- Plunge in USD/JPY hinged on hope for a stimulus package.

- USD/JPY hits four-week low on Wednesday.

- Presidential debate has little impact as campaign enters final stretch.

- Differential in real interest rates favors the Japanese yen.

- FXStreet Forecast Poll predicts consolidation near the low

The once and future US stimulus package is the market intervention of the month. As the Republicans and Democrats tried to wring as much electoral advantage from negotiations, hopeful statements for a deal from Democratic House Speaker Nancy Pelosi and President Donald Trump on Wednesday, sent the USD/JPY cascading to a four-week low.

Markets are still fixated on the risk-on and risk-off impositions of the proposed second COVID-19 bill. Traders buy the dollar when the deal seems headed for failure on the notion that an unsupported US economy will heighten global risk and sell the dollar when an agreement seems imminent with the opposite logic.

Another stimulus support bill is a given, the only question is when. Whether Donald Trump or Democratic candidate Joe Biden wins the presidency, the economy will be the first order of business and the stimulus will flow.

An admission from Ms Pelosi later in the week that a new bill might not happen until after the election had little impact.

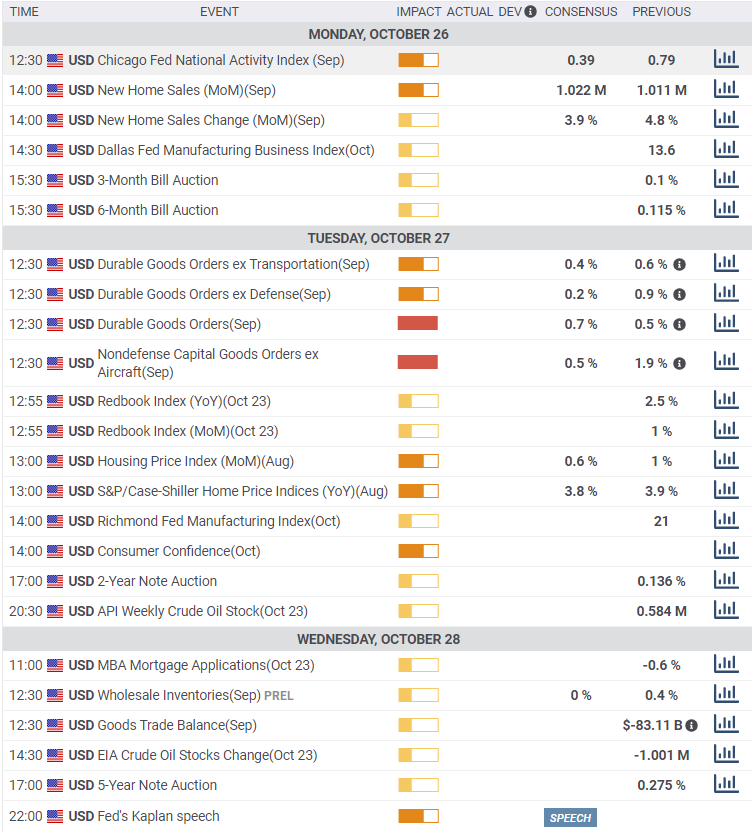

The long-running descending channel remains the overall formation with a general range of 104.50 to 106.00 over the last seven weeks. Wednesday's drop went straight to that 104.50 support which held in trading on Thursday and Friday. With further stimulus a reasonable assumption and limited support beneath 104.50, the immediate prospect is lower.

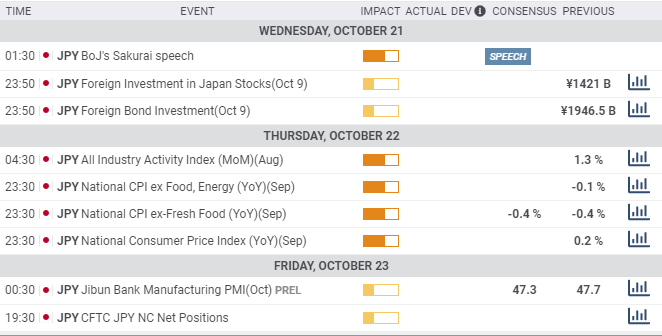

Japan and US statistics October 19-October 23

It was a minor week in Japanese statistical reporting.

Japanese inflation dropped to its lowest annual level in three years falling to 0% in September from 0.2% in August. Core inflation rose from -0.1% to flat.

