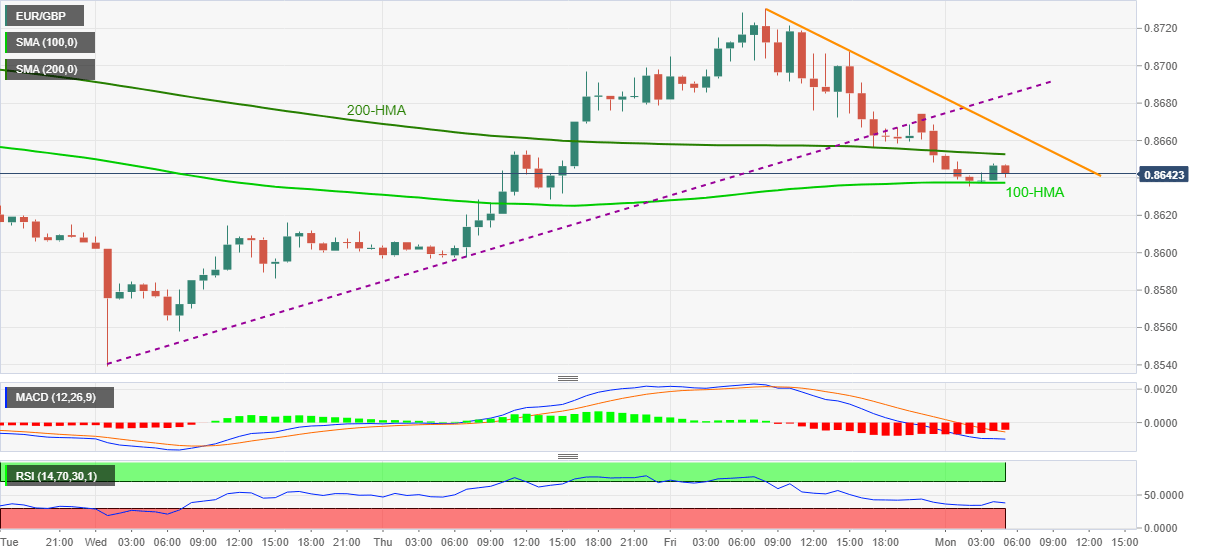

- EUR/GBP remains on the back foot between 100 and 200-HMA.

- Bearish MACD, sustained break of short-term support line, now resistance, favor sellers.

- The falling trend line from Friday adds to the upside barriers.

Following its downtick to the lowest since Thursday in early Asia, EUR/GBP seesaws in a choppy range inside the 100 and 200-HMA, currently down 0.25% to 0.8640, during the pre-European session on Monday.

In doing so, the quote keeps downside break of an ascending trend line from Wednesday amid bearish MACD.

As a result, EUR/GBP sellers seem to wait for a clear downside break of 200-HMA level of 0.8637 while targeting the 0.8600 threshold.

However, the previous month’s low, also the lowest since February 2020, around 0.8540, will lure the EUR/GBP bears below the 0.8600 round-figure.

Meanwhile, an upside break of 200-HMA level of 0.8652 will trigger a fresh run-up targeting an immediate resistance line, at 0.8665 now, a break of which will highlight another hurdle, the previous support line, close to 0.8685.

If at all, the EUR/GBP bulls manage to cross 0.8685, multiple lows marked during April 2020, close to the 0.8700 psychological magnet, will challenge the quote’s further upside.

Overall, EUR/GBP remains on the back-foot but sellers await confirmation for fresh entries.

EUR/GBP hourly chart

Trend: Bearish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays near 1.2450 after UK employment data

GBP/USD gains traction and trades near 1.2450 after falling toward 1.2400 earlier in the day. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, limiting Pound Sterling's upside.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world supported by a strong US labour market.