And finally... here’s our news story about today’s market mayhem:

We’ll be back tomorrow to continue the story... Goodnight! GW

Rolling coverage of the latest economic and financial news, as European markets sink to their lowest point since May

And finally... here’s our news story about today’s market mayhem:

We’ll be back tomorrow to continue the story... Goodnight! GW

Ouch! Rather than recovering, Wall Street headed even lower in the final minutes of trading.

The Dow Jones industrial average has closed down 942 points, or 3.4%, at 26,520 - which looks to be the worst drop since June.

The S&P 500 shed 3.5%, while the tech-focused Nasdaq tumbled by 3.7%

Rising Covid-19 case numbers in the US, and globally, drove stocks lower as investors worried that the lockdowns in Germany and France will hurt the global recovery....and perhaps be replicated in the US.

As CNBC explains:

The recent uptick in Covid cases has led some countries to reinstate certain social distancing measures. In the U.S., the state of Illinois has ordered Chicago to shut down indoor dining. In Europe, German officials agreed to a four-week partial lockdown, while the French government imposed new nationwide restrictions until Dec. 1.

“I think there’s going to be a call for lockdowns the likes of which we’ve seen in Chicago,” CNBC’s Jim Cramer said Wednesday. “The lockdowns without the stimulus equals what we’re seeing.”

“It’s a shame because, had there been stimulus, we’d then be focusing on earnings and the earnings are actually pretty darn good,” he said.

Dow sinks more than 900 points for its worst drop since June amid rising virus cases globallyhttps://t.co/EszM0ucKBN pic.twitter.com/4Zu5VkWu3p

— CNBC Now (@CNBCnow) October 28, 2020

U.S. stocks close down 3.5% https://t.co/bDmJQtGWtQ pic.twitter.com/GFl26Hb4Mh

— Bloomberg (@business) October 28, 2020

That adds to Monday’s 650-point drop on the Dow, and Tuesday’s 220-pointer, meaning this is turning into a thoroughly poor week.

The Dow industrials fell for the fourth straight session, dropping about 3.4% and marking its longest losing streak since February https://t.co/JkXUuBmT3i

— The Wall Street Journal (@WSJ) October 28, 2020

Wall Street is showing a marked reluctance to clamber back off the mat.

As we move into the last 15 minutes of trading, the Dow is still deep in the red - down 2.9% or 797 points at 26,666 points.

What will it take for the markets to recover their nerves?

Guy Foster, head of research at wealth manager Brewin Dolphin, says there are three major uncertainties hanging over investors at the moment.

Namely, the Covid-19 pandemic, next week’s US election, and the need for a new US stimulus package.

And the bad news is that each one might not be resolved quickly.

Foster explains:

Over in Paris, President Macron has imposed a new national lockdown.

The restrictions mean that people can only leave the house to buy essential goods, seek medical attention, or use their daily one-hour allocation of exercise.

But most schools are to remain open, while universities will revert to online teaching and working from home will be generalised.

Visits to care homes will still be allowed, as will funerals, Macron has explained in his national address. More here:

Checking in on Wall Street again...and stocks are still deep in the red.

With less than 90 minutes trading to go, the Dow is down 2.8% or 787 points at 26,676.

Some big name stocks have been hit badly by anxiety over Covid-19, with credit card operator Visa down 4.8%, enterprise software firm Salesforce.com losing 4.5%, construction machinery maker Caterpillar down 4.3% and sports firm Nike off 4.3%.

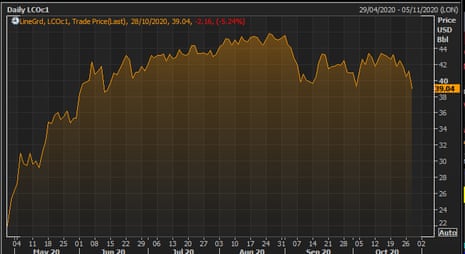

Anxiety over the economic outlook has wiped more than 5% off the oil price today.

Brent crude has fallen to $39.07 per barrel - its lowest level since the start of October, and nearly the weakest point since June.

Here’s a video clip of today’s market action, from the Wall Street Journal.

#WSJWhatsNow: U.S. stocks are down sharply amid rising coronavirus infections pic.twitter.com/Uxh049YPWE

— The Wall Street Journal (@WSJ) October 28, 2020

David Madden of CMC Markets reminds us that the demise of US stimulus talks also helped to drive the FTSE 100 to a six-month low today.

The failure of Democrats and Republicans to agree a fresh economic package before the election wasn’t entirely unexpected, but it still dampened the mood in the markets.

European stocks have endured a brutal wave of selling today as coronavirus concerns prompted dealers to dump stocks. There is a feeling in the markets that governments are not in control of the pandemic and that is why traders are running scared.

The number of new covid-19 cases is rising at an alarming rate and the increase in the hospitalisation rate is a worry too. Several European countries have announced tougher restrictions this week, including Spain and France. Today, it was reported that Germany will commence a ‘light’ lockdown next week, and that rocked sentiment because Germany was seen to be relatively in control of their situation.

