Citigroup stock closed about 7% lower on Friday after its fourth-quarter revenues missed the Street’s estimate. The bank’s 4Q revenues of $16.5 billion declined 10% year-on-year and came in below analysts’ expectations of $16.7 billion.

The banking giant’s weak top-line performance reflects a 14% decrease in its Global Consumer Banking division. The bank said that the lower interest rates and decline in card volumes weighed on the segment’s revenues.

Citigroup (C) reported earnings of $2.08 per share that exceeded the Street estimates of $1.34 per share, reflecting the lower cost of credit. However, its EPS declined 3% year-on-year due to weak revenues and higher operating expenses. Moreover, an increase in the effective tax rate further pressured its bottom line.

Citigroup’s total deposits increased 20% year-on-year to $1.3 trillion, while loans declined 3% to $676 billion. Meanwhile, its allowance for credit losses on loans stood at $25 billion.

Citigroup’s CEO Michael Corbat said, “We remain very well capitalized with robust liquidity to serve our clients. Our CET 1 [Common Equity Tier 1 Capital] ratio increased to 11.8%, well above our regulatory minimum of 10%. Our Tangible Book Value per share increased to $73.83, up 5% from a year ago.” (See C stock analysis on TipRanks)

The bank also announced that it could resume share buybacks in the current quarter.

Following the earnings release, Oppenheimer analyst Chris Kotowski maintained a Buy rating and a price target of $111 (72.8% upside potential) on the stock. In a note to investors, the analyst said, “Given the nature of the year we are having, a blip in expenses is not a major concern.”

From the rest of the Street, the stock scores a bullish outlook with the analyst consensus of a Strong Buy based on 13 Buys and 2 Holds. The average analyst price target of $74.93 implies upside potential of about 16.7% to current levels. Shares have declined 18.4% in one year.

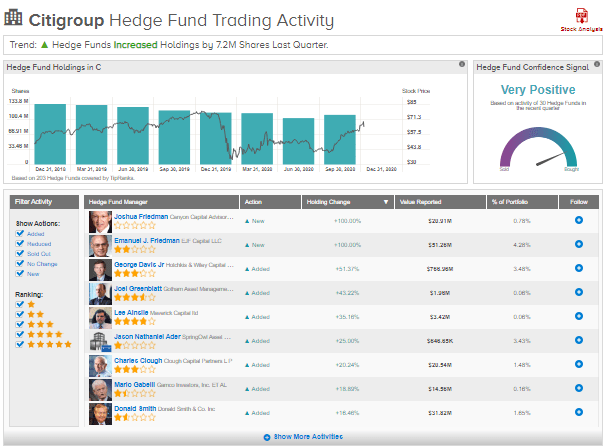

Meanwhile, TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Citigroup is currently Very Positive, as 30 hedge funds increased their cumulative holdings in Citigroup by 7.2 million shares in the last quarter.

Related News:

Citibank To Redeem Notes Worth $2.55B In January; Street Sees 9% Upside

BancorpSouth Buys FNS For $108M

JPMorgan On The Hunt For Asset Management Businesses – Report