On Friday (January 15), popular New Zealand-based crypto analyst Lark Davis (@TheCryptoLark on Twitter) talked about the four major positive catalysts that could propel the Ether price to $2000 before the end of February.

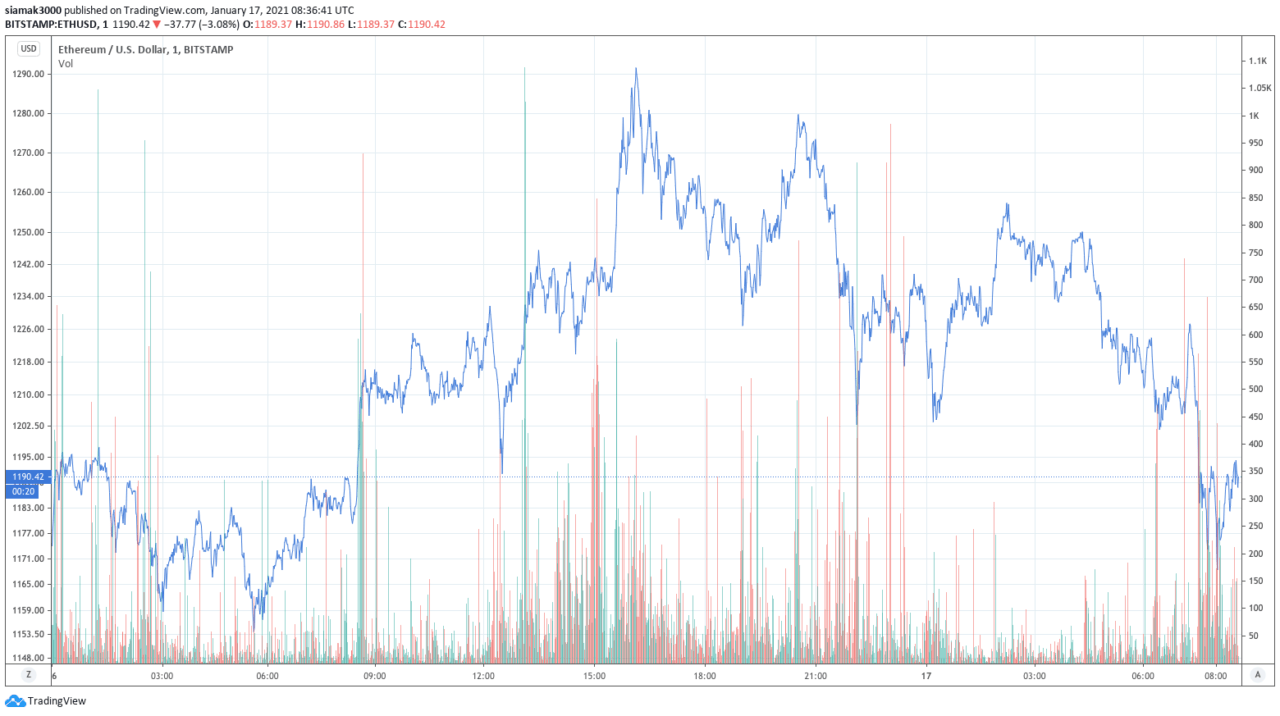

According to data by TradingView, Currently (as of 08:36 UTC on January 17), on Bitstamp, the Ether (ETH) price is trading around $1190.

However, in a video released on his YouTube channel on Friday (January 15), Davis gave the reasons for believing that the ETH price could go as high as $2000 before the end of next month.

Davis started by saying that “although the price and theory is actually lagging behind Bitcoin, the interest in Ethereum has never been higher according to Google Trends.”

He then proceeded to mention the major catalysts that could push the Ethereum price higher:

- ETH 2.0 hype

“Ethereum is currently undergoing the most significant upgrade in its history. The first phase of that upgrade is already underway. In fact, there are now 2.5 million Ethereum locked up in the ETH 2.0 deposit staking contract. Now this number is growing continually, and for every 32 Ethereum that gets locked up on the one-way trip into ETH 2.0, that’s actually 32 less Ethereum available on the open markets… we can now start looking forward to the next major phase of Ethereum 2.0: phase 1… by the way, phase one, in case you don’t know, will bring in network sharding…“

“This is the improvement protocol that is intended to change Ethereum’s fee model for transactions by introducing a base fee to pay for each transaction. That helps protect the network from spam, so it’ll lower congestion on the network, but also, I think more importantly, part of this Ethereum upgrade is that it’s going to introduce fee burning, so we’re actually going to start to see a just incredible amount of Ethereum being burned.

“Every single day, every single transaction, they’re going to start burning Ethereum when they implement this improvement proposal, potentially even making Ethereum into a deflationary cryptocurrency which would be totally awesome for long-term price appreciation. Now that becomes almost a certainty with Ethereum 2.0 phase 1.5…“

- Layer 2 Scaling Solutions

“The biggest deal, right now, probably in terms of new technology layer 2 is probably going to be Optimistic Rollups… This will allow the major DeFi applications — all of our DeFi favorites like Aave and Synthetix — to dramatically reduce fees by implementing optimistic technology into their applications. Now, Synthetix is probably going to be the first major Ethereum DApp to pull this off… that’s going to be game-changing for these applications… because you’re going to be able to use them without paying, you know, insane prices you’ve been paying for gas fees recently with Ethereum.“

- Increasing Demand.

“More and more, we see big money waking up to what Ethereum is, the power of the technology, the value proposition of the technology… and while many institutions are still hesitating to even go out and buy Bitcoin, the smarter, more agile, hedge funds and big money guys, they are buying Ethereum… and the top it all off, we have the CME Ethereum futures going live at the start of February. This will again give big money a way to get exposure to the price action of Ethereum.“

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Featured Image by “AgelessFinance” via Pixabay.com