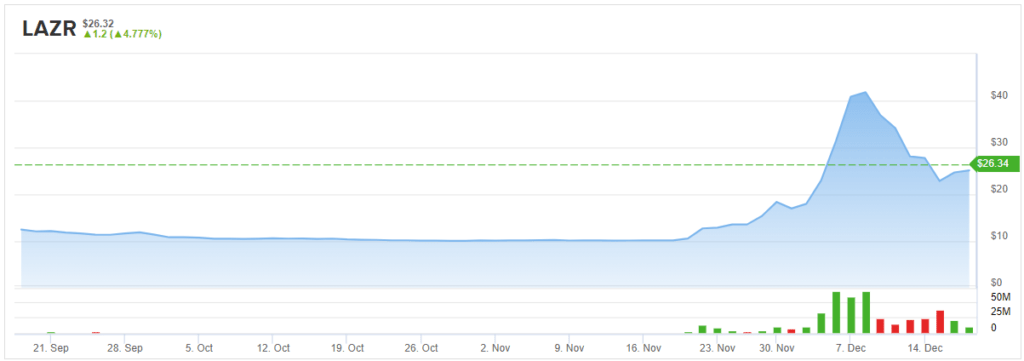

Luminar Technologies (LAZR) is only two weeks old, after going public via a SPAC merger, but already a firm favorite among investors. It appears Wall Street’s analyst corps are now slowly joining the fray.

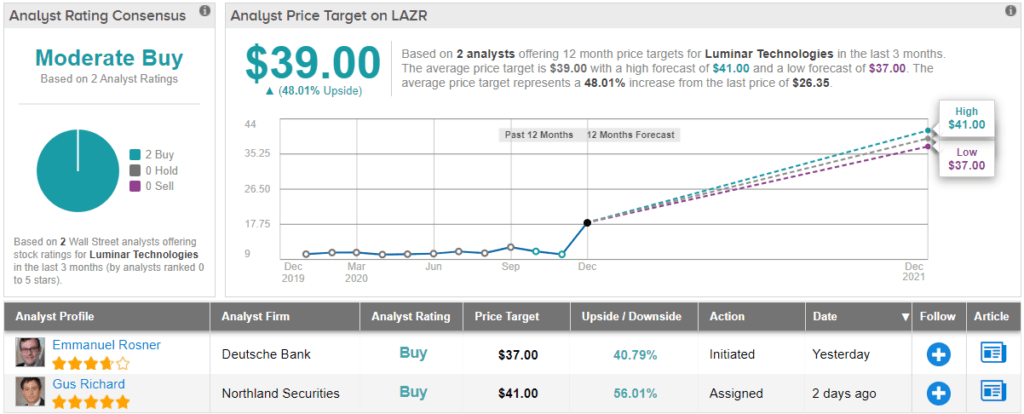

Enter Deutsche Bank analyst Emmanuel Rosner who initiates coverage on LAZR shares with a Buy rating and $37 price target. Investors are looking at upside of 40%, should Rosner’s thesis play out over the coming months. (To watch Rosner’s track record, click here)

So, what’s tickling the analyst’s fancy?

Rosner explained, “Luminar offers investors an attractive way to invest into higher-level vehicle autonomy whose adoption is poised to take off, as we expect the company to become a leader in LiDAR solutions, with a true addressable market of ~$40bn by 2030.”

The analyst added, “Its differentiated LiDAR technology, featuring proprietary architecture and components, is essentially the only one delivering the performance needed for highway-speed autonomy at the right cost, and already received external validation from Volvo, Daimler and Mobileye through production contracts.”

While the company already boasts an $8 billion market cap and its valuation is “rich by near-term metrics,” Rosner argues it is justified due to Luminar’s “superior technology and the size of the mid-term market opportunity.”

The lidar market is still in its early innings and lidar probably won’t be required by sub L3 autonomous vehicles. However, as higher-level vehicle autonomy becomes more commonplace deeper into the decade, the need for Lidar solutions will increase.

Apart from Robotaxis -for which Mobileye has already signed on to use Luminar’s lidar in its fleet – Rosner expects commercial trucks will be quick to adopt advanced driverless features “given large operating costs savings.”

Rosner expects Luminar’s sales to have a steep upwards curve over the coming years. The analyst thinks the company will shift from selling 500,000 sensors in 2025E to more than 6.5 million in 2030E. Revenue should follow accordingly and climb from $635 million in 2025E to $4.5 billion in 2030E.

In terms of other analyst activity, it has been relatively quiet. 2 Buy ratings assigned in the last three months add up to a ‘Moderate Buy’ analyst consensus. In addition, the $39 average price target puts the upside potential at 48%. (See LAZR stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.