The Jibun Bank Manufacturing PMI rose slightly in October to 48 from 47.7 in September. The sector has been below the 50 division between expansion and contraction for 18 straight months.

US data was limited but generally better than forecast headlined by a surprise drop in jobless claims.

New home construction remained strong. Housing Starts rose 1.9% to 1.415 million annualized in September from 1.388 million and Building Permits climbed 5.2% to 1.553 million from 1.476 million.

The Fed's Beige Book, the anecdotal survey of the US economy prepared for the November 4-5 FOMC meeting, noted “slight to modest' growth in the latest indication that the recovery from the pandemic lockdown is slowing. With no interest rate developments expected through the end of 2023 by the bank's own economic projections, markets took no notice of the new assessment.

Initial Jobless Claims in the week of October 16 dropped to 787,000, their lowest level since the beginning of the pandemic in March. A listing of 860,000 had been predicted. The prior week's original release of 898,000 was revised down to 842,000. The four-week moving average fell to 811,250, the lowest since the week of March 13. Continuing Claims fell to 8.373 million in the October 9 week, also a pandemic low and well below the 9.5 million forecast.

Existing Home Sales, 90% of the US housing market, rose 9.4% almost double the 5% prediction, to 6.54 million in September, from 5.98 million in August. It was the highest rate of annual sales since February 2007.

Markit's Manufacturing Purchasing Managers' Index for October rose 0.1 to 53.3. The Services Index climbed to 56 from 54.6 in September.

USD/JPY outlook

The main bias in USD/JPY remains lower. Markets have continued their risk based buying and selling of the US currency referencing the vagaries of the stimulus package in Washington.

As COVID-19 diagnoses rise again in Europe and the US there has not been a reversion to the pandemic response exemplified by the peak in the USD/JPY in late March and its steady decline since. The pandemic has ceased, at least for the present, to be a risk motivating factor.

Economic statistics and recovery favor the US and the dollar but interest rates do not.

Perhaps surprisingly given the Bank of Japan's (BoJ) history, the real interest rate, the base rate minus inflation, is higher in Japan. This is a function of Japan's very low rate of inflation.

In September the BoJ's base rate was -0.1%, as it has been since January 2015. National CPI for the month was flat, leaving the real rate at -0.1%.

In the US the Fed funds mid-rate was 0.125% (target range 0%-0.25%). However, the Personal Consumption Price Index for the year in August was 1.4% putting the real interest rate at -1.275%.

It may seem almost counter-intuitive that a negative base rate could produce a higher return but this fact is no doubt partially behind the yen's recent strength.

Technical considerations point lower for USD/JPY. Markets continue to ignore the fundamental factors that favor the US and until that becomes the basis for comparison the drift down, a combination of the existing trend, stationary Fed rate policy and the interest rate differential, will order trading.

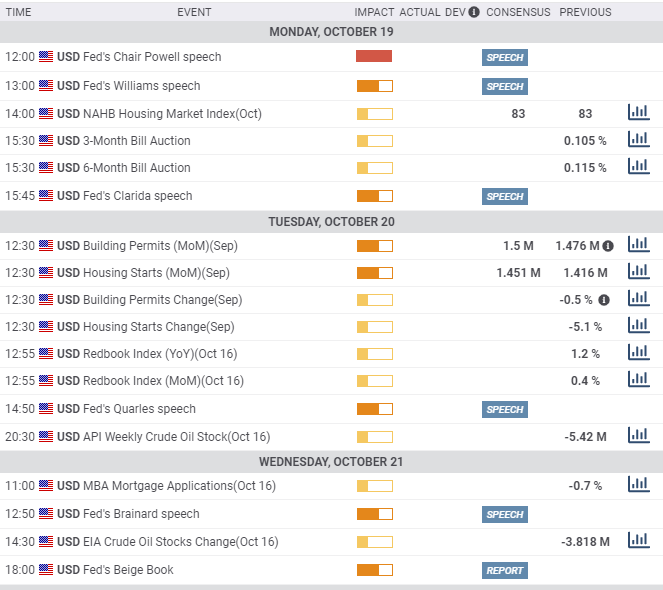

Japan and US statistics October 26-October 30

This week is expected to bring further evidence of Japan's economic woes.

Retail Trade (retail sales) is forecast to drop 7.7% in September from -1.9% in August for the seventh negative month in a row. The Japanese consumer has not rebounded from the March, April and May collapse of 31.1% with sales declines in June, July and August.

