French drugmaker Sanofi has made an offer to snap up biotech company Kiadis for an aggregate adjusted equity value of €308 million ($358.5 million), in a move to expand its range of cell-based immunotherapy products.

Sanofi (SNYNF) seeks to acquire the entire share capital of Kiadis for 5.45 euros per share. Kiadis is developing ‘off the shelf’ natural killer (NK) cell-based medicines for the treatment of life-threatening diseases. Under the terms of the takeover bid, Kiadis’ NK cell-based medicines will be developed alone and in combination with Sanofi’s existing platforms

The clinical-stage biopharma company’s proprietary platform is based on allogeneic NK cells from a healthy donor. NK cells seek and identify malignant cancer cells across various tumor types. Sanofi said that the platform has the potential to make products “rapidly and economically” available for a broad patient population across a wide range of indications.

“We believe the Kiadis ‘off the shelf’ K-NK cell technology platform will have broad application against liquid and solid tumors, and create synergies with Sanofi’s emerging immuno-oncology pipeline, providing opportunities for us to pursue potential best-in-disease approaches,” said John Reed, Sanofi’s Global Head of Research & Development.

In July this year, Sanofi licensed Kiadis’ pre-clinical K-NK004 program for potential combination treatment for multiple myeloma. Following the completion of the public offer, Sanofi will provide the resources and capabilities necessary to accelerate the development of current Kiadis programs for the treatment of blood tumors, solid cancers, and infectious diseases.

The deal comes after Sanofi acquired US company Principia Biopharma in August in an all-stock deal valued at $3.68 billion to build a portfolio of treatments for autoimmune diseases.

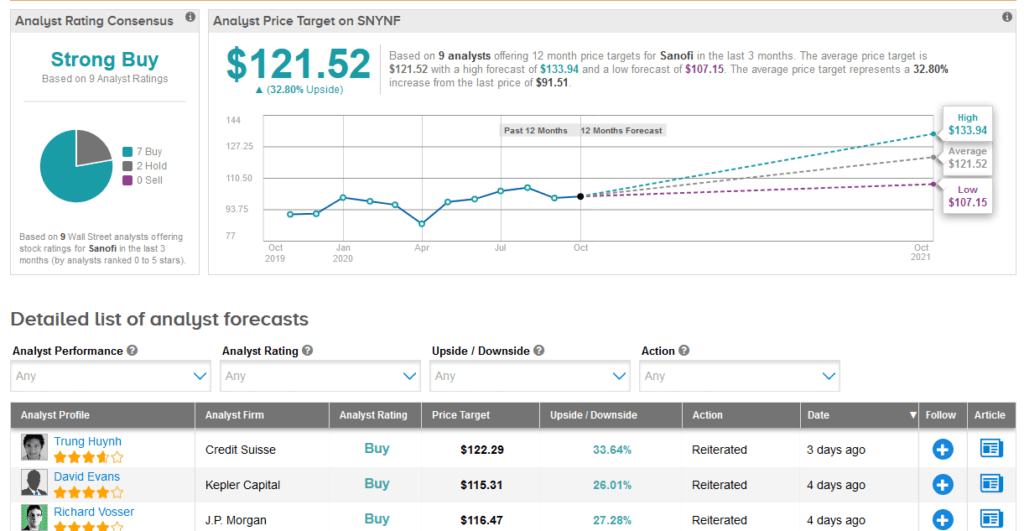

Shares of Sanofi have dropped 11% over the past month and are trading about 8.1% lower than at the beginning of the year. Looking ahead, the $121.52 average analyst price target reflects 33% upside potential in the shares in the coming 12 months.

The majority of Wall Street analysts are bullish about the stock. The Strong Buy consensus boasts 7 Buy ratings versus 2 Hold ratings. (See Sanofi stock analysis on TipRanks)

Related News:

J&J Strikes Covid-19 Vaccine Manufacturing Deal With Aspen

Moderna Scores $1.1B From Covid-19 Vaccine Deposits; Shares Rise 3%

Opko Health Tanks 10% Despite Solid Q3 Covid Testing Revenue