- AUD/USD refreshed weekly tops on Wednesday in reaction to upbeat Australian CPI figures.

- The uptick lacked any follow-through and remained capped amid the prevalent cautious mood.

- Investors also seemed reluctant ahead of the FOMC monetary policy decision, due later today.

The AUD/USD pair witnessed an intraday turnaround from over one-week lows and rallied around 85 pips from the 0.7670-65 region on Tuesday. Despite doubts over the size and timing of the US fiscal stimulus package, hopes for a strong global economic recovery remained supportive of the underlying bullish tone in the financial markets. This, in turn, prompted some fresh selling around the safe-haven US dollar and was seen as a key factor that benefitted the perceived riskier Australian dollar.

The upbeat market mood got an additional boost after the International Monetary Fund (IMF) upgraded its forecast for 2021 global economic growth to 5.5% from 5.2%. The IMF, however, warned that the second wave of infections and new variants of COVID-19 pose risk for the outlook. Meanwhile, the upbeat release of the Conference Board's US Consumer Confidence Index, which improved to 89.3 in January from 87.1 previous, did little to impress the USD bulls. The pair finally settled near the top end of its daily trading range and refreshed weekly tops during the Asian session on Wednesday.

The aussie benefitted from hotter-than-expected Australian consumer inflation figures, which showed that the headline CPI rose 0.9% during the October-December quarter. Annual CPI also beat forecasts and climbed 0.9% versus an estimated 0.7%. The inflation report will go into policy considerations at the upcoming Reserve Bank of Australia (RBA) meeting on February 2. That said, the RBA has already made it clear that it will not tighten borrowing costs until inflation is sustainably within the 2-3% target band. This, in turn, failed to assist the pair to capitalize on the early uptick.

Apart from this, escalating US-China tensions in the South China Sea further collaborated to cap gains for the China-proxy Australian dollar. Investors also seemed reluctant to place any aggressive bets, rather preferred to wait on the sidelines ahead of the latest FOMC monetary policy update on Wednesday. The Fed is scheduled to announce its decision later during the US session and is widely expected to leave its policy settings unchanged. Hence, the key focus will be on the accompanying policy statement and the Fed Chair Jerome Powell's comments at the post-meeting conference.

Investors will look for clues about the central bank’s plan to start tapering the asset purchases later this year, which will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to the major.

Short-term technical outlook

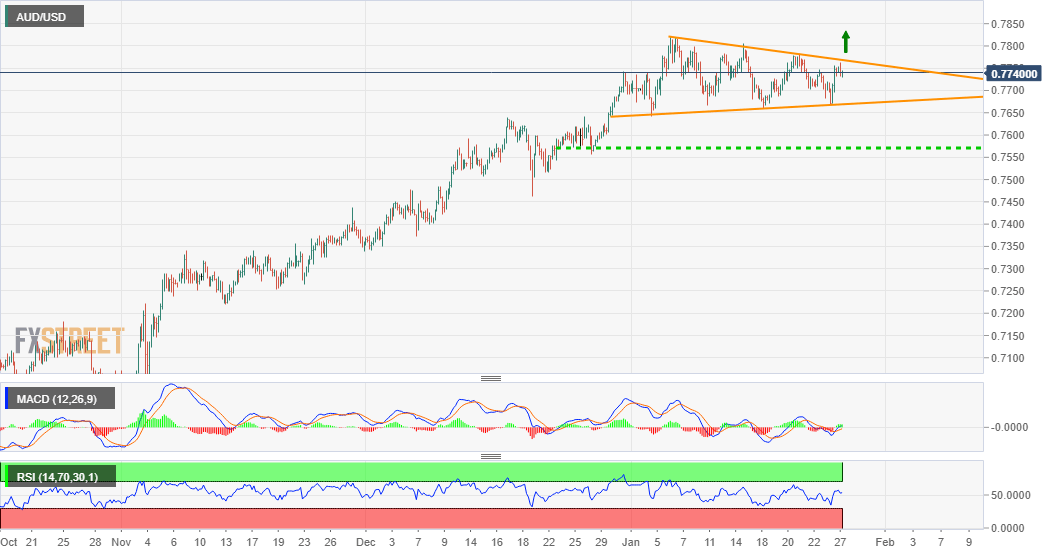

From a technical perspective, the pair has been oscillating between two converging trend-line since the beginning of this year, forming a symmetrical triangle on short-term charts. Given the recent strong positive move, the triangle constitutes the formation of a bullish continuation (pennant) chart pattern and supports prospects for additional gains. That said, the direction of the next major move can only be determined after the occurrence of a valid breakout.

This makes it prudent to wait for a sustained move beyond the triangle resistance, currently near the 0.7770-80 region, before placing fresh bullish bets. Above the mentioned barrier, the pair seems all set to surpass the 0.7800 mark and test monthly swing highs, around the 0.7820 region touched on January 6.

On the flip side, the 0.7700 mark now seems to act as immediate strong support. This is followed by the lower boundary of the triangle, around the 0.7675 region. Failure to defend the mentioned support levels will negate the constructive set-up and turn the pair vulnerable. A subsequent fall below the 0.7635-30 area will reaffirm the bearish bias and drag the pair further below the 0.7600 mark, towards testing 0.7575-65 support zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.