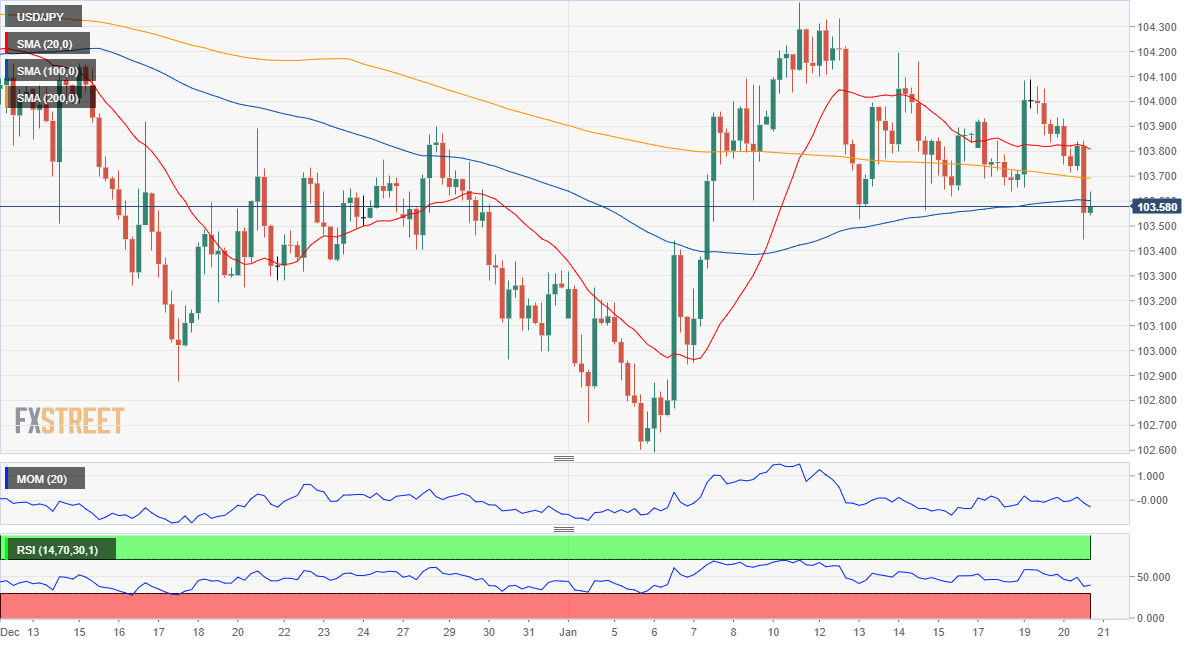

USD/JPY Current price: 103.57

- Wall Street soared on optimism, the dollar fell unevenly afterwards.

- The Bank of Japan is having a monetary policy meeting this Thursday.

- USD/JPY gains bearish traction after the first test of the 103.50 support.

The USD/JPY pair plunged to 103.44, its lowest in almost two weeks, recovering ahead of the close but ending the day of the day around 103.60. The pair edged lower as Wall Street surged to record highs, quite an unlikely scenario. On the other hand, Treasury yields were unable to find directional strength and continue to hover around their weekly opening levels.

Market´s optimism was backed by the new US administration. US President Joe Biden has nominated Janet Yellen as Treasury Secretary, who pledged to boost stimulus to support the economy. Japan will publish this Thursday the December Merchandise Trade Balance, expected to post a surplus of ¥942.8 billion, improving from the previous ¥366.8 billion. Additionally, the Bank of Japan will announce its latest decision on monetary policy.

USD/JPY short-term technical outlook

The USD/JPY pair is slowly gaining bearish potential, at least in the near-term. The pair has briefly pierced the 50% retracement of its January advance, which stands at 103.50, also a strong static support level. The 4-hour chart shows that it’s finishing the day around a directionless 100 SMA and below flat 20 and 200 SMAs. Technical indicators hold within negative levels but lack directional strength.

Support levels: 103.50 103.15 102.70

Resistance levels: 104.05 104.40 104.80

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.