- GBP/USD looks to recapture 1.40 amid firmer risk tone, weaker DXY.

- Powerful resistance aligns at 1.4014 while RSI stays bullish.

- The cable awaits UK final PMI amid vaccine and budget optimism.

GBP/USD is making another attempt to recapture the 1.4000 level amid the upbeat market mood-led broad-based US dollar weakness.

Investors cheer a positive start to March, as bond markets look to stabilize following last week’s rout, lending support to the risk currencies, the GBP.

Also, hopes of additional budget stimulus and successful covid vaccine rollout in the UK aid the recovery in the cable.

The bulls now await the UK final Manufacturing PMI and US ISM Manufacturing PMI for fresh trading opportunities, as the risk sentiment remains favorable.

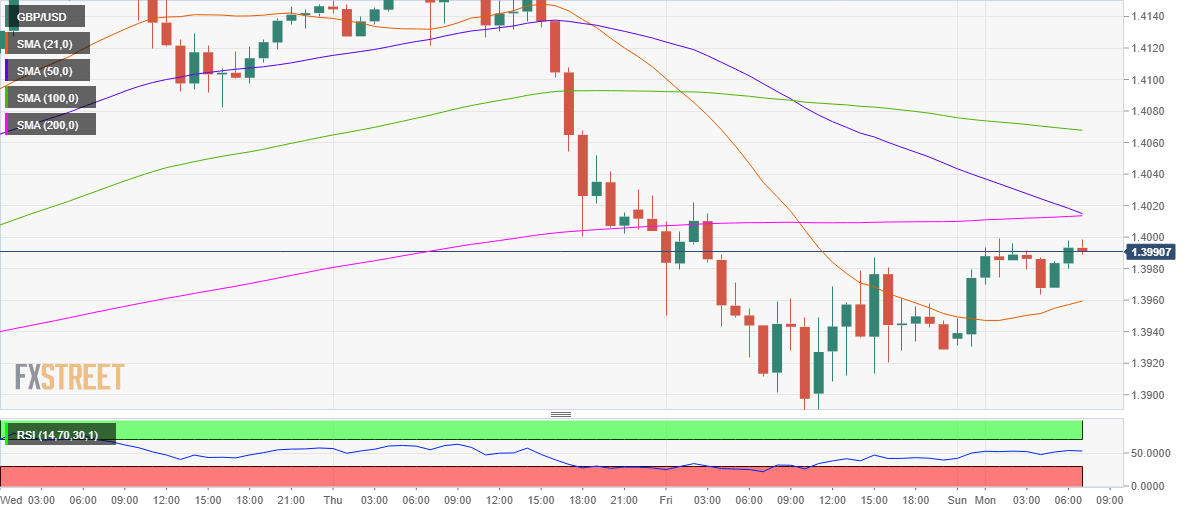

From a near-term trading perspective, the major is inching closer towards 1.4000, above which the critical resistance at 1.4014 could be challenged. That level is the convergence of the horizontal 200-hourly moving average and 50-HMA.

Note that the convergence of the 50 and 200-HMAs calls for an impending death cross on the hourly sticks. The bearish formation will get validated once the 50-HMA breaks below the 200-HMA on an hourly closing basis.

The pair could then stall its recovery momentum and turn south towards the 21-HMA at 1.3959. The further downside appears cushioned, as the Relative Strength Index (RSI) still holds above midline, currently at 53.34.

GBP/USD: Hourly chart

GBP/USD: Additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

Bitcoin price drops, but holders with 100 to 1000 BTC continue to buy up

Bitcoin price action continues to show a lack of participation from new traders, steadily grinding south in the one-day timeframe, while the one-week period shows a horizontal chop. Meanwhile, data shows that some holder segments continue to buy up.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.