GBP/USD Current price: 1.3664

- Health Secretary Matt Hancock said that there are early signs the latest measures “are working.”

- The UK unemployment rate is expected to have risen to 5.1% in the three months to Nov.

- GBP/USD is neutral-to-bearish in the near-term, decline to accelerate once below 1.3620.

The GBP/USD pair is posting modest daily losses this Tuesday, trading by the end of the American session around 1.3660. An early advance was offset by the prevalent risk-off mood throughout the second half of the day, although the downside remained limited for the pound. The UK didn’t publish relevant macroeconomic data, although coronavirus-related news were encouraging. The country reported 22.2K new contagions on Monday, the lowest since mid-December. UK Health Secretary Matt Hancock said that there are early signs the latest measures against COVID-19 “are working.”

This Tuesday, the UK will publish an update on employment. The ILO Unemployment Rate is foreseen at 5.1% in the three months to November, up from 4.9% previously. The number of people claiming for unemployment benefits is expected to have shrunk from 64.3K to 47.5K in December.

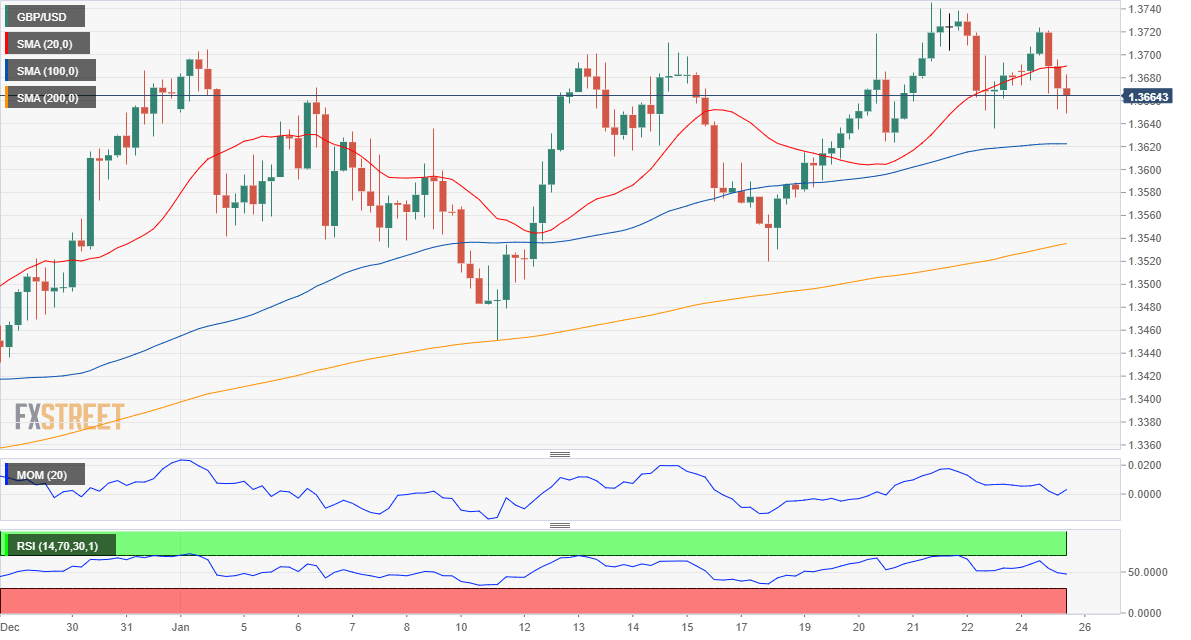

GBP/USD short-term technical outlook

The GBP/USD pair is poised to extend its decline in the near-term. The 4-hour chart shows that it is developing below a directionless 20 SMA, although above an also flat 100 SMA. Technical indicators stand within negative levels, but without clear directional strength. A steeper decline could be expected below 1.3620, the immediate support level.

Support levels: 1.3620 1.3585 1.3530

Resistance levels: 1.3695 1.3745 1.3790

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.