Silver: The Family Circus Of Investments

Still from an r/WallStreetBets meme riffing on the 2006 movie 300.

Moving On From Precious Metals

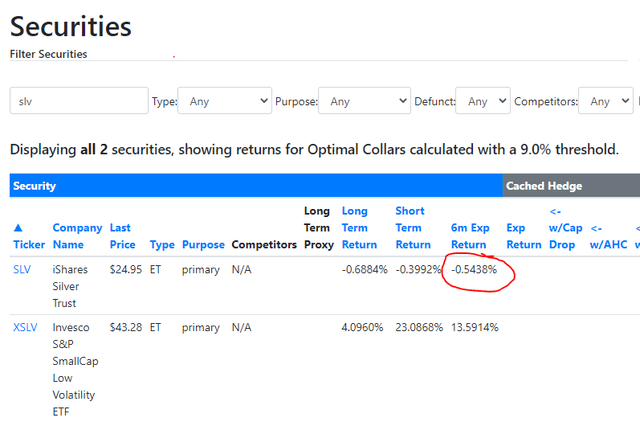

In our last post (Precious Metals: Time To Move On), we explained why our system had moved on from precious metals names. In a nutshell, their recent returns had been too weak, causing them to fail one of our preliminary screens. We illustrated this with the iShares Silver Trust (SLV), along with a couple of other precious metals ETFs.

We need the mean of the most recent 6-month return for a security and its average 6-month return over the long term (long term = 10 years, if available) to be positive. The higher a securities average 6-month return has been over the long term, the more forgiving this screen is over the short term, and vice-versa.

In the case of SLV, the average 6-month return over the last 10 years has been negative, so the screen's not very forgiving.

Freeing Up Space For New Winners

Another point we made in that post was that cutting losers loose frees up space to pick more potential winners.

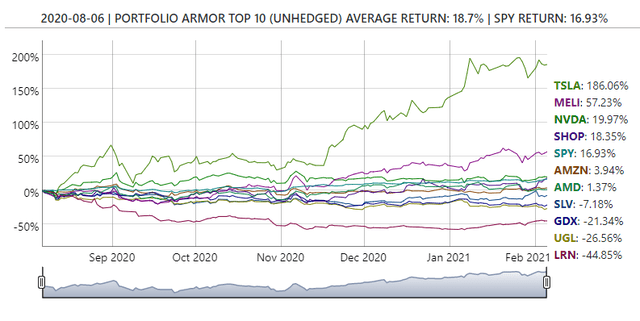

This screen doesn't weed out all losers, of course. After all, it didn't weed out the losers among our August 6th top names.

Screen capture via Portfolio Armor.

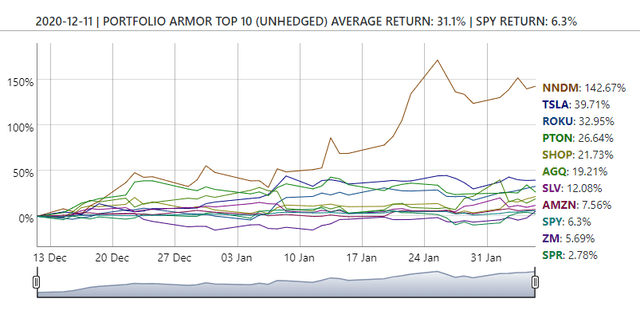

But it does keep you from picking names in a downtrend. And, in doing that, it frees up space to find new winners, as our system did with Nano Dimension (NNDM) a couple of months ago.

