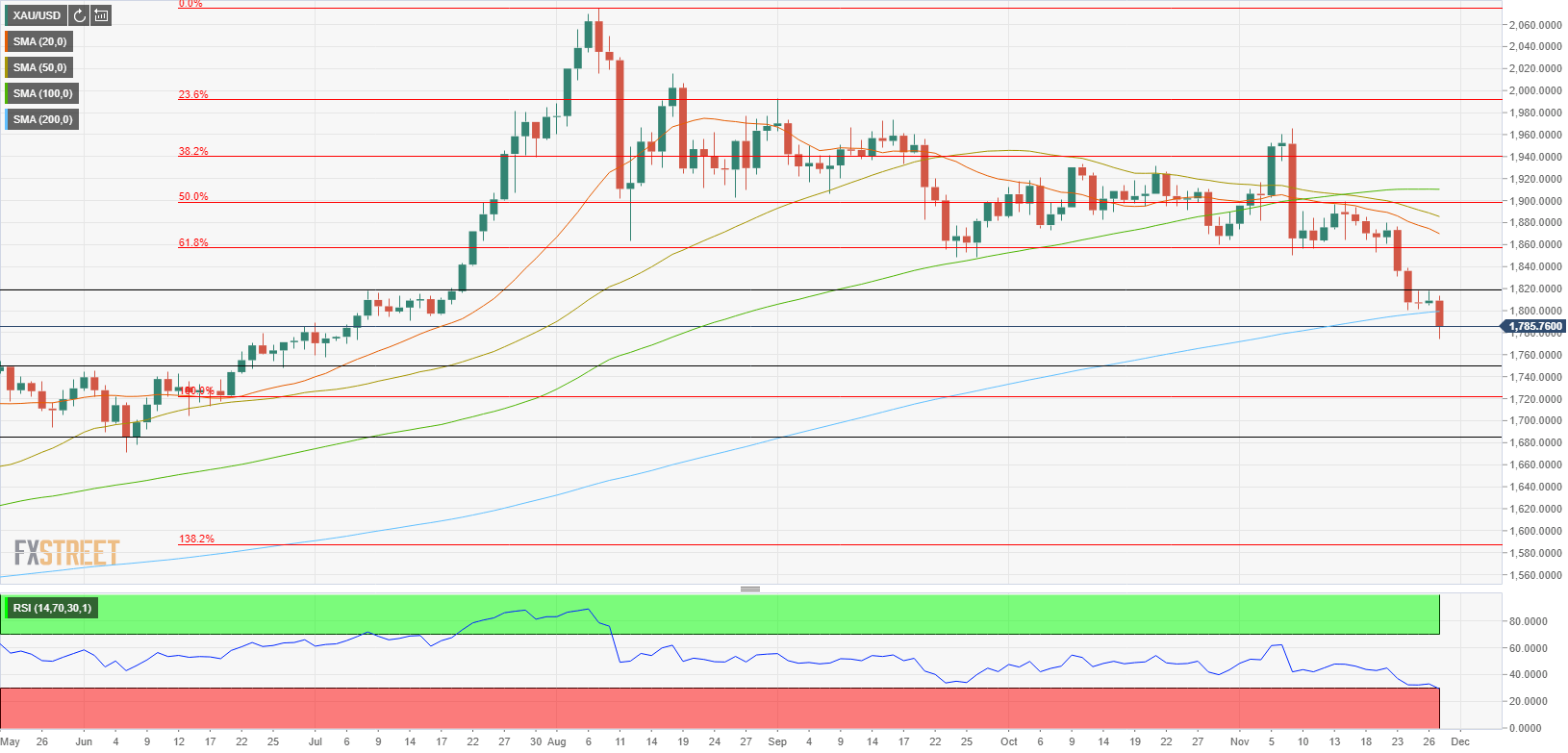

- Gold slumped to its lowest level since early July below $1,780.

- Gold trades below 200-day SMA for the first time since March.

- Bearish pressure is likely to remain intact unless XAU/USD breaks above $1,800.

Gold broke below key support areas and lost more than 4% to end the week below $1,800 pressured by technical selling pressure and the lack of interest for safe-haven assets.

What happened last week

Gold started the week under strong bearish pressure as risk flows continued to dominate the financial markets.AstraZeneca announced on Monday that the COVID-19 vaccine they have been developing with the Oxford University showed up to 90% effectiveness in the latest trials. Following this development, the XAU/USD pair lost 1.77% on Monday. Moreover, the upbeat Markit PMI data from the US, which showed ongoing expansion in the manufacturing and service sector’s business activity at a robust pace in November, provided an additional boost to the risk-sensitive assets and further weighed on gold.

On Tuesday, the risk-on mood remained unimpaired and caused XAU/USD to slump to its lowest level since July 17th near $1,800. However, the broad selling pressure surrounding the greenback allowed the pair to limit its losses.

On Wednesday, mixed macroeconomic data releases from the US failed to trigger a significant market reaction. The US Bureau of Economic Analysis reported that it left the annual GDP growth in the third quarter unchanged at 33.1%, the Department of Labor’s weekly publication showed that Initial Jobless Claims rose by 30,000 to 778,000 in the week ending November 21st. Additionally, the US’ international trade deficit widened to $80.29 billion from $79.36 billion and the University of Michigan’s Consumer Sentiment Index declined to 76.9 from 81.8. On a positive note, the Durable Goods Orders in October rose by 1.3% and surpassed the market expectation of 0.9%.

The thin trading conditions due to the Thanksgiving Day holiday in the US allowed gold to consolidate its losses in the second half of the week. However, a drop below $1,800 on Friday triggered a technical selloff and dragged XAU/USD to a fresh multi-month low of $1,774.

