UK-based IG Group Holdings Plc has offered to buy online brokerage and trading platform tastytrade for a total of $1 billion, in a move to strengthen its footprint in the US.

IG shares declined 4.3% in UK trading following the news. Under the terms of the proposed offer, tastytrade shareholders will get $300 million in cash and 61 million IG (IGG) shares, valued at $700 million. The cash requirement will be funded by £150 million of new debt facilities with the balance from IG’s own cash resources.

The acquisition is expected to be low single digit accretive to IG’s adjusted earnings per share in the first full year following its completion. The management teams of IG and tastytrade will remain the same.

Specifically, IG believes that the deal would significantly strengthen its presence in the US derivatives market and further diversify its product offering. According to IG, tastytrade has emerged as one of the top-rated brokerage businesses for online trading by active traders in options and futures. The US online platform has over 105,000 active accounts, with gross assets of $200.5 million as of December 31.

“This acquisition will materially expand and scale our business in the U.S. and see us further diversify into the exciting high growth market of U.S. retail options and futures, a market which is adjacent to IG’s core retail trading skill set,” said IG CEO June Felix. “The U.S. market has more than 1.5 million retail traders and is the largest derivatives market in the world. The financial and strategic rationale underpinning this deal are compelling.”

Following the completion of the deal, key tastytrade management shareholders will collectively own about 5.7% of the enlarged share capital of IG. (See IGG stock analysis on TipRanks)

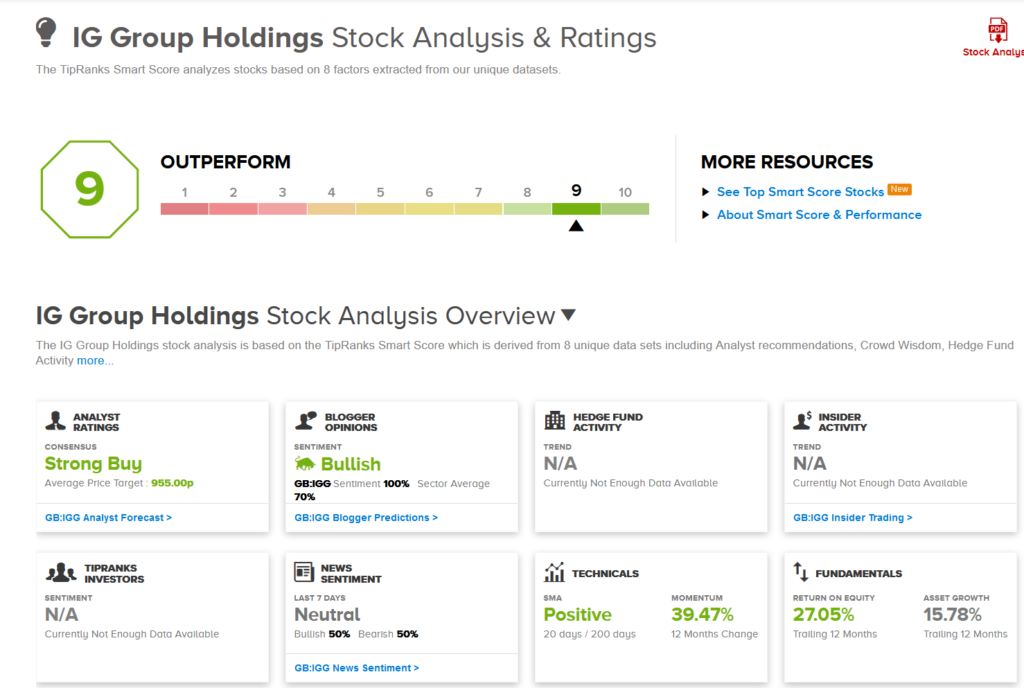

The Street has a bullish outlook on the stock. The Strong Buy analyst consensus boasts 3 unanimous Buy ratings. Meanwhile, the average price target stands at 955p and implies 12% upside potential over the coming 12 months.

What’s more, IGG scores a 9 out of 10 on TipRanks’ Smart Score rating, indicating that the stock has a strong chance of outperforming market expectations.

Related News:

Inovio Sinks 7% After Pricing Of $150.5M Share Offering; Street Says Hold

Akzo Nobel Enters Tikkurila Takeover Battle With $1.7B Bid

Oil Giant Total Inks $2.5B Deal For 20% Stake In India’s Adani; Shares Gain