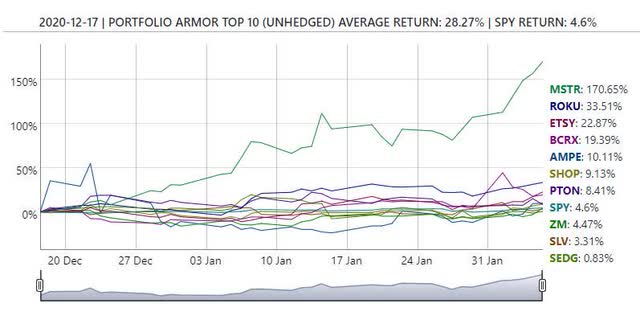

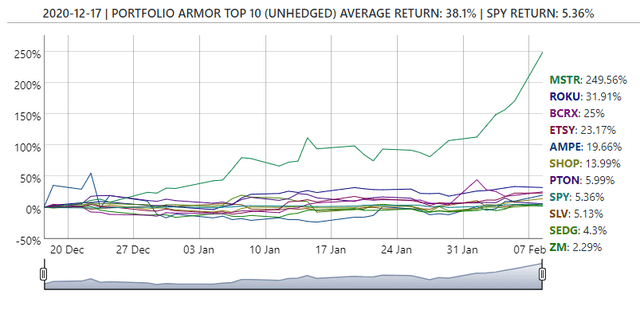

And with MicroStrategy (MSTR) a week later.

MicroStrategy was up another 29% Monday, underlining that point (Nano Dimension was up a more modest 7.65%).

A more recent top name of ours, Riot Blockchain (RIOT), was up more than 40% Monday. Like MicroStrategy, it was boosted by the actions of another recent top name of ours, Tesla (TSLA). And Tesla's actions were apparently inspired by the CEO of MicroStrategy, Michael Saylor.

We love synergy.

Tesla Boosts Bitcoin

Both MSTR and RIOT are involved with Bitcoin. How, exactly, we leave to fundamental analysts. If you quizzed us on what either company does, we'd fail (a quick glance at MicroStrategy's busy website offers no help). In any case, both were boosted by the spike in Bitcoin on Monday. And Bitcoin of course spiked on the news that Tesla had added it to its balance sheet.

Tesla puts $1.5B in #Bitcoin on the books.

— Nathaniel Whittemore (@nlw) February 8, 2021

Inevitable. pic.twitter.com/OhVpGLu6kC

That spike has continued as I type this early Tuesday morning, suggesting more gains for MSTR and RIOT are on tap. As of Monday's close, though, MSTR was up more than 249% since it first appeared on our top ten names on December 17th.

As a reminder, we update our top ten names each trading day, based on our system's analysis of total returns and options market sentiment for every underlying security with options traded on it in the U.S.

The Family Circus Of Stock Picks

There's a seen in the 1999 movie Go where one character explains why he hates the comic strip The Family Circus.

It's funnier hearing Timothy Olyphant tell it, but if you don't have time to watch the clip above, he hates it because it's the last thing he reads on the comics page, sitting on the bottom right "just waiting to suck".

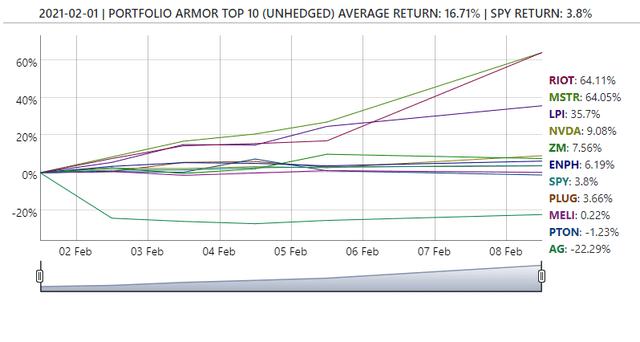

That's how we felt looking at the returns so far from our top names from February 1st.

RIOT, up 64.11%; MSTR, up 64.05%; and at the bottom right, First Majestic Silver (AG) down 22.29%.

It could have been worse though. Imagine if we had had another silver name instead of RIOT? Only having one silver name freed up space for another winner. Remember, too: all of our top names can be hedged cost-effectively (that's part of our screening process). So you can buy and hedge them in case they pull back.