To add to the bearish news, it was the confirmed that there will be no US coronavirus stimulus package agreed upon before the presidential election. The update wasn’t a total shock as hopes were fading recently.

German chancellor Angela Merkel has now confirmed that Germany would be going into a partial lockdown from 2 November after talks with regional leaders.

The measures will apply to the whole country and will be reviewed in two weeks time, Reuters reports.

She told reporters:

“These are tough measures.”

According to Reuters, private gatherings will be limited to 10 people from a maximum of two households. Restaurants, bars, theatres, cinemas, pools and gyms will be shut and concerts cancelled.

Anticipation of such measures triggered today’s market selloff in Frankfurt, of course.

There’s no respite on Wall Street, where the Dow Jones industrial average is still down 3.2%, or 880 points, at 26,583.

That meant the storied index has lost around 1,700 points, or 6%, since the start of this week, and is now wedged at a one-month low.

Laith Khalaf, financial analyst at AJ Bell, says investors have - finally - woken up to the threat of a second wave of Covid-19 infections and deaths.

“It’s surprising it’s taken markets this long to take fright at the second wave of the pandemic, and the havoc it might wreak on the global economy. The writing has been on the wall for several weeks now, but stock markets have had their blinkers on.

“Even the mighty US stock market, which has reached record highs in the face of a global economic slowdown, finds itself in the red. This is a broad sell-off, with almost no stocks in the market making positive ground, which tells us it’s a classic risk-off reflex.

“Until the virus is contained, there can be no clear direction for markets in the short term. We can expect sharp sell offs and relief rallies in line with the ebb and flow of the virus, and the unfolding economic damage it leaves behind.

Fears that new Covid-19 restrictions will derail Europe’s recovery from recession hit all the main European markets hard.

The Stoxx 600 index of European companies has slumped to its lowest level in five months, ending the day down 3.1%.

Consumer-focused companies, miners and property firms were among the worst performers (although every sector lost ground).

Germany’s DAX has slumped by 4.1%, losing 503 points to 11,560, as the country prepares for a circuit-breaker lockdown.

That’s its weakest point since late May, and the biggest one-day drop in Frankfurt in over a month.

Frances’ CAC ended the day down 3.3% - again, a five-month low - as investors await president Macron’s national address tonight, and a likely four-week lockdown.

Newsflash: Britain’s stock market has fallen to its lowest closing level in over six months, as pressure builds for a new national lockdown.

The blue-chip FTSE 100 has ended the day down 146 points at 5582 points, after scrambling back slightly from its earlier lows. That’s a fall of 2.5% today.

This is the index’s lowest close since 6th April, in the early weeks of the pandemic, and means the index is down 26% this year.

The top fallers were precious metals miner Fresnillo (-6%) and Polymetal (-5.5%), conference organiser Informa (-5.2%), mining giant Anglo American (-5%) and chemicals firm Johnson Matthey (-4.9%).

The selloff comes as a leading government scientific adviser warned this morning that the number of coronavirus patients in UK hospitals could pass the spring peak by the end of November without further lockdown measures, and both France and Germany moved towards new curbs.

The latest UK government figures show that a further 310 coronavirus-related deaths were recorded in the last 24 hours, compared with 367 yesterday.

Another 24,701 people have tested positive for the virus.

Alexis Gray, investment strategist at Vanguard, says today’s selloff highlights that “the economic outlook has dimmed”, as Europe faces more Covid-19 curbs.

Gray explains (via the FT):

“We’re facing unprecedented uncertainty and that’s what the market is struggling with.”

With less than an hour until European stock markets close, here’s the state of play....

Shares are plunging on both sides of the Atlantic, as rising Covid-19 cases force governments to impose tighter restrictions.

In London, the FTSE 100 is currently down 167 points, or 2.9%, at 5563 - on track for its lowest closing level since early April. Mining stocks, property firms, banks and energy companies are leading the selloff.

The selloff accelerated after it was announced that Nottinghamshire will enter the UK’s tough ‘tier-3’ restrictions on Friday, and pressure mounts for a national lockdown.

The picture is just as grim across Europe, with the Stoxx 600 index of listed European companies down 3.4% at a five-month low.

Germany’s DAX is currently down 4.7%, on track for its worst one-day fall since March, as Angela Merkel and state leaders reportedly agree a partial lockdown next week.

France’s CAC has also lurched south, losing over 4% to its weakest level since May. President Macron is expected to impose a new four-week national lockdown, in a national address tonight.

New York’s stock market has sunk deep into the red too, with coronavirus worries mixing with US election angst.

The Dow Jones industrial average is currently down 881 points, or 3.2%, at a one-month low.

Germany’s stock market has now slumped by 12% in little more than a fortnight, amid the sharp jump in Covid-19 cases.

Global markets sink in a sea of red on lockdown fears. Germany's Dax now in correction territory, down 12% from Oct 12th high. pic.twitter.com/ooUsorKFft

— Holger Zschaepitz (@Schuldensuehner) October 28, 2020

Comments (…)

Sign in or create your Guardian account to join the discussion