrast to Disney, the market has rewarded the outsized performance, and shares are up by 67% in 2020.

Disney, though, has been taking note. Earlier this week, the entertainment colossus announced a reshuffle of its priorities, with the intention of focusing more on Disney+. The new streaming service has been a roaring success and picked up new subscribers faster than expected, leaving Netflix watching its back.

With Q3 earnings season kicking off, we wanted to see which company is more likely to come out on top in the battle of the streaming services.

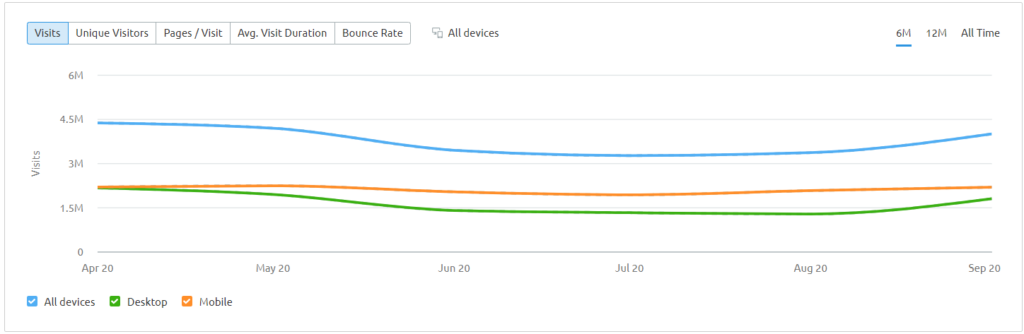

Using SEMRush, the world’s most accurate website traffic monitoring tool, we did a deep dive into the data. Looking at each streamer’s website traffic, we were able to better gauge viewer sentiment during the quarter. Let’s take a look at the results.

Netflix

According to SEMrush, Netflix had 4.3 billion visits (not including app traffic) during the third-quarter, which is 14% below the previous quarter’s 4.9 billion visits.

Heading into the print, Credit Suisse analyst Douglas Mitchelson believes Netflix’s guide for 2.5 million additions is a tad conservative. The 5-star analyst expects Netflix to add 3.5 million new subscribers in the quarter, which is also above the Street’s 2.8 million estimate.

While Mitchelson does not see the pretenders to Netflix’s streaming throne as posing any near-term danger, the analyst thinks shares have soared enough for now.

“Netflix continues to capture a growing share of global video consumption, and we do not see Netflix ever yielding its leadership position to ‘the old guard’, our traditional media companies,” Mitchelson said. “Still, we see risk/reward as balanced and do not see a catalyst near-term for Netflix’s stock…”

Accordingly, Mitchelson sticks to a Neutral rating (i.e. Hold) and $525 price target, suggesting shares will drop by 3% in the coming months. (To watch Mitchelson’s track record, click here)

Like Mitchelson, J.P. Morgan analyst Doug Anmuth does not see the competition encroaching on Netflix’s turf. In fact, Anmuth does not even consider Disney a long-term rival.

“While DIS+ should add a large number of subscribers through 2025, we do not believe it will capture significant subscribers away from NFLX. NFLX has breadth and depth of content, backed by more than $15 billion of content spending this year. The Digital TV Research estimate of 91 million NFLX net adds by 2025 is below our 2020-2024 net adds estimate of ~100 million,” Anmuth said.

In 1H20, Netflix’s subscriber count rose by over 110% year-over-year. Following the outsized additions, the analyst notes that sentiment is “certainly more mixed than into recent quarters.”

However, Anmuth believes the Street is seriously underestimating Netflix’s Q3 performance and raised his third quarter net adds estimate from 3.1 million to 5.1 million, way above Netflix’s 2.5 million guidance.

The expectation of an estimate-beating performance is reflected in Anmuth’s bullish outlook. The 5-star analyst reiterated an Overweight (i.e. Buy) rating alongside a $625 price target. What’s in it for investors? Upside potential of 15%. (To watch Anmuth’s track record, click here)

As for the rest of the Street, the analyst consensus rates Netflix a Moderate Buy, based on 20 Buys, 7 Holds and 5 Sells. Evidently, Wall Street thinks Netflix needs a cooling down period, as the $537 average price target suggests 1% downside potential. (See Netflix stock analysis on TipRanks)

Disney

Now, let’s take a look at Disney and specifically Disney+’s performance. Although Disney’s status as an entertainment giant is not in dispute, its streaming service is still in its first innings as borne out by the amount of traffic it has been generating.

During the third quarter, SEMrush data points to 10.7 million visits to Disney+’s website, with the visits increasing as the quarter progressed. However, this is still 11.5% below the previous quarter’s 12.6 million visits.

Disney+, however, has been performing well ahead of expectations so far. The company saw out the June quarter with 57.5 million subscribers and as of August 3, Disney already had 60.5 million viewers subscribed to the service. It had originally hoped to have this many by 2024 – when it expects the service to break even – so it is clearly ahead of schedule. Add in Hulu and ESPN+, and Disney has over 100 million subscribers across all of its streaming platforms.

Looking ahead to the quarterly statement, Wells Fargo analyst Steven Cahall believes “all eyes will be on Disney+ (and Hulu) due to limited disruptions and/or benefits from the pandemic.”

Following the recent launches in Europe and Indonesia, the analyst expects Disney+ to see out the quarter boasting 69.5 million subscribers.

However, Cahall does not expect the service to turn a profit anytime soon.

“While it’s possible DIS may upgrade the Disney+ sub guidance, we’re not forecasting a pull forward in profitability as the earlier revenue is arguably best used for more content investments,” Cahall said.

Overall, the analyst keeps an Equal Weight (i.e. Hold) rating on the shares, along with a $136 price target. Investors are looking at upside potential of 7% from current levels. (To watch Cahall’s track record, click here)

On the other hand, J.P. Morgan analyst Alexia Quadrani argues Disney+’s exceptional performance will result in Disney readjusting its outlook for the service.

“We continue to believe management will likely pull forward the breakeven guidance for Disney+ given the service has surpassed the low end of its 5-year subscriber target,” the analyst said. “But we don’t expect an announcement until the investor day for Star which will likely be after FQ4 earnings.”

Quadrani is “impressed” with Disney+’s “robust growth” and believes investors should “continue to appreciate the exceptional growth in digital subscribers and Disney’s superior content.”

As a result, Quadrani remains confident in the Disney story, and keeps the price target at $155, representing possible upside of 22% from current levels. Quadrani’s rating stays an Overweight (i.e. Buy). (To watch Quadrani’s track record, click here)

The analyst community has a bullish outlook on the stock. Based on 11 Buys, 6 Holds and 1 Sell, Disney has a Moderate Buy consensus rating. At $137, the average price target indicates 8% upside potential. (See Disney stock analysis on TipRanks)

Conclusion

Based on the SEMrush data, there is a clear volume gap between the two streaming services, with Netflix generating way more traffic. However, Disney+ trends were ticking upwards as the quarter progressed, and considering it is a much younger service, and Disney has pledged to focus more on its development, it could exhibit faster growth over the coming quarters.

To find good ideas for internet stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.