The BoJ rate decision on Thursday is foregone though the Outlook Report for the third quarter may hold some interest.

Consumer Confidence for October is expected to drop to 31.6 from 32.7. CPI for Tokyo should be flat on the year in October, down from 0.2% in September. The core rate is expected to drop to -0.3% from 0% in September.

Industrial Production in September is forecast to fall 9.7% on the year, up from -13.8% in September. Production has fallen for 11 straight months through August.

The Unemployment Rate in September is predicted to rise to 3.1% from 3.0% prior. Housing Starts in September are projected to fall 8.7% annually, slightly better than the 9.1% drop in August.

American statistics should outline the excellent housing market and resilient consumer sector.

New Home Sales are forecast to reach 1.022 million annually in September from their record 1.011 in August. The prior high had been 981,000 in April 2007, at the height of the housing bubble.

Durable Goods Orders are estimated to rise 0.7% in September from 0.5% in August. Nondefense Capital Goods Orders, the business investment proxy, are expected to add 0.5% after August's 1.9% increase. Durable Goods Orders ex Transportation are expected to rise 0.4% and ex Defense Orders are estimated to rise 0.2%. After the strong results for September Retail Sales the risk to the Durable Goods Orders is to the upside.

Initial Jobless Claims are forecast to continue their descent to 763,000 in the October 23 week. Third-quarter annualized GDP is forecast to jump 30.8% after collapsing 31.4% in the locked-down second quarter.

The Personal Consumption Price Index (PCE) is expected to rise 0.1% on the month and 1.3% on the year in September. The core rate should gain 0.1% and 1.4% respectively.

Personal Income is expected to recover to a 0.5% gain in September after falling 2.7% in August. Personal Spending should be unchanged in September at 1%.

Despite a large number of statistics market impact should be limited. New Home Sales may be at a record level but at 10% of the housing sector they do not set the pace. The slow improvement in Initial Jobless Claims is now normal and Personal Spending and Income figures restate earlier information.

Third-quarter GDP has the greatest chance to effect trading and support the dollar, partially because the risk is for an improved number. The Atlanta Fed GDPNow model is slightly higher than our survey at 35.3%.

USD/JPY technical outlook

The overall technical indicators of the descending channel with plentiful resistance lines and weak support that has existed for several weeks remain in place.

The Relative Strength Index at 39.66 moved sharply lower with the decline in USD/JPY on Wednesday and suggests further losses to the oversold level of 32. The 21-day moving average at 105.43 fronts initial resistance at 105.50. The 100-day average at 106.20 is midpoint between the lines at 106.00 and 106.40. The 200-day average at 107.26 is part of resistance at 107.30.

Resistance: 105.50; 106.00; 106.40; 106.60; 107.00; 107.30

Support: 104.50; 104.00; 103.10

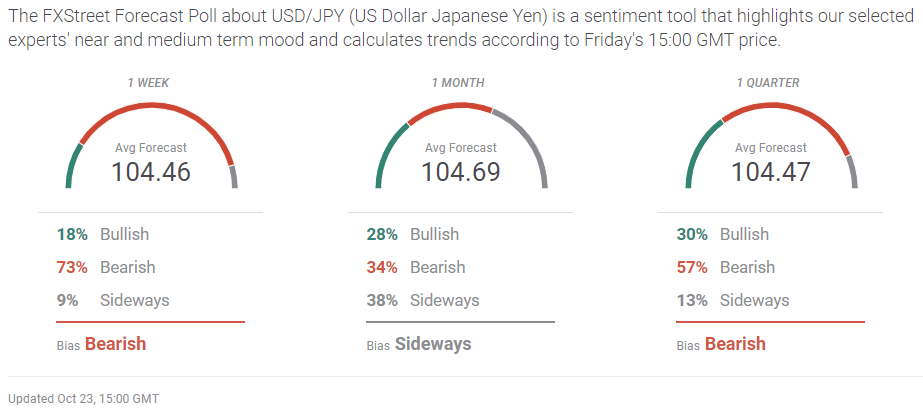

USD/JPY Forecast Poll

The overwhelmingly bearish outlook in the FXStreet Forecast Poll that extends across all three time frames is oddly flat. The forecasts all respect the support line at 104.50 and are within 23 points out to three months. The long decline in USD/JPY clearly has run out of impetus, but for the moment there is no replacement.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.