- Economists expect the UK Unemployment Rate to top 5%.

- Previous upside surprises are hinting at another pound-positive development.

- An acceleration in wage growth and manageable jobless claims may also support sterling.

The world is worried about the British coronavirus variant – and Brexit is causing bureaucratic issues – yet the labor market is yet to feel substantial pain. How long can this continue? The economic calendar is pointing to an increase in the UK's Unemployment Rate from 4.9% to 5.1% in November.

There are several reasons to expect a better outcome. First, Britain fully left the EU at the very end of 2020, and despite the robust rhetoric around the negotiations during the latter part of the year, most market participants and companies anticipated an agreement.

Second, companies learned to live with the virus. Restaurants, pubs, conference operators, and other sectors involving crowds undoubtedly suffered from restrictions, but office workers already got used to working from home.

Third, the government's furlough scheme has been proving successful at maintaining the labor market intact – and Chancellor of the Exchequer Rishi Sunak has been extending the program, providing certainty to businesses. That should have prevented excessive firings.

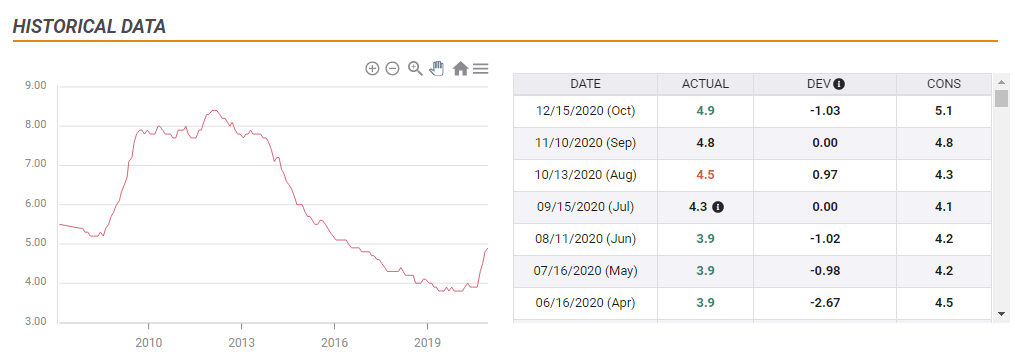

Last but not least, economists proved too pessimistic in the past four of seven releases, including the latest one.

Source: FXStreet

GBP/USD impact

If Britain's Unemployment Rate holds at or below the round 5% level, it would boost the pound, regardless of other developments. An increase to 5.1% or 5.2% would likely put the focus on other figures.

Average Earnings forecast to accelerate from 2.7% to 2.9% when including bonuses, and from 2.8% to 3.1% when excluding them. If these predictions materialize – and especially if the latter figure surpasses 3% – it would send sterling higher.

Last but least, the Claimant Count Change figure is for December, therefore providing a more up-to-date view of the labor market. An increase by less than November's 64,500 could be considered a positive development. It is essential to note that the Unemployment Rate has been having the most impact on markets.

Pound/dollar has been struggling as the greenback gains ground. A dose of upbeat economic news – alongside Britain's rapid vaccination drive – would serve as a shot in the arm to sterling.

Conclusion

There is a good chance that the UK's first labor market release in 2021 exceeds expectations, boosting the pound.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.