UK Retail Sales Overview

Having witnessed upbeat inflation numbers for December on Wednesday, GBP/USD traders are waiting for Friday’s UK Retail Sales, to be published at 07:00 GMT, for fresh impulse. The key data to British GDP, Retail Sales, is expected to rise from -3.8% prior contraction to +1.2% % MoM in December. The same is likely to help total retail sales that are seen rising from 2.4% to 4.0% over the year in the reported month.

Additionally, core retail sales, stripping the basket off motor fuel sales, are also likely to print upbeat readings with +0.8% MoM and +7.0% YoY numbers compared to -2.6% and +5.6% respective priors.

It should be noted that the preliminary readings of the UK’s Manufacturing and Services PMIs for January, up for publishing near 09:30 GMT Friday, also become important data for the Cable traders.

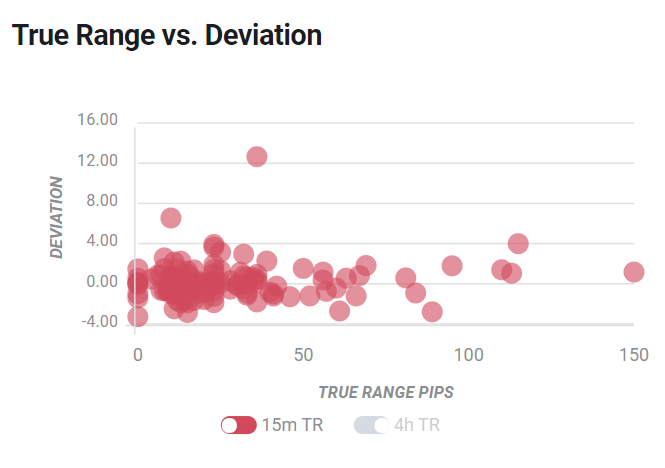

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 80 pips in deviations up to 3.5 to -1.5, although in some cases, if notable enough, can fuel movements of up to 150 pips.

How could it affect GBP/USD?

GBP/USD fails to cheer the US dollar weakness during early Friday as the coronavirus (COVID-19) fears do probe the bulls near the highest since May 2018. The quote snaps four-day winning streak, currently down 0.18% near 1.3712, amid chatters over the British policymakers' push to UK PM Boris Johnson for complete closure of national boundaries.

While the covid woes can join the Brexit disappointment to probe the GBP/USD buyers, a sustained run-up in the Retail Sales will amplify the early-week inflation data and back BOE Governor Andrew Bailey’s rejection to the negative rates.

TD Securities anticipate a mild recovery in the UK Retail Sales figures as they say,

We look for a -0.3% m/m decline (market forecast +0.6%), on the back of the -3.8% drop in November. There's a huge amount of uncertainty though, as the end of the year was a complex time for retailers, bouncing between a 'lite' lockdown in November, a limited re-opening in early December, and then another shutdown in large parts of the country at the end of the month as the new Covid variant saw the government moving quickly to tighten restrictions. The impact on food store sales, which comprise about 40% of UK retail sales, is especially uncertain, due to strict limits on gatherings over Christmas. It's unclear how the downside impact from no big Christmas or New Year's Eve celebrations balanced out against the upside to food store sales from restaurants being closed (so more eating at home), and the fact that there would have been many more single-household celebrations (fewer big turkeys, more turkey crowns). We suspect that the net impact would have been negative, which is the main driver of our below-consensus forecast.

Technically, multiple tops marked during January highlight the 1.3700 as the key immediate support whereas the weekly rising trend line near 1.3685 adds to the downside filter. Meanwhile, the 1.3800 lures GBP/USD bulls if at all they manage to return.

Key notes

GBP/USD stays above 1.3700 despite looming border close in Britain, eyes UK Retail Sales, PMIs

GBP/USD Forecast: Bulls not ready to give up

About the UK Retail Sales

The retail sales released by the Office for National Statistics (ONS) measures the total receipts of retail stores. Monthly percent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive, or bullish for the GBP, while a low reading is seen as negative or bearish.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.