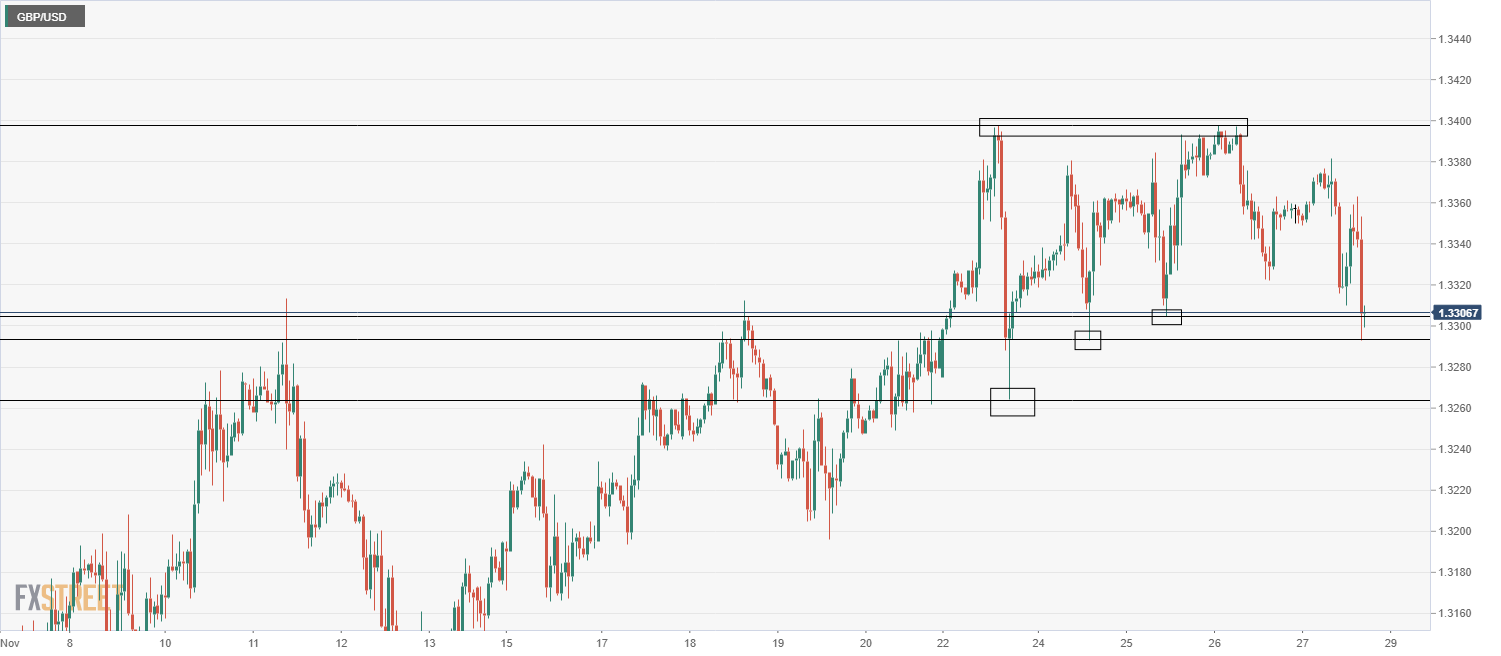

- GBP/USD has dropped to 1.3300 in recent trade, around which it is currently consolidating.

- No new news appears to have driven the move, though there has been an overarching pessimistic feeling regarding Brexit talks this week.

No new news is driving the move, but GBP/USD is back to fresh lows of the day and briefly fell below 1.3300, for the first time since Monday. Though price action is now consolidating back above the psychological level, the pair does seem to be testing this area with more aggression than before, something which is likely to be making the bears feel uncomfortable that a downside break could be coming up next.

As a reminder, market conditions are thin given the absence of most of the US participants due to a second day of Thanksgiving holiday celebrations. Although that normally is a precursor to rangebound trade, a lack of market depth can leave assets vulnerable to big moves.

Brexit pessimism (there has been no indication today that the EU and UK have moved any closer to a deal this week) is likely to be behind today’s downside. Indeed, GBP is far and away today’s worst-performing G10 currency, down 0.4% against the US dollar on the day versus AUD, NZD and EUR, which are all trading with gains of 0.45 against the US dollar.

In thin liquidity conditions, it only takes a few big bearish orders to drive the pair lower, and that looks likely to have been the case today, with month-end flows also likely to be a factor working against sterling.

GBP/USD testing the bottom of this week’s range and looking heavy

GBP/USD’s move lower to 1.3300 has taken the pair back to the bottom of recent day’s ranges. For now, cable is holding up at support in this area, but if the bottom of this week’s range were to go, that would open the door to a move lower towards Monday’s low just above 1.3260 and then onto last Thursday’s low around the psychological 1.3200 mark.

However, some may see this recent move lower as another opportunity to buy the dip, in which case GBP/USD could march higher again. In this scenario, the main levels to watch would be Friday’s 1.3380ish highs and this week’s highs around 1.3400.

GBP/USD one hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.