- EUR/USD has been lagging behind its peers in gaining against the dollar.

- Concerns about covid variants and slow vaccine rollout may outweigh hopes for new US stimulus.

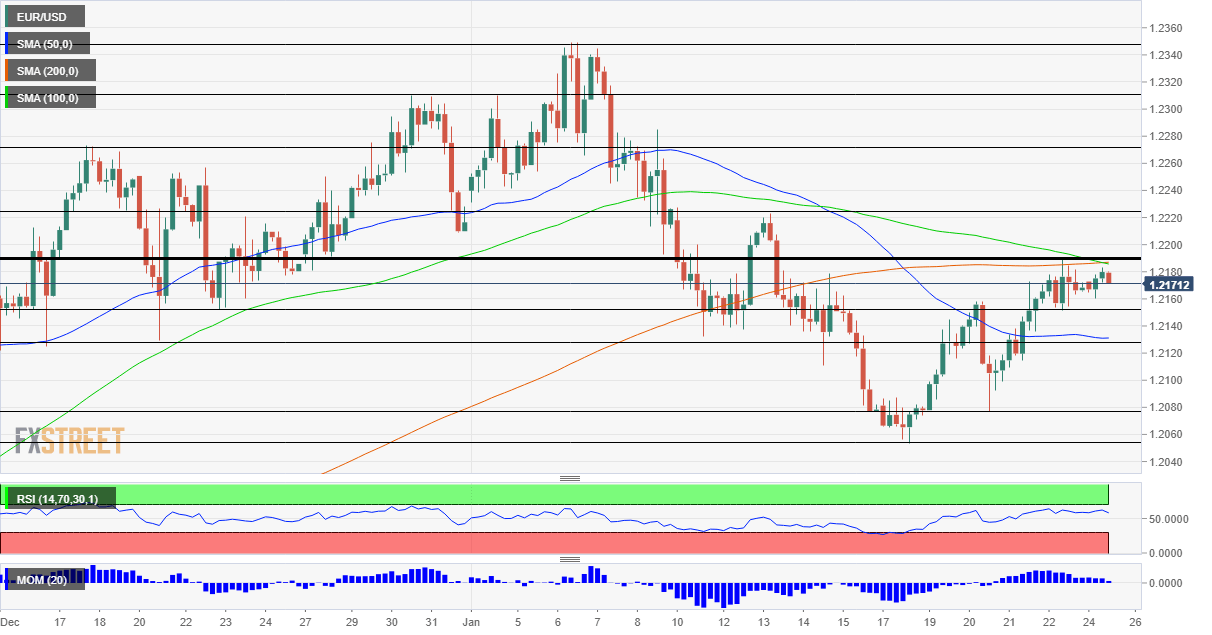

- Monday's four-hour chart is showing that the pair faces robust resistance.

When even the slow-moving yen is gaining ahead of the euro – the common currency's weakness is exposed. The safe-haven US dollar is on the back foot across the board as US President Joe Biden is advancing his $1.9 trillion relief program, yet the common currency's advance is minimal.

Several issues weigh on the common currency. The COVID-19 vaccination rollout lags behind in the old continent amid slow distribution – and new manufacturing issues. After Pfizer told the EU that retooling in its Belgian plant will cause a delay, AstraZeneca made a similar announcement on Friday. The bloc has a substantial deal with the British pharmaceutical and the European regulator is set to approve it on Friday.

Apart from the vaccine delays, fears of new coronavirus strains are also of concern and may trigger another nationwide lockdown in France, the eurozone's second-largest economy. The news from Paris comes after Berlin extended its restrictions through mid-February.

The German IFO Business Climate figures for January are set to show cautious optimism, despite these issues. Christine Lagarde, President of the European Central Bank, is scheduled to speak on Monday, but there is probably little that she can say to rock markets – she spoke on Thursday after the ECB left its policies unchanged.

As mentioned earlier, hopes of a substantial US stimulus package have been keeping markets bid and investors are eyeing the next developments from Washington. On the one hand, moderate Senators from both parties are pushing back against approving new expenditure, only a month after they greenlighted $900 billion of funds.

On the other hand, there are reports in Washington that Democrats are set to ram through the package via a "reconciliation" which would relieve them of the need to receive Republican support. Another option is quick approval of coronavirus-related funds while delaying other aspects of the suggested package, such as a hike to the minimum wage. Biden is scheduled to speak about American manufacturing later in the day.

Investors are also speculating about the Federal Reserve's decision on Wednesday. The world's most powerful central bank is set to leave its policy unchanged and reject an early tapering of its bond-buying scheme. Will Fed Chair Jerome Powell take the extra step of hinting at expanding the current scheme? Probably not – at least while markets remain upbeat.

Overall, while developments in Washington are mostly downbeat for the dollar, the euro is unable to fully capitalize on them – and that may lead to a downfall for the currency pair.

EUR/USD Technical Analysis

Euro/dollar is capped at around 1.2190, which is the confluence of last week's high, and both the 100 and 200 Simple Moving Averages on the four-hour chart. While momentum remains to the upside, it is waning.

Above 1.2190, the next lines to watch are 1.2220, a high point early in the month, followed by 1.2270 and 1.2310.

Support awaits at the recent cushion of 1.2150, followed by 1.2125 – a former triple bottom – and then by 1.2080 and 1.2050.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.