Next week

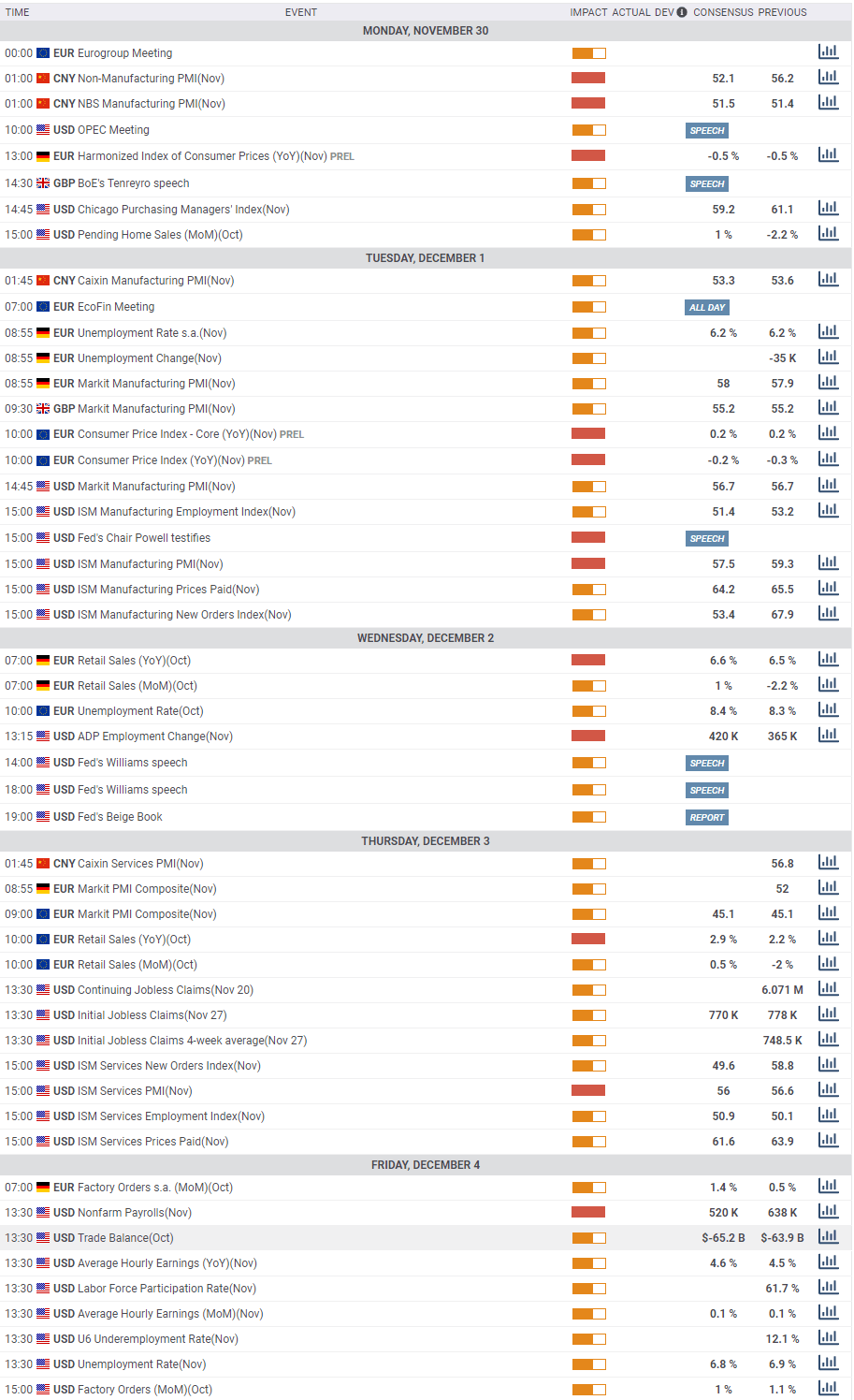

At the start of the week, the official Manufacturing and Non-Manufacturing PMI figures from China will be the first data that could have an impact on market sentiment.

On Tuesday, FOMC Chairman Jerome Powell will be testifying before Congress and investors will look for fresh clues regarding possible adjustments to the asset purchase program. The FOMC’s November Minutes showed on Wednesday that policymakers noted they could provide more accommodation, if appropriate, by increasing the pace of purchases or shifting to longer maturities. In the meantime, the ISM Manufacturing PMI will be featured in the US economic docket.

On Thursday, the ISM Services PMI and the Initial Jobless Claims data will be released from the US. However, investors are likely to ignore these data while waiting for the US Bureau of Labor Statistics Nonfarm Payrolls (NFP) report on Friday. Analysts expect the NFP to come in at 520,000 in November following October’s increase of 638,000. A better-than-expected reading could help US stocks gain traction and make it difficult for gold to find demand.

Gold technical outlook

The sharp decline witnessed on Friday dragged XAU/USD below the critical 200-day SMA for the first time in more than eight months. On the daily chart, the Relative Strength Index (RSI) indicator is at its lowest level since March near 30. The last time the RSI fell to this level, it staged a decisive rebound.

Although a technical correction in the near-term is likely, buyers could struggle to take control of the price unless it reclaims $1,800 (200-day SMA). Above that level, $1,820 (November 25/26 high) is the next resistance before $1,850 (Fibonacci 61.8% retracement of the June-August uptrend).

On the downside, the initial support is located at $1,750 (static level) ahead of $1,720 (the beginning point of the June-August uptrend).

Gold sentiment poll

Despite the fact that the technical outlook favours bears following this week's sharp decline, the FXStreet Forecast Poll shows that experts see the precious metal recovering in the near-term. The one-week and the one-month views point out to an average target of $1,820 and $1,829, respectively.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.