This report provides an update (as of 08:30 UTC on 27 January 2021) on the latest thinking on Bitcoin by analysts, investors, and traders.

Bitcoin’s Price Action

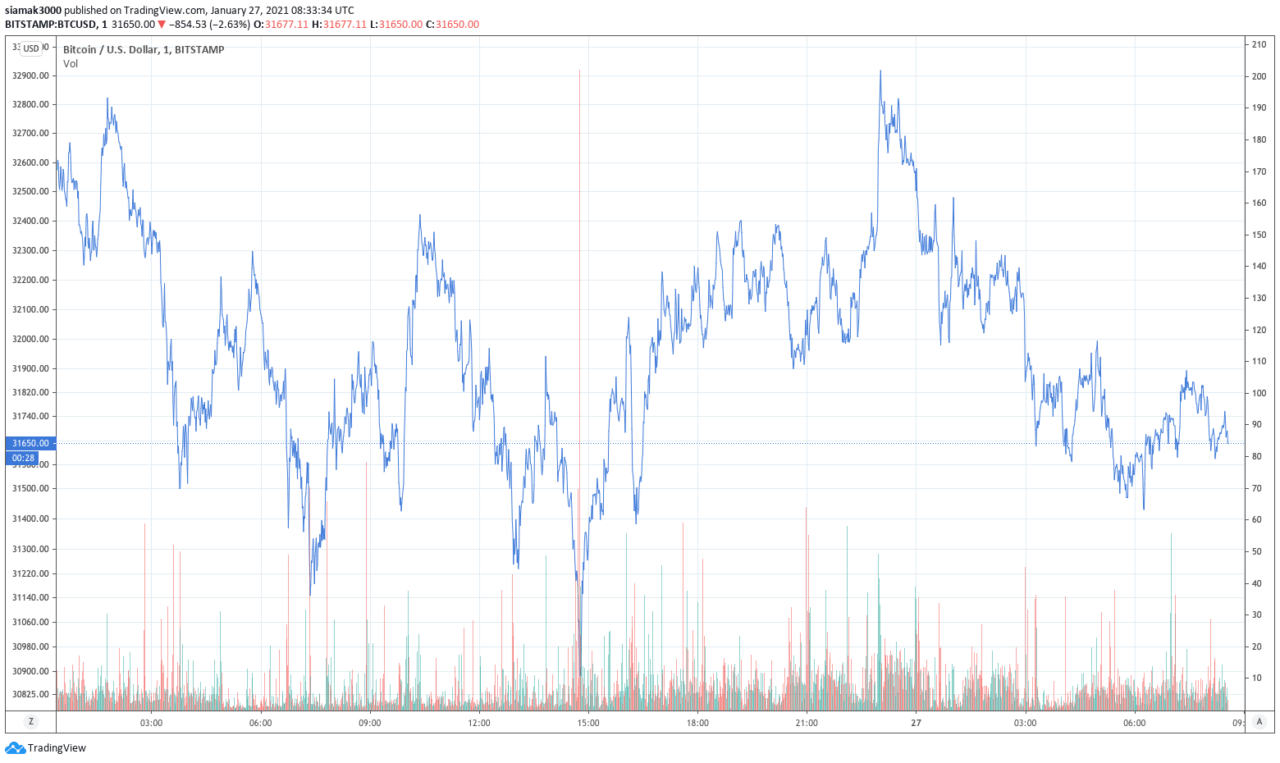

According to data by TradingView, on crypto exchange Bitstamp, Bitcoin traded in the range $30,884 (at 14:45 UTC) – $32,919 (at 23:01 UTC) on Tuesday (January 26).

Crypto analyst Alex Krüger offered this analysis of Bitcoin’s latest price action:

- “$BTC is stuck in a range within a range: 29K-35K. It can break either way. The key reason I lean bullish is interest rates. Exuberance has rinsed off the system dramatically, as relected in falling rates. This is a bull market, and traders are now bearish. That’s bullish.“

- “Funding is either flat or negative. Perpetuals are trading below spot. The perp-spot basis has not been negative for this long since pre Nov elections, And the annualized quarterly basis has dropped from 25%-28% a week ago to 7-10% now. All sings of a healthy cool-down.“

- “Unlike past times during this bull market, my level of confidence for upwards continuation is not absolute. Key reason being ‘fear of the heights’. Price may be too high to attract the buying interest to sustain the run. Also, Tether FUD is real. Put odds of breaking up at 70%.“

Bitcoin ETFs

Last Friday (January 23), Dallas-headquartered Valkyrie, which is “a specialized alternative asset management firm”, perhaps sensing the winds of change—following the announcement that crypto-friendly professor Gary Gensler has been named by President Biden as his nominee for Chairman of the U.S. Securities and Exchange Commission (SEC)—filed a Bitcoin ETF (named “Valkyrie Bitcoin Fund”) proposal with the SEC.

According to a report by Coindesk, on Tuesday (January 26), Catherine Wood, Founder, CIO, and CEO at ARK Investment Management, LLC (aka “ARK” or “ARK Invest”), while talking at ETF Trends’ “Big Ideas 2021” event, said that she did not think that the SEC would approve a Bitcoin ETF proposal until Bitcoin’s market cap (currently around $580 billion) reaches $2 trillion:

“The flood of demand has to be satisfied so it’s going to have to get well over a trillion dollars – $2 trillion, I think, before the [U.S Securities and Exchange Commission] will feel comfortable…“

Are Miners Selling Unusually Large Amounts of Bitcoin Into the Current Rally?

Ki Young Ju, the CEO of South Korean blockchain analytics startup CryptoQuant said that short-term, he remains bearish on Bitcoin due to profit-taking by miners since the Bitcoin price reached $42,000:

CryptoQuant defines Miners’ Position Index (MPI) as “the ratio of an amount of all miners’ outflows in USD divided by 365 days moving average of it” and “values above 2 indicate most miners are selling.”

Neil Van Huis, Director of Sales & Institutional Trading at Blockfills, told Coindesk:

“For the first time in a while, it appears miners sold some fairly substantial holdings to raise cash as we expected on a rally after October… With a need to allocate capital to more (and newer) mining rigs, taking bitcoin off of their balance sheet for cash at three or four times higher prices 30-60 days after the wet season ended in China was about the best scenario [miners] could’ve asked for